Fundamentals always play out at the end, but boy what a week. Until mid-July Crude oil was experiencing the lowest volatility in more than a year, all it took was a couple of shakedowns to both sides for volatility to explode. And here we are, after (another) brutal self-off driven by headlines with a good amount of macro data in the background. Demand was and still is soft but we already knew that, what was different this past week is that any piece of macro data coming out was an event to push prices down hard, headlines from Middle East derailed the algos and triggered the buy mode, later to realize WWIII wasn’t happening that night and resumed selling.

We are at the mercy of algos, what who are these algos? CTAs are individuals or firms that manage and trade client assets using futures and options contracts. They are regulated by the CFTC and must adhere to specific regulatory requirements, including registration and periodic reporting, which is commonly known as “Commitment of Traders” every Friday when we see how many longs or shorts positions have been opened/closed.

Press enter to Sell everything!Particularly I don’t pay much attention since it only captures a portion of the market, what is traded and cleared on exchanges, there is a lot happening in the OTC markets, especially oil trading houses speculative desks trade in those dark pools and we rarely have a view on their positioning. What CFTC data is good for is for identifying extreme positioning, that usually signals a reversal as we saw when market was confidently short in late July and had market run away 10 bucks in 3 days. Today CTAs volume is much lower due to a myriad of factors, one, we are close to contract roll and pricing dynamics tend to go haywire, also extreme volatility reduces position size due to inherent risk management of these funds, which for oil, the majority are simply trend following and spread arbitrageurs. Given the low volume and since much is concentrated in the front of the curve violent moves are expected to dominate the short term. Should you be interested in learning more about CTAs there is a comprehensive list of funds messing around with futures https://www.iasg.com/indexes/trend-following-index

We are also in a particular stage of equity, Fx and debt markets where doubts are starting to emerge over the promising future of AI, savviness of our political leaders, female boxing and economic data. However, while not much has changed from the physical side in oil there some bright spots to believe the worst is behind us in terms of price action.

Oil Physical

Comparing previous week with last, loading volumes have been steady (noted by colour, where green is more and.. you get the idea) TMX shipped a little bit more to Asia, but transshipment areas like the Caribs and South East Asia saw a notably increase in liftings, also Pertamina in Indonesia releasing to the market a few cargoes. Meds were quite active but that must be in anticipation of political turmoil in Libya where Sahara field (300kbd) is experiencing some disruptions during the weekend, you have to give it to them, we were running like 2 months without any Libyan mishap.

On a more regional level, Middle East is fulfilling its promise to keep these barrels competitive in Asia, were full allocations were given to Asian refiners. Chinese intake of Saudi and Iraqi oil are expected to pick up in the first half of August in anticipation of September OSPs with just released small increases (as expected) but a wide discount to Europe. All of this considering escalation in the region.

On the North Sea cargoes changed hands at a lower premium but a premium at least to forward in time deliveries. A flotilla of Aframaxes are expected in Europe from the USGC but since a few days back Equinor has been on a buying spree of light grades, being the sole bidder. What are these Norwegians up to is anybody’s guess, is not that their flagship JS crud is selling particularly well (Dated-0.5).

On WAF things were getting better, not before news of Dangote reselling some cargoes (that they later denied), NNPC moving a new stream of light sweet crude and shipowners claiming demurrage monies ruined the sentiment and everything fell back to previous weeks. Also in Angola, a retreat from Chinese and Indian buyers is putting more pressure.

Brazil is also falling behind for some weeks now, as is more of Lula getting in Petrobras and some taxation trickeries that is keeping volumes in land.

Without doubt what shocked me most were the final numbers for july crude oil imports to China, 9.3Mbd for July is quite a slowdown, as seen in selected origination zones, North Asian destined barrels decreased considerably from all regions.

Paper Markets

We have the contract roll in the coming days for ICE traded Brent from Sept to Oct and some weird pricing dinamics might happen, but the trend in DFL and spread is clear from the last 15 days, markets try to hold the premiums while flat price was collapsing but you can only push it that much.

Now things are getting interesting for the spread between Dubai and Brent, failing to continue the widening, Asian buyers already locked up pretty much 100% of allocations and market seems to want more. Recent September OSPs with 20 cents increase for Asia and a grotesque discount to European buyers will definitively signal OPEC trying to rebalance the market and relief the leverage Asian buyers have been enjoying for the last 3 months. Brent should start to price closer to Dubai benchmark. As stated before volumes traded in futures are thin even for commercial hedgers.

Products

Here is where I’m taking a more constructive view. Refined products weren’t hit that hard during the sell off days. With the exception of Gasoil in Europe (you’d better get used to, that thing will remain oversupplied for a long time). Margins in result improved even in Asia.

Gasoline stocks saw continuous draws across the globe and we heard some relief gasoline demand figures in the US and Asia for the past week and since we are in an environment of low stocks and modest refining runs circa 90%, a steady demand pull could create a rush to cover cargos. With the transatlantic arb closed we don’t see many TC2 (300kb ships from Rotterdam to New York) gasoline arriving either.. Add it a hurricane or a tropical storm and you have an explosive cocktail.. Don’t get caught on this one.

Jet/Kero is becoming an Asian story so far. There still is a short in Japan, many people vacationing there since the cheap Yen, China not exporting despite renewed product export quotas and arb economics from India and Middle East. As tensions escalate in the Middle East, a closure of air space will open up again the arb to Asia, but applicable to all trades from the region, I’m hearing shipowners reluctant to lift the area.

Tankers

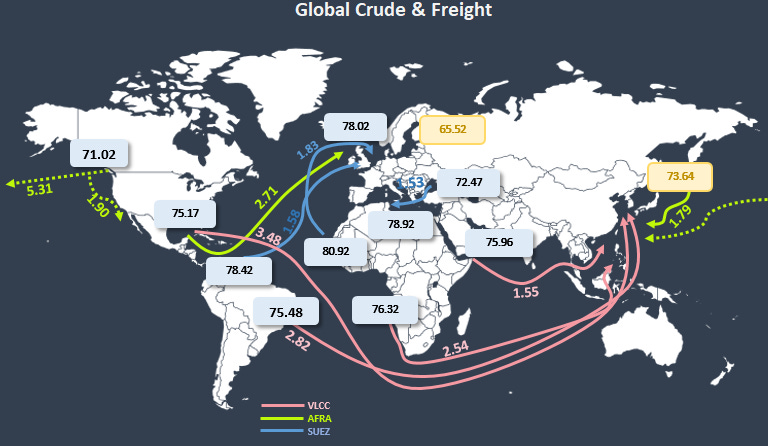

Just when I thought a rebound in rates were at reach, the market came crushing down once again, and is not because lack of available cargos but a surplus of ships in all regions, due to the recent nature of shorter hauls. Rates in $/tn gave in also because bunker prices fell sharply as well following crude but still, is a weak environment for spot cargoes. Most of the liftings in the Middle East (TD3C) are being shipped on term deals with ballasters left with no much option than to wait out a new influx of chartering activity.

As September OSP prices kick in we might see a return of Atlantic cargoes flowing back to Asia if the spread narrows enough. We know the freight component at these levels is there.

For Aframaxes, what was keeping them busy in the Gulf of Mexico were those reverse lightering to VLCCs destined to China, which are gone. The Meds is a different scene altogether, where rates are steady incentivizing vessels from the Atlantic to take the plunge and ballast East now bunkers are cheap. For Suezmaxes, their destiny is linked to VLCCs and I saw some Afras taking suez cargoes in Asia and Middle East. Brazilian missing cargoes are the ones leaving a void for the mid sized ships.

Now for Clean cargoes Asia is displacing MRs to the Atlantic were activity is keeping them busy, not making a lot of money but at least they enjoy a fast turnaround, and should any disruption happen, they are in the front row to capture it.

For Naphtha/Gasoil cargoes originating in the Arab Gulf, we are getting into prices that bode well with Europeans, and again, in an event of disruption these are good prices to lock in.

The Verdict

Market is amplifying movements on both sides with poor economic data that should be already priced in, oil is trading on the lower band of the range, granted, the last bounce was artificially driven but given the geopolitical front where things are escalating quickly and now entering in a phase of certain retaliation from Iran and its proxies. The most unsettling scenario for oil would be closure of the Hormuz Strait, which is very unlikely, mainly in a US election year but what I see as a certain possibility is for Houthis Rebels expanding their franchise up to the Eastern Med where they already have shown they can reach. That would halt the only outlet left for Middle Eastern oil to reach the West, the Sumed Pipeline in Egypt that is bypassing the conflict in the Red Sea.

The other ramification would be Russian cargos to India, which wouldn’t be safe either. Should Russian aframaxes need to detour around the Cape the size of the dark fleet won’t be sufficient and will feel the pinch 20/25 days after. Oh, and there is Venezuela as well..

We are on the most fragile it’s been in the last couple of months, I won’t be comfortable shorting this market, but I wouldn’t pay the geopolitical premium either. Stay out