Since last week, we had tariffs imposed on Canada and Mexico—then quickly removed—tariffs on China, and retaliatory measures from China, slapping a 10% tariff on LNG and U.S. oil. Iran’s maximum pressure—five VLCCs and a well-known array of facilitators… that’s it? Aramco OSPs soared, an OPEC meeting took place, extreme weather events unfolded… and yet, oil (flat price, that is) barely moved.

So, what’s going on? Beneath the surface, nothing. But on a more philosophical note, I believe the trading community has matured enough to take these swift headlines for what they’re worth. It’s just noise. However, filtering through the noise, we do find some interesting developments.

Let’s address the “nothingness.” We are at that time of year—especially this one—when trading activity halts. We are already trading well into April, with refinery turnarounds hitting the hardest in what looks to be a heavy season. It’s just an air pocket. European refineries are entering this period with ample product supplies (see ARA stocks below), poor refining margins for simple configurations, and forward demand uncertainty as the economic pulse struggles to take off.

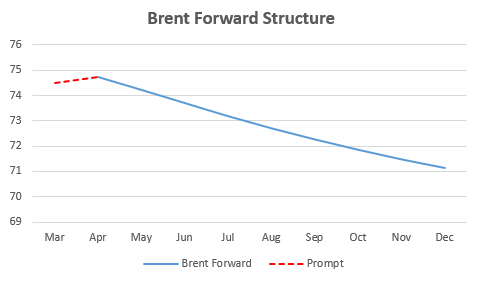

This partly explains Brent’s awkward position—too rich for Asian buyers, too competitive for the transatlantic arbitrage. Rumors are swirling about a major North Sea player that got too long too late and is now in dire need of offloading barrels, keeping a lid on the prompt market. We even saw an unusual situation this week: Dated Brent in contango (10–30 days forward scheduled cargoes) while futures remain in backwardation.

Meanwhile, on the other side, we are averting a crisis, with crude stocks finally building at a seasonal rate. However, Cushing is still drawing inventories, possibly redirecting more crude to PAD II in anticipation of tariffs that never materialized—at least for now. WTI weakness aligns with this narrative.

A proper crude inventory build should have begun in December when China started frontloading, followed by sanctions and India’s rush to cover. Instead, it was deferred, and maybe now we’ll see a few consecutive weeks of rising inventories through the rest of Q1. The usual forecasters expected builds of around 1 million bpd in Q1, but we’ll end up nowhere near that—200/300 kbd at most—before we hit the shoulder season.

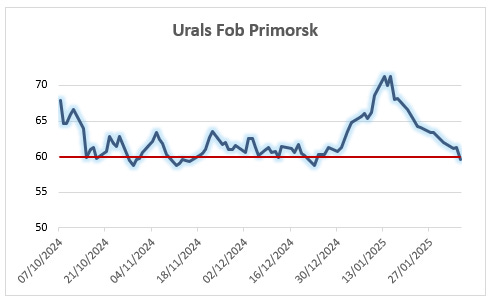

Speaking of normalization, the market always finds a way. This week, Urals FOB prices fell below the price cap, allowing Western ships and service providers to re-engage in Russian trade. What triggered the Mediterranean sours tantrum will likely end it. With Russian refineries targeted, the only option is to free up crude for exports. There’s a caveat, though—fewer refinery runs mean less fuel oil, creating some hiccups in Asia.

Last time, I questioned whether Saudi Aramco would dare to raise prices for March loadings. Not only did they dare, but they also went for a moonshot—raising the OSP to the highest level in two years at $3.90 for flagship Arab Light.

We should see allocation results early next week, and my guess is that the Chinese won’t be happy. They likely won’t request as many cargoes as in the past. There are still cheaper alternatives available, especially for lighter grades (some inquiries about Forties have already begun).

Does China even need this much oil? Maybe. Early indicators suggest improving energy consumption, and even with the tariff spat, petrochemical demand remains solid. (There’s a reason China left naphtha and LPG out of the tariff retaliation scheme.)

Domestic margins for road fuels are improving, and the shift away from teapots is in full force. Despite tensions, I’m growing optimistic—something has changed within China. India is also performing well in terms of domestic demand, with January numbers once again surprising to the upside. Let’s see if this trend continues into February, where the full brunt of the Dubai spike plays out.

Policy could go either way—except in Europe. Brussels’ mandate to keep gas storage at arbitrary levels is pushing TTF back into familiar territory. Now, despite its recent run-up, diesel is once again a cheaper power-generation source (excluding EUA allowances). Combined with reduced refinery runs, a potential draw for heating and power generation will support prices through the end of winter.

Several factors are supporting current price levels, even as trading activity cools. We’re not out of the woods yet, and every market participant is keenly aware that the U.S. could slap tariffs on Europe at any moment. From a discretionary standpoint, shorting this market makes little sense—you’re just one tweet away from being stopped out. Buying at these levels? Maybe too early. But there isn’t much to push prices below $70.

For now, the trade is about capturing margins and playing the light vs. heavy reversion to the mean. Dubai needs to come off. Elsewhere, the market is exploiting freight differentials, arbitrages opening and closing within a day, and just waiting for the next tweet to sell the counter.

And it’s only been 17 days. 1,443 to go.