This week seemed like a continuation of the previous one, with the undertone of the physical markets doing okay (note that last week, I put it as doing well). However, the financial oil markets are still prone to headlines, and more so to bearish headlines.

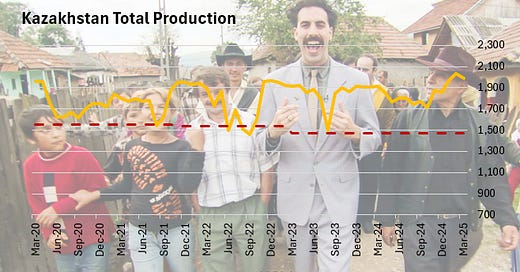

Nothing new happened, Trump and Xi playing hide and seek, Iran talks, and OPEC non-compliance, but interestingly, Kazakhstan's newly appointed Oil Minister opened his mouth and rocked the boat, sending a defying message to the organization.

If OPEC is between a rock and a hard place, our Kazakh friends are even worse… they have great oilfields, great well productivity, integration with the biggest players in the business, everything, except direct access to international markets, and that has been a burden since 2022 when Russia became a pariah state. The only reason they are still in the OPEC+ is because 90% of their exports are still routed through Russia, and Russia showed just a couple of weeks ago that they can turn off the tap at will.

For now, they are trying to bypass as much as they can, moving barrels through the Caspian Sea to Baku, and then injecting that into the BTC pipeline that has spare capacity. There was a project to build a pipeline through the Caspian, since it’s too shallow to move real volumes on tankers, they are using 50kb barges, which is not nearly enough to get started.

They have a thing on their side though, and that is their international partners, namely Chevron who sank a ton of money to develop the Tengiz field, and when something doesn’t go the way they intend, they have a direct line with Washington, and things get expedited from there (like the Moscow Court reversing the loading halts in CPC terminal in 24hrs for example).

Anyway, those comments precipitated a reaction from other members pledging for a faster unwind of the voluntary cuts, which was enough to send the flat price back down 2 dollars, which is the same 2 dollars it gained last week when Iraq and the very same Kazakhstan committed to compensatory cuts…

Despite these misunderstandings, the fear of Saudis unleashing the beast is evident in the forward curve. The notion of when lifting Russian sanctions another price war can break out between Moscow and Riyadh, as Putin will try to catch up on lost revenue and pump as fast as he possibly can.

For its part, the US administration is doing its best from the demand side, as we learned this week from refiners' earnings calls that the guidance is gloomy, with plans to scale back. It is also worrying that their Q1 numbers were this bad, even with what we could call “decent refining margins” which suggests that they couldn’t capture this cycle in full, turnarounds that took longer and outages, which is now challenging my view for this current cycle. You see, I was in the camp “Oh man with these margins when they come back they will run as hard as they can” … maybe not.. Maybe this is the new status quo for refineries when they prioritize smooth running across the year and not flooding the product markets during summer, to be left with products in the tank later in the year, with all this uncertainty around global growth.

Back to the physical side, that mood is starting to permeate differentials and premiums. Last week WAF was the only weak link, but that is spreading first into the Atlantic and later in the week into the Middle East, but truth be said, it was amid the strength in tanker rates, but when shipowners have more pricing power than oil traders, something is not right.

We had two consecutive short weeks and that created the illusion of activity as we stuffed 10 trading days into 8, but as we go back to normal with lift the veil and see what it looks like. For markets, the $65 mark seems like a good point to pause and evaluate.

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.