This week we’ll try to bypass the ongoing hostilities in the Middle East and focus on fundamental. With recent violent moves in flat prices the physical market kind of broke down again and we now have miss-pricing all over the place that led to arbs (short for “arbitrage”) to close reverting any advancement we had during September in benchmarks normalization. But did I ever explain how arbs work?

We will take a simplistic approach, not going into refinery configurations and that boring stuff, but the real arb calculation for crude has to take into account what we call “refinery netback” which is the total value of products obtained when running a barrel of crude oil through a refinery, or simply put, the whole refining margin (including naphtha, base oils, resids, bitumen and all that garbage).

Every refinery is different and by no means this is a one size fits all calculation, but is a rough approximation when certain grades are competitive in certain areas. Also, refineries were built and configured to process a baseload grade to maximize yields (PADD 3 heavy sours, ARA Urals, Asian Pacific Med sours) but as markets move there might windows of opportunity when a product crack is stronger, so running an alternative crude that yields more, let’s say naphtha which is the case right now, it might be cheaper to bring a crude from far away than using the baseload that yields less naphtha and more distillates.

Here is the mindset: you are an “asset light trader”, you don’t own equity crude, you don’t have a ship, a terminal, nothing… just a credit line from BNP Paribas and you happen to have a connection at Pernis refinery in Rotterdam and secured a deal to sell some oil to them. Within certain specifications you have a myriad of options to offer them 600kb (or one Aframax) “CIF Rotterdam”. So, what can you offer them and make some money in doing so?

Remember, when you trade physical barrels, you are moving molecules through space and time, buying and selling at floating prices.

On top of that, you have a delivery window you have to meet, so you will have to work back how long it will take you to deliver each crude grade from each origin region.

For the porpoise of this exercise, we will ignore the refinery netback and compare two similar grades that yield kind of the same amount per barrel and are relatively close to each other. WTI vs Forties to Rotterdam.

The baseload crude in this case is “Forties”, so that is what we are competing with. Can we land a barrel in ARA cheaper than the benchmark grade?

We have some moving parts to consider:

Crude price structure across different benchmarks

Freight costs

Price Structure

Remember last week, we learned that you can derive a price to any day, given a forward curve, using Cfds, using swaps, etc… In this case as of today (Oct 10th) we have forward curves (not futures) for November’24 for Brent and WTI and from December for Dubai but we need reference prices for both the loading and discharge dates, so we can calculate the arb.

If we want to buy WTI in Houston today, the soonest we can ship it would be in 15 days, do we care how much is WTI FOB worth today? No, we are getting invoiced for the crude after we load (depending on the pricing scheme) but we need to have an idea of how much it will be worth in 15 days (Oct 25th) so using the forward curve we bring the price back to Oct 25th: $76.67

Since we are selling our crude to Europe, we need to use the destination benchmark: Brent. We know that a tanker takes 18/9 days from Houston to Rotterdam then we get the landing date (Nov 13th), we now need to have a view on what the market thinks the price will be at that date. That number today is $79.34 using the same interpolation method.

Ultimately, you don’t care what the outright price is, oil could be worth 100, 200, 50… all you care is the spread between a barrel of oil in Rotterdam on Nov 13 vs a barrel of oil in Houston on Oct 25.

Is not over yet, we need to move those barrels so we call a shipbroker and try to get a tanker for Oct 25 and we get a quote of $4.34 a barrel for those loading dates

So, negative 1.67 dollars per barrel, does this mean the arb is closed?

Wait a minute amigo, let’s check the baseline, if we do the same with Forties, that needs to land on the same date and at the same price $79.34 on Nov 13, but you bring it from a terminal in the North Sea, so freight only takes one day and might costs $0.90.

Using the same interpolation technique, loading one day before we have the pricing, but for freight is a little more complicated, if you call a shipbroker today to secure a vessel in the North Sea in a month time you won’t get a quotation. You need to go to the freight futures market (FFAs) and see what the market is trading for the next month, and derive that $0.90/bbl.

hey! that number is also negative, is the arb closed then?

Let’s go back to last week again… remember we saw how traders offered their cargo on the Brent window? Dated +1, Dated +2…? Well, that is exactly the premium they need to charge to overcome these costs (structure + freight). There were some traders offering WTI CIF Rotterdam @Dated +2.25 yesterday, their profit is the difference 2.25-1.67... they didn’t attract any buyer because someone was offering Forties FOB @Dated +$0.7 (0.7+0.9 freight to Rotterdam=1.6)

Which one is cheaper? Forties, is the Arb closed then? Yes, it is

You could try to load a VLCC and reduce the freight cost by more than $1, which technically would allow the arb to reopen, but you are only selling 600kb, what do you do with the other 1.4Mb barrels? offering those in the open market would weaken the premium at destination, making the spread to compress, making it unworkable again.. you get the idea.

In order for the arb to reopen a few things should change, either freight must go down, the price curve must flatten out, or for some reason the destination benchmark must go up more than the origin one (something like this happened with Brent when Libya went offline)

The takeaway is, in backwardated markets like we had for the last year you pay a penalty to ship a barrel further afield, hence closing the arbs and in term depressing freight rates until is cheap enough to offset the loss in pricing structure, the arb reopens and we start all over again.

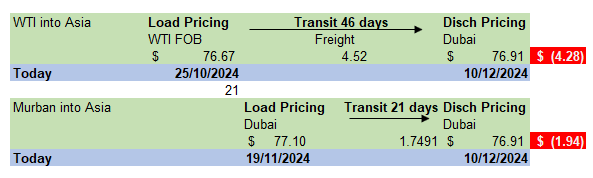

Here is another example for a longer voyage, WTI to Asia

In order to make a profit you will have to market your WTI barrels in Asia at least Dubai+4.28, but someone can offer Murban for the same dates Dubai+1.94 and that pushes you out, -needless to say, this arb is closed as well-

Pretty simple uh? Below is the xls arb calculator for your delight, playing with numbers will help you better understand the concept.

Now you know, let’s see what has been going on this week

Oil Physical

The picture above is just a snapshot of different grades and freight levels, is not representative of arb since all of these are “prompt” prices. But I want you to leave with this message: Physical premiums are going the wrong way when comparing with flat prices, leading us to think that weakness persists despite the uncertaintiy in the Middle East.