Oil prices declined from the previous week's peak after reports indicated that Israel was not targeting Iran's oil infrastructure as they make us believe, coupled with a weakening demand outlook. If we go back two weeks ago, before the Israel/Iranian spat, we had oil physical trending down with weak premiums before everything went nuts, well, this week we saw that trend resuming but with paper markets catching up again by the end of the week.

The Commitment of Traders (COT) report is a weekly publication by the Commodity Futures Trading Commission (CFTC) that provides a snapshot of the positioning of different types of traders in futures markets, including those on the NYMEX (New York Mercantile Exchange) and ICE (Intercontinental Exchange). It shows how different participants, like hedge funds, commercial entities, and smaller traders are positioned in various commodities.

I don’t usually pay that much attention since they publish once a week, and is lagging at least 7 sessions when it finally comes out, but from time to time I check if anything pops up like we had a few weeks ago for “Brent futures have never been this short” that was all over the news. We had something this week not as revealing as that but interesting nonetheless.

In Nymex, overall positioning decreased as the threat of an imminent attack faded as days went by. WTI futures are the preferred speculation vehicle for oil since there are a few ETFs that constantly rebalance in that market, USO 0.00%↑ for example..so tracking the ETF is a good proxy for futures demand.

The interesting part is here in ICE Brent positioning which is more Macro/Commodities/Risk Parity Hegde Fund territory. Net speculative length came back to normal levels due to the short covering that sent prices near $80, as expected, but look who was selling into the rally: Producers and Merchants (refiners, offtakers, traders). That gives you a taste of what the physical market considers a good price to lock in.

Contributing to the downward trend, both OPEC and the IEA once again adjusted their global demand and supply forecasts, indicating a more well-supplied market. OPEC lowered its oil demand growth projections for 2024 and 2025 for the third consecutive month. The IEA projected a big surplus of 1.11 million barrels per day in 2025 and also reduced its forecast for global crude throughput and long-term oil demand.

It definitely brings down sentiment, but should pay attention to these forecasts? the short answer is NO, and take this from a guy who used to make forecasts for a living… (I just picked a round number that would please upper management and not create much controversy and be done with it). As gloomy as these projection reductions might be all of the 3 agencies (EIA, IEA & OPEC) are calling a Chinese demand growth between 200-600kbd for 2024, we are in mid-October and China is down 300kbd YTD… that’s why in this house we focus on short term drivers and price deviation from fundamentals.

Speaking of fundamentals, lighter crudes continue to be plentiful in Europe, driven by increasing Libyan exports and exports of Caspian light sour CPC Blend which are expected to grow by 30% in November, reaching back 1.4 million barrels per day.

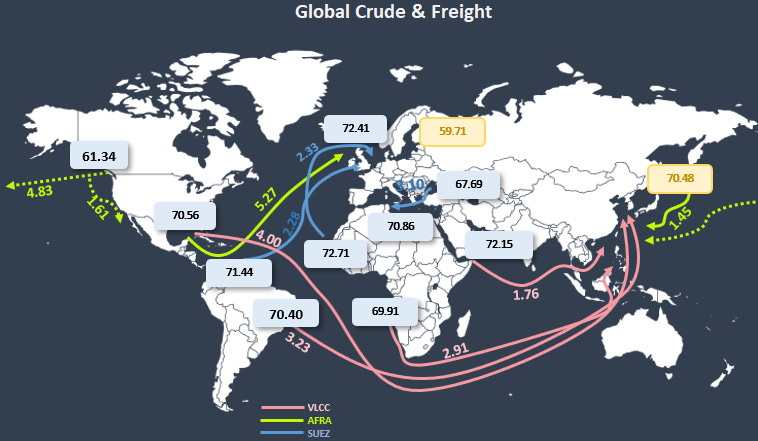

This came in the midst of a prolonged refinery maintenance in NWE and the Meds, and the market cannot absorb this sudden supply until late November. We saw WAF, Meds and finally North Sea premiums collapsing trying to entice buyers with the added inconvenience of freight rates not in their cheapest form, and though not expensive in relative terms is enough to keep arbs closed.

Looking at the Dated structure (prompt loadings) is flat at best, going in and out of contango, more on that later.