This week relative strength on oil markets has been marked by refining margins that came back with a vengeance, especially gasoline that everybody left for dead.

What stressed the market was not Syria, that doesn’t hold much implications for the oil markets other than weakening the bargaining power for Iran, but that would play put in the long run. Actually is transversal to the oil markets, since once again this is a gas story, or broader energy prices. A cold snap in the Northern hemisphere plus the spat for Russian gas between Eastern European countries was enough to spike electricity prices and carry over alternative sources of heating, mainly gasoil and kerosene.

By no means those markets are undersupplied but as temperatures go down, resembles of 2022 start to emerge and panic buying ensue. In a thin market like the one we have today every piece of information that mimics supply disruption will inject some much-needed volatility in the oil complex.

Regardless of the nervousness, flat prices remain caged in the 70-74 range, albeit, finishing the week on the upper range and with no signs of letting it go. A few developments from this week can support these levels, but also some signs that put caution especially on differentials across regions.

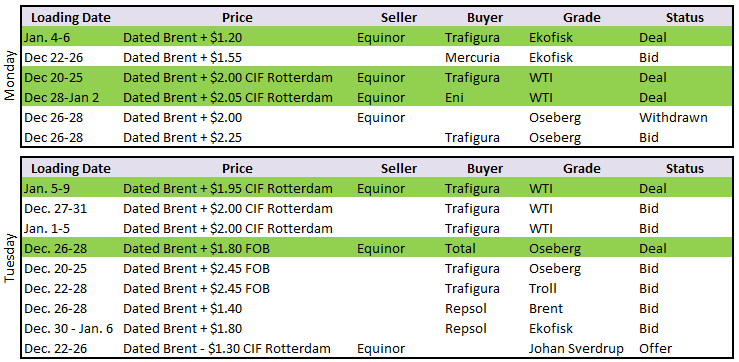

Action in the North Sea remains upbeat, with a more than usual cargoes changing hands, barely inching up premiums until it took a beating on Thursday (from Dated +2 to Dated +1.60) with the same participants, Total and Trafiura on the buy side, Equinor the sole provider of barrels for every grade imaginable.