Enter The Dragon

In recent days, a more positive dynamic regarding prices has been observed. High-frequency indicators in China are suggesting a bottom has been reached. Is the worse behind us?

This week, geopolitical developments and supply-side fundamentals helped support Brent crude oil prices at the seemingly unbreakable $71-$74 range.

Additionally, positive data from China began circulating among trading desks, particularly the provisional crude import volumes for November by Chinese refiners. At first glance, it might seem we are witnessing the much-anticipated trend reversal, with monetary stimulus measures finally taking effect and a renewed level of optimism.

However, it’s still too early to confirm a trend shift, as surface-level numbers can be misleading. To understand this, it’s essential to grasp China’s buying patterns in the international oil market. China is an opportunistic buyer, purchasing when prices are low. Interestingly, today’s observed purchases are likely from two months ago when prices hit lows. During that time, increased activity in the Middle East was evident through VLCC fixtures. This activity prompted Middle Eastern producers to adapt by pricing all their spot cargoes competitively and adding some term barrels. As a result, the Dubai physical premium collapsed from an average of $1.6 in September to $0.6, though it rebounded to over $1 this week, chasing Brent’s strength. The M1-M3 structure also flattened, incentivizing participants to lift cargoes during the Platts window. The lack of activity from Japanese and Korean refiners, who are sourcing more from the Atlantic, was compensated by Total, which we discussed last week.

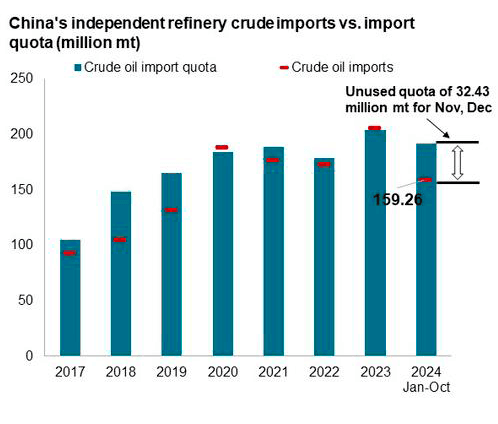

This buying rush, like much in China lately, is politically driven. Refiners are taking advantage of the Q1 2025 import quota, getting ahead of the next 4-million-ton allocation. However, non-state refineries are hesitant to increase purchases due to uncompetitive margins in the export market, except for diesel. The VAT rebate for Chinese petroleum exports, currently at 13%, will drop to 9% on December 1, further squeezing margins.

China is preparing for potential disruptions with Trump in the White House, stockpiling oil and products as a precaution.

China also benefits from relatively strong margins in Asia, reversing arbitrage flows, with distillates now finding a home in Singapore. Yet, refinery runs remain low, reflecting margin constraints. It’s unlikely we’ll see “teapots” operating above 70% capacity soon, especially given the uncertainty surrounding Iran, a key supplier for these refiners. Iran's crude purchases are usually negotiated three months ahead of delivery, and under the current cycle, China should be actively buying but isn’t in the market.

China is, however, active in parts of the Atlantic, capitalizing on intermittent Brent weakness (Petroineos, PetroChina, and Gunvor have been collecting barrels) and in Canada’s TMX pipeline, which has proved a relief valve for heavy crudes.

For January, the cycle seems slow, possibly due to some refineries undergoing maintenance. This is speculation, but considering the close relationship between China and Saudi Arabia, they might know something about OPEC’s December 1 decision that we don’t.

Aramco’s upcoming OSP announcement might provide clues, but recent weeks suggest they’re willing to ship more volume at slightly lower prices—just a thought.

With ongoing conflicts in Ukraine and the Middle East, market perceptions are shifting. Many believed that with Trump in power, conflicts would quickly resolve, barrels would flow again, and prices would drop. The question now is: how much leverage does Trump truly have to shape outcomes for his benefit? How much can he influence oil prices?

We will continue to dance to China’s rhythm. What we know so far is simple: below $70, China buys; above $80, China doesn’t.

It seems we’ll remain in this range for a while, unless OPEC breaks this tedious trading range—and it wouldn’t necessarily be to the upside.

In the meantime, the crude market appears constructive, with bids supporting physical differentials, refiners actively participating in the Platts window, and independent traders finally stepping in on the buy side.

A recovery seems plausible from current levels, as refineries in the Western Hemisphere gradually resume operations and the onset of winter drives seasonal demand.