In this episode we talk:

Regional tour

China

Paper Trading

Oil Physical

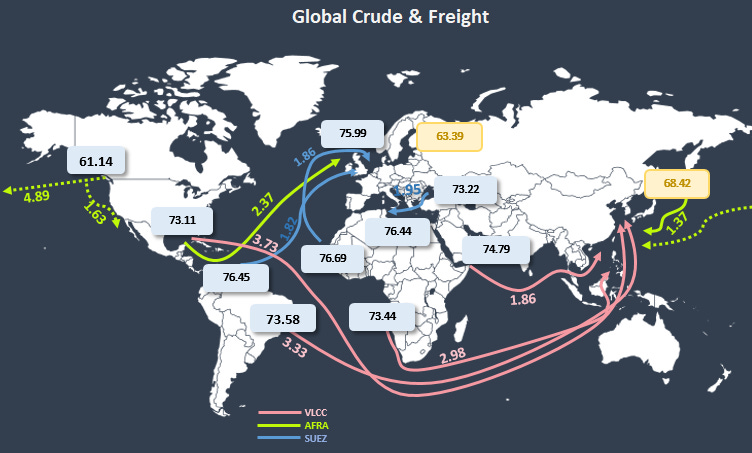

In a week of consolidation, where finally paper market (futures) aligned with the reality of the physical markets, if not overshot a little, we discuss what have been happening in the oil markets. Hopes for a rebalance of the market in the medium term, plus some opportunistic buyers keep the machine going.

OECD commercial oil inventory is sitting at a low level and is well below historical norms, but this offers little reason to be bullish. OECD oil demand now represents less than 45% of global demand, down from almost 50% 10 years ago and 60% in 2004. The volume of crude at sea in transit which is also an inventory item since Russia invasion of' in Ukraine in February 2022 is 5%, or roughly 35mn bl, higher than in 2019. And while it cost next to nothing to borrow money to finance and hedge oil in tank when interest rates were close to zero, the increases since early 2022 have made holding inventories a much pricier proposition. Also, with the curve structure highly backwardated as it’s been since 2022, there is little incentive for companies to hold stocks.

We have also seen a decouple from Oil futures to broader equity markets (excluding GOLD) so I’m starting to think that tourists, the few left were already flush out and market is moving on their own.

The mixed signals keep coming, money is 0.50% cheaper, oil is 10% higher, sentiment is still 90% bearish.

Americas

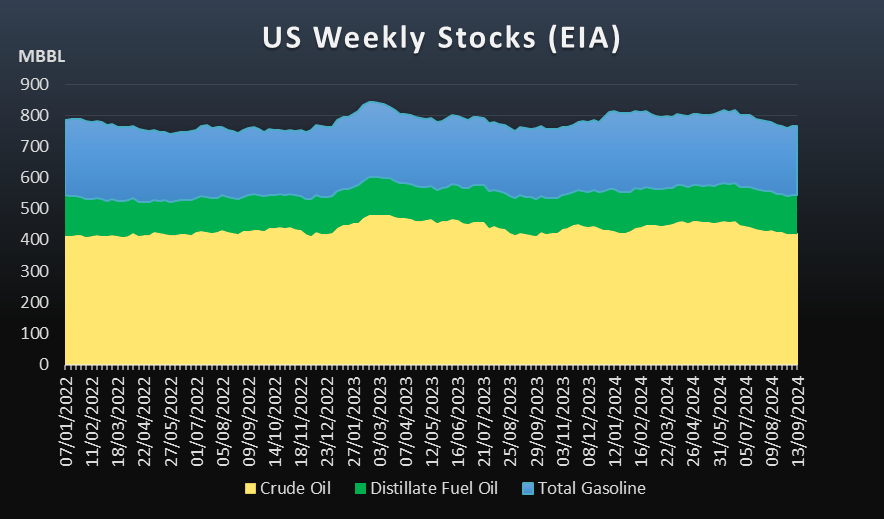

Despite lower WTI exports, US crude inventories fell by 1.6mn bl last week on higher exports and lower imports, the Energy Information Administration (EIA) reported this week. US crude stocks fell to 417.5mn bl in the week ended 13 September, down from 419.1mn bl a week earlier. This is the eighth drop in 10 weeks, but stockpiles remain comparable to the same week last year, lower by about 900kb.

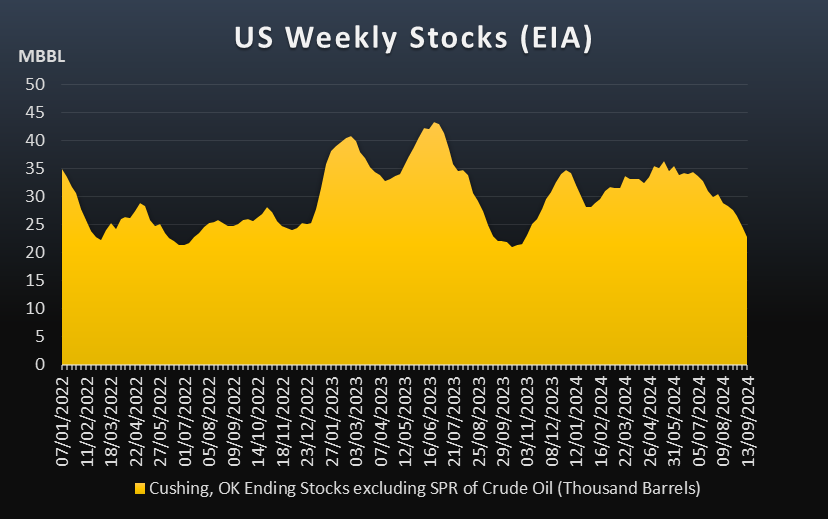

Cushing inventories, which are particularly important since WTI futures price there is also experiencing draws, the most interesting is what kind of crude are they drawing. There is some evidence that refineries are taking light sweets and storing medium/heavies, economies allow for that. If any, what’s holding the market is Cushing at extreme lows, how long will this last? Next few weeks we should start to see seasonal builds and expect the spread between inland and off shore (FOB) to normalize a bit. The hurricane didn’t help. Some reports highlight that this Auttum refinery maintenance season won’t be so intensive as it was last year in the US, just over 500kbpd of scheduled turnarounds so far, compared with 1.2 last year.

Early October-loading cargoes were trading around a 50¢/bl premium to WTI Houston, gaining 15¢/bl over the week. Late October-loading WTI saw bids and offers ranging from a 35¢/bl discount to a 5¢/bl premium, signaling some interest for transatlantic arbitrages. Meanwhile, November-loading talks picked up throughout the end of the week, with early-month loadings valued between a 30¢/bl and 60¢/bl premium to WTI Houston. Is definitively a change of spirit, since last week were trading flat to Houston marker or slightly at a discount.

WTI has become a substitute for Mediterranean buyers owing to its ample supply, while Algerian Saharan Blend has more limited availability. Nonetheless, the Algerian grade is Esharara's closest direct regional competitor because of similar product yields and journey times into the Mediterranean. The Mediterranean is expected to receive more WTI crude during September.

Recently, trades were reported involving Brazilian medium sweet Buzios crude cargoes scheduled to arrive in Europe during October and November. One cargo, expected in October, was heard to have been sold at October North Sea Dated +1.00 CIF Rotterdam, which roughly equates to Dated +1.80 on a November Dated basis. Meanwhile, a cargo set to arrive in the final 10 days of November was reported to have been traded at approximately November Dated +1.25 CIF Rotterdam.

In Latam, shipping fixtures indicate Petrobras plans to load the VLCC Universal Innovator in Brazil for Daesan, South Korea on 20 October, while TotalEnergies' shipping arm CSSA booked the Suezmax Mare Siculum for October loading from Brazil to Europe. BP will load the Suezmax Nordic Star early October in Guyana for Europe, and state-owned Shandong Port International Trade Group will take the VLCC Gustavia S from Curacao to Asia-Pacific in mid-October.

North Sea

Petroineos keeps helping to support Brent benchmark bidding Forties and Ekofisk as well as WTI on a delivered-Europe basis. We will miss them next year when they close down the Scotland refinery. Meanwhile, Petroineos and Mitsui bid crude from various streams handsomely. For the Japanese it looks like a comeback from maintenance is in play, and Naphtha margins (abnormally strong in Asia) might have to do with it.

Shell said that it will close parts of its 400kb/d Pernis refinery in Rotterdam in the last week of September for maintenance. The company did not specify which units of the refinery are involved, but said the work is part of a six-yearly maintenance cycle and that flaring may occur during the shutdown, how long will it last is the question now. Refiners in Europe will certainly take their time to carry out works, no need to hurry with these margins.

Meds

CPC Blend was supported by the Libyan crude blockade, strong naphtha cracks and a tight October loading programme, with fewer than 10 cargoes scheduled to load over end of October — two of which having already traded. Around 16 were scheduled over the same period in September. Looks like Kazakhstan will abide the OPEC quotas for once. (We all know this compensation plan is not “voluntary”). Libya seems to be loading some Es sider this weekend, but the market no longer cares, replacement barrels are coming from Egypt with Arab lights that was stored there. Algerian where also clearing at normal pace with the premiums now receding. Everything is going back to normal in the Meds.

WAF

There are still 25/30 cargoes of October-loading Nigerian crude still available. This compares with 30/34 unsold cargoes in the prior week. Total exports in October were set at 1.52mn b/d across 50 shipments, according to available programmes for 17 grades. Nigerian differentials should be heading for a correction to entice buying interest from Europe, its top outlet, in the face of competitively priced alternatives from Latam and US and unsupportive refining margins in the region. Angola was clearing at a normal pace, with only a handful of cargoes left to sell, but China wasn’t particularly active.

Middle East

Chinese refiners bought several cargoes of medium sour Mideast Gulf crude this week, with Unipec and Mitsui propping the benchmark. Medium sour Oman strengthened for a 4th consecutive session in a rare reversion for Dubai linked grades. Dubai’s rally also put the Nov contract at a 21¢/bl premium to light sour Murban November futures, the widest premium since 30 July. November Dubai partials were heard to have traded at $73.35-73.65/bl. Reliance sold a cargo of November-loading Upper Zakum to Mitsui following the convergence of 20 Dubai partials, while ExxonMobil sold a cargo of November Al-Shaheen to Mitsui.

We are in a stage where now Middle East grades look expensive, so premiums will have to adjust, but as long as Asian buying power is there is hard to see. What shifted in the market is the renewed interest for Mid-sour barrels.

Reports overproduction by Opec+ countries could be weighing on overall sentiment. In reality, while this was clearly a feature of the market earlier in the year, more recently it has been equalized. On a net basis, early-year overproduction has become mid-year underproduction, with disruption in several non-Opec countries growing to more than offset persistent non-compliance by others.

Biggest factor weighing on the market is the menace of Opec+ returning more than 2mn b/d of crude. As the balance shows, if fully pushed through, this would result in an increasingly oversupplied market. By the fourth quarter of 2025, supply would exceed demand by almost 1.3mn b/d should they choose to go through.

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.