And just like that, we are at the previous trading range of 75, in view of the most anticipated military operations in recent history, in fact it was so widely publicized that no one believed it could happen, not even the guy in the White House.

If you are reading this publication, I assume you are an informed individual, so I will ignore the obvious and get right to it.

This week, we had two FOMO instances, first one on Wednesday, from the money funds when the evacuation rumors started to circulate, that was powered by the flushing of the few remaining net short oil, the infamous CTAs. With the first attacks then retail piled up in the overnight futures market when liquidity is thin, propelling moves up to 14% in a few hours and intermonth spreads of $4, since the volume was only concentrated in front month. Either way, it was enough to trigger some stop-outs but as soon as the Asian market opened the selling flow sent us back to a respectable +5 bucks boost, the usual $5 of geopolitical premium that was embedded at the start of the year and we lost at the hands of the OPEC and tariff drama.

So, is $75 fairly valued? If you concede that the geopolitical premium is worth $5, yes, before this mess, Brent reached $70 on its own merits with supply friction and a stubborn demand. So, next question is, is this premium worth $5?

Primal fear is the loss of a reliable supply in the Middle East if attacks spread to neighboring countries or Israel decides to target Iranian oil infrastructures. I don’t think they have the green light from the White House, but I don’t think Bibi had it either to unleash the attacks yesterday… and that’s the key difference with the last encounter and I think what concerns the market more, both are unrestrained, and we don’t know how and when this could end up.

So far, we know oil is flowing normally, ships are sailing through the Persian Gulf and from the physical side, there was no desperation whatsoever, with the Dubai premium only a few cents up, but still below last week's levels.

Every time we hear explosions in the Middle East, right after that the “Strait of Hormuz” follows, and this time is no different. Yes, it is one of the most important maritime chokepoints, with almost 20% of the global oil consumption going through daily, and no, it is not possible to blockade it completely. Iran tried that during the 80s “Tankers Wars” but failed, despite being just 3km wide of navigable waters in each direction with a 2km buffer.

There is bypass infrastructure, the main one being Aramco’s East-West pipeline with 6Mn b/d, UAEs Abu Dhabi to Fujairah pipeline (1.5 Mn b/d) and Iran's own Goreh-Jask pipeline to the Gulf of Oman, with an estimated 1Mn b/d capacity, though never used at max rate.

The closure of the Strait of Hormuz is not in the interest of either Iran or Israel and its allies, nor to China, so the likelihood of this happening is close to zero, but I have been wrong before…

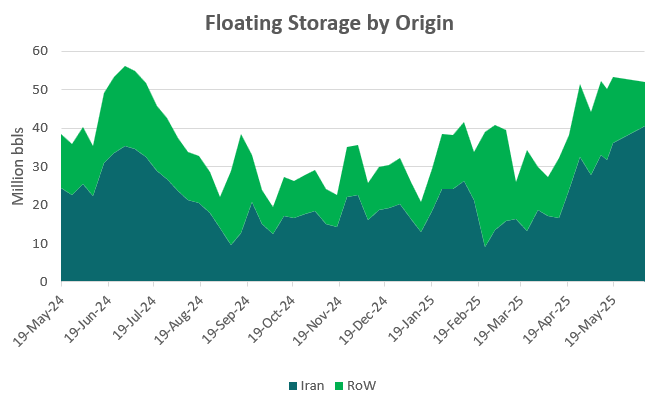

Chinese assessment will be interesting because it stands to lose the most, and it is not oil, is LPG, where Iran is a major exporter in the region, and right at the time when Chinese petchems are scrambling for feedstock, whereas Butane, Naphtha or Ethane. The oil front is covered, they have more than 40 millions of Iranian crude floating near their shores, with even the luxury of turning away some of these boats. Is not just the barrels floating, but the price as well, so if they didn’t take them last Monday at $65, even less they will at $75, but they will become a beacon of China perception of the conflict, if they start drawing from that floating inventory at these prices they could be an indication of panicking. They still have quite a buffer from what they built during March & April.

At the time of writing, there are rumors of Israel targeting Iranian refineries, which could make sense as “it will not disrupt the crude oil flow” they say… but it comes at the peak consumption period in the Middle East, and Iran is already struggling with gasoline production, and is no secret that Iranian gasoil and fuel oil is crossing into Iraq to aid their power generation so the contagion could easily spread throughout the region, hence the nervousness around distillates today (more on that in the products section)

In the realm of what’s possible, my main concern is focused on shipping. You see, if this drags on and becomes a blow-for-blow exchange, the most feared cartel of them all, the ship insurers, would consider the wide Gulf Area as high risk, demanding a War Risk Premium for vessels transiting from and to. Current premium stands at 0.05% for Hull & Machinery, but if things flare up, it can go up to 0.5%/0.7%, meaning, in a VLCC worth let’s say $80 Million, the premium for 7 days transit in the area equals to $560k on top of a $3.5M freight from Middle East to Asia, those extra 0.30c per barrel has to come out from some pocket, is not from shipowners and certainly not from charterers, is coming from the barrel itself. The Dubai benchmark will have to adjust for the increase in freight. Suezmax loading in the area would command a higher 0.4c premium, so there is another interplay here.

But nothing is linear in shipping, looking at who picks up barrels in the Middle East is a mixed bag, Western shipowners, Japanese and Koreans will avoid or be fully insured if they have to, Chinese? Some will, but the rest operate on a different level.

And that brings me to the last layer of complexity: Iran will try to load as much oil as it can in the coming weeks, testing the limits of the dark fleet. Is not alone, though, we had news about the G7 aiming to lower the price cap on Russian oil, regardless the US is on board or not, and Russia has already started to tap into the open tankers in that corner of the market. Today, Russian crude is back trading above the price cap.

All in all, this spells: more friction on the Medium/Heavy Sour barrels, diesel and fuel oil showed us the way.

Ignoring the FOMO, the physical barrel had its say this week

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.