A short week, slow news, and for flat concerns pretty much uneventful, but underneath the story is more interesting. The start of the week was undoubtedly Gasoil in Europe,

I shorted this thing simply because it looked expensive and it was trailing the scenario of Middle East tensions that had already dissipated by then, tankers were down, diffs were down, Russia was loading more gasoil…easy money I thought... but that is as far as I went in due diligence, and I got what I deserved.

We are trying to find out what’s going on with middle distillates, which I think could be more structural than sporicidal.

Exports and flows in June were consistent, albeit with more barrels surfacing in the East than in the West, but at the same time, there was a consistent pull from Latam and Africa that were unaccounted for. The market in the last two weeks fell out of balance, with now NEW, the Meds, and the US East coast competing for these gasoil and jet barrels. There aren’t that many outlets other than PADD3 that were busy splitting between Europe and Latam,

What at first glance looked like a West of Suez problem slowly transposed itself to the East. We know China and India are on the low side of the demand because of heavy rains, but that is also affecting the logistics of refining and serving the export markets.

Middle distillates started to draw in the East as a consequence, making the arb from Middle East points back to Asia, even after LR2 freight normalization, which is making things harder in Europe, where we enter this self-reinforcing re-pricing mechanism. The cure for high distillate prices would be more barrels… but the question is, from where?

The real conundrum in the current market is where to source the Heavy/Med Sour barrels from. Middle East is keeping the cheapest barrels from direct crude burn, the Dubai premium above $3/bbl suggests a squeeze in these barrels, despite record volume loadings during the last two weeks. OPEC is playing the game they recently discovered, they don’t need to corner the whole oil market, just the fraction they dominate, which is the prompt spot heavy barrels, but they are not alone, Canada, Mexico also trimmed down exports due to various reasons coupled with weather events in Latin America.

Prices for Latam heavies are in demand not only from the US but now Asia is trying to replace the slowdown in TMX liftings. Is no coincidence that this week EIA reported that the whole US refining complex is running on a record “Light Slate” of 36 degrees API. Adding to the 250kbd of Venezuelan oil that were lost last month, there were quality issues with Mars, resulting in a lower yield of middle distillates.

In fairness, these were known factors, and if on top of that we add an extreme heat wave in Europe and the US, which is trimming down refinery runs at the risk of refineries exploding, (which it did happen anyway) and a polar freeze in part of Latam that required more heavier distillates for power generation we have the perfect scenario for a blowout in the spreads.

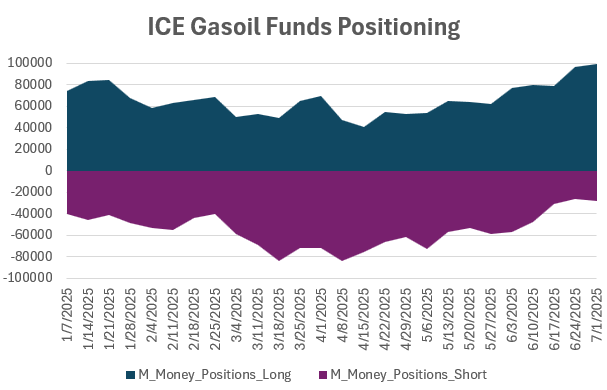

Funds have been positioned on the long side for weeks now, reaching the greatest length in ICE Gasoil futures YTD. Although that trade looks overcrowded, it might have some legs, and here is what I get to the structural part.

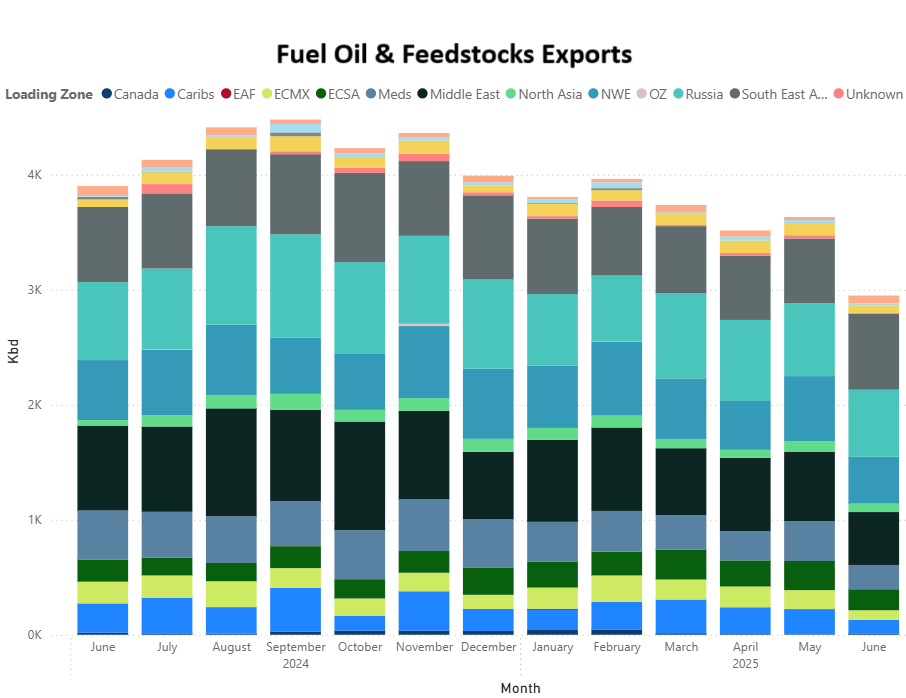

We have been missing Fuel oil and dirty feedstocks for months now. We could have attributed that to Russia's swing in supply of HSFO, but there is more to it. The shortage is now VGO and resids, more acute in PADD3.

The West has been running on light sweets for a while now, leaving the market well supplied with VLSFO (Very low Sulfur Fuel Oil) that the complex refineries deemed uneconomical to re-run in desulfurization units and that helped to mask the shortage in High Sulfur, as disti demand wasn’t there, and then came the 12 days war that lifted the vail and made evident the shortfall in the West.

The barrels we are missing are from Latam, Mexico, Brazil and Argentina were tinkering with their refineries to keep more of these barrels at home, as the slate in these countries oil is also turning lighter, with more condensate in the production mix. They are keeping the fuel oil to blend at home instead of shipping it. In the case of MX, or better put PEMEX, production is collapsing due to decades of mismanagement.

So, unless OPEC comes to the rescue, this scenario, where the cheapest feedstocks are restricted, could reconfigure the relationship between light ends and middle distillates. That’s one reason why gasoline is underperforming middle distillates.

As the market awaits the next output hike decision from OPEC, there are some encouraging signs for them to move forward.

For my part, I learned a lesson, I won’t short this thing until I see a real commitment from India and Middle East to ship diesel to Europe. The Red Sea is still locked, and though freight is coming down hard, there is a sudden restraint from China to push distillates to the export markets now the ethane thing has been solved; they are trying to get rid of light ends now.