The week started on an auspicious tone with the anticipated repricing of Aramco’s February loadings official selling prices (OSPs), that carried flat prices above the range, not without some volatility that made benchmarks to re test how solid was the breakout, and then we had a taste of what was about to define this week, sanctions. Blacklisting some Chinese interests by the DoD, US department of defense, created some confusion around these companies of which COSCO, one of the main tanker operators, among other shipping segments was in the clear. Some excitement around that but quickly faded since the only sanctions the Chinese abide are the OFAC ones, and to some extent, but that prompted Shandong Port operator to impose a ban on all OFAC listed vessels, mainly aimed at Iranian carriers to berth and receive services.

Later this was dismissed by some Chinese officials but the concept kept in the back of the mind of Chinese traders, that were quickly looking for alternatives. The message from the outgoing Biden administration is the crackdown is real, setting the table for a “maximum pressure” campaign on Iranian exports, more suited for Trump rather than Biden, but a change in tone nevertheless.

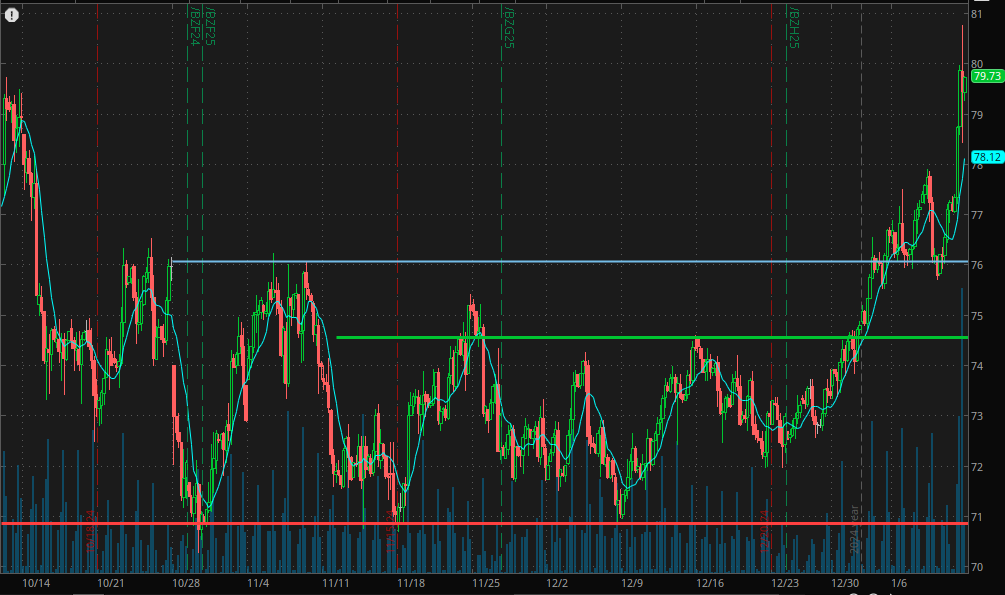

The rest of the week went uneventful with some shift in pricing dynamics that were inline with this newly founded strength in oil prices, and then on Friday the news hit. After much a week of rumors and speculations, OFAC delivered with the most comprehensive rounds of sanctions to Russian linked entities, individuals and vessels. Somehow the list got leaked before European market open and oil that needed an excuse to touch upon the 80s mark didn’t find much resistance.

As we mentioned last week, there was a change in sentiment around “all things oil” even when prices were still stuck in the range. Funds buying did their part but there was more to it, as it looks like the market was trying to rotate back to the “energy as a call option” while the markets were crumbling, dollar shooting up and rates climbing unrestrainedly.

During this week we had some final 2024 numbers on some countries regarding oil consumption and the market re-assessed, since these numbers weren’t as bad as previously thought. More importantly, final December production numbers weren’t as rosy as predicted, with the threatening “Non-OPEC growth” starting to fade. In the last quarter if 2024, as prices were locked in the low 70s, we saw a contraction in the rate of growth pretty much everywhere, Brazil, Argentina, US plateauing and even the poster child Guyana with minimal growth in exports. Market is coming to the realization that maybe this massive Q1 surplus that main forecasting agencies were telling us about, won’t come to fruition. That helped to cement the sentiment.

Is safe to say that the price action we saw on Friday was in the making, especially when looking at Russian exports in the last months, we saw a shift from China and India to Middle East, WAF and Latam, as they didn’t feel that comfortable relying that much on Russian for the marginal barrel.

Iranian loadings show the same pattern with crude floating storage building in South East Asia (these barrels are taking longer to clear) probably as a gesture from China of good will, cooperation with Trump and rebrand themselves as law abiding state that don’t deserve the harsh tariff treatment, but on the flipside, we are seeing China buying more crude from wherever they can get a decent deal, but worryingly, they do not intend to refine those barrels, they are going into inventories, which are already high. The big question the market is wondering, is in anticipation to what? A fierce trade war? A sharp Yuan devaluation? (I’m inclined to this one) frontloading Chinese Lunar new Year? We had a new batch of crude import quotas for Q1 favoring state owned oil Co, but nothing out of the ordinary. Some monetary policies are indeed taking affect, lowering the cost of borrowing for Chinese oil majors that are now confident in sourcing barrels from more distant regions, but other than that, economics for refining in both the domestic and export markets look underwhelming.

Moving forward, the market is still trying to digest how Putin will adapt to this new reality of sanctions. We have heavy hitters now, from Gazprom and Surgutneftegas to a myriad of middle men and banks handling the transactions. This has proven to be disruptive in recent months, and now with the addition of 180 vessels, the grip is tightening. Back on the envelope calculations, this fresh round of blacklisted vessels would take half of the carrying capacity of the established Russian dark fleet, choking 1.2/1.5Mnbpd of exports, specially Urals from the Baltic ports. Most of the flagged vessels are Ice Class Aframaxes, that were already scarce given weather conditions in the Baltic Sea, and we know for sure that India won’t touch those vessels, even when they buy on DAP incoterms (Delivered at port) and don’t have a view on what components of the delivery price is oil and what is freight. The quickest way out for Russia to evacuate its oil is to lower the FOB under the price cap and open the market for Western owned vessels to relieve the pressure, until they get their act together, sit down and negotiate with the Donald or shift more crude to domestic refining which has been plagued by hiccups and interruptions, so this looks like the least feasible.

There 3 tanker bound for India that has been hit today, let’s see if they discharge at port or perform and STS, my guess is they will stay idling for a while.

If India and China have to source around 2Mnbpd, I assume the ESPO trade in the Russian far East will continue even with sanctioned vessels (there are a couple of OFAC flagged already working there), maybe Saudis will step in and fill that void, but there aren’t many heavy sour barrels to go around either. Imposing this kind of sanctions in the middle of the coldest winter in a decade might backfire, as we are seeing prices hitting 6 months highs in a supposedly loose market.

In any case, volatility is much welcome, this revival of the energy markets is also helping to put into perspective all asset class valuations, hence the resilience of oil related equities.

Does this shift in positioning marks a continuation of the 2022 cycle? I don’t think so. Chinese structural demand decline is very much real, this energy price spike is denting even more a failing to recover European economy, emerging market currencies are nosediving and 2025 is shaping to be not a walk in the park as lingering conflicts are looking harder to subdue.

These lasts weeks bullishness was a rare combination of exacerbated pessimism for oil balances, climate events, Trump uncertainty and a violent Chinese policy shift, underneath, the physical market is more cautious albeit moving in the right direction. Next two weeks are key, we should have definitions before Chinese go on holiday and if history repeats, remember what happened back in 2016, the market pre inauguration was behaving pretty much the same and reversed as soon as Trump took office, will this time be different?