Two things got clear to me this past week, peak oil demand season has started and for those of us waiting for any kind of a geopolitical resolution on the open fronts, after witnessing the break up between arguably “The most powerful man in the world” and the wealthiest man in the world (20% poorer than last week), is clear than t these people can’t and wont negotiate nothing, so there is no point in forecasting scenarios with deals, sanctions, friends and foes, etc.. any of this has been discarded by the oil market that marches at its own pace.

And that’s a good thing, because when markets are left to their own devices, interesting things happen, so let’s get to it.

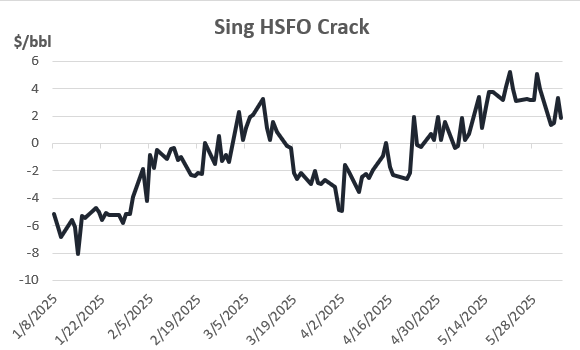

Justice has been served; the inexplicable bull run in Asian fuel oil came to an end this week although it is still high on historical levels. We have many explanations for the move, ranging from OPEC increasing output (allegedly), more Heavy/Med sours hitting the spot markets in the Arab Gulf, increased runs, etc.. but the proof of the matter is, Bunker sales both in Fujairah, Singapore and even the bonded sales in Zhoushan Port in China have been stagnant, to the point of ex-warf bunker deliveries (when you fill a vessel with fuel in the docks) is quoting at a discount to the Sing380 benchmark. Direct burn for power generation? Too expensive, they would rather burn crude oil. And on top of that, Russian fuel oil is getting more accessible as refinery runs are coming back (we haven’t heard of any Ukrainian attack on oil infrastructure for a while now). It’s a sell

Summertime, the joy of driving. Well, not according to the EIA, which showed a rather slow start to the season for US drivers, as measured by product supplied and rising inventories. Data looks wonky, as it always does when there is a public holiday in the middle of the sampling period, expect some revisions, since for now, the length in gasoline is only observed in the US, EU is clearing the backlog it built during Q1, Asia is also showing some renewed strength in light distillates at the same time refineries are running back at normal levels. Granted, most of the East of Suez is were on holiday these past days, so we will see what's what next week.

I mentioned some of this last week, and this week it was more acute. ADNOC reduced the export availability for Light Sour (0.76 is almost sweet) from 65,000 bpd in August up to 177,000 bpd from September 2025 to May 2026, to optimize their Ruwais refinery. Removing these barrels from the spot market flipped again the pricing dynamics between Murban and Upper Zakkum / Oman grades. There were talks about introducing a negative quality premium to Dubai to make it price below the Dubai benchmark and avoid these shenanigans in the Middle East window. ADNOC decided to take them out before that. This is linked with the previous comment on High Sulfur Fuel Oil, making available more higher sulfur grades and at the same time, tightening the light sweets not only in Middle East but it was one of the kickers for the bull run in Brent differentials. This decision caused the Dubai window to practically come to a halt, with only a few partials changing hands, and not one single cargo converged.

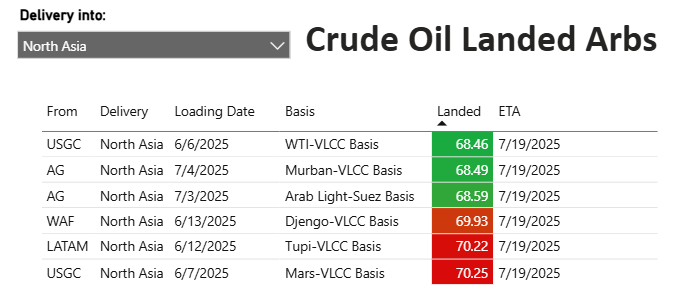

And the other thing that kept us busy is the VLCC collapse, not tankers, just VLCCs, and this is an odd one. VLCC rates got to new lows for the year, starting in the AG with TD3C and then spreading like a virus to the Atlantic. What’s the deal here? Too many ships? That is true in the US Gulf, when WTI was a little expensive to cross the Atlantic at the beginning of the week (more on that later) and cargoes favoring smaller size vessels.

Not enough cargoes? That is true in the Arab Gulf, well, there are cargoes, but not enough spot cargoes. Remember the last round of almost 50mb allocations to China? Those are there, but moved by their own tonnage, COSCO COAs (contracts of afreightment) or Bhari term ships. Inquires for the spot cargoes, those from UAEs, Iraq and Oman are being picked by India on Suezmaxes, leaving more VLCCs available…

But fear not, tied with the Murban drama in the Middle East, making light grades more expensive leaves WTI, Brazil/Guyana in play to sail East. Brazil was quite active already, so was TD22, albeit at rock bottom rates, this should start to heat up in the coming weeks. I’m calling the bottom for VLCCs here, enough bloodbath.

With all these developments, is no surprise that oil is holding on the $65 mark, trying to break free of the range we have been for a couple of weeks now. Does it have what it takes?