Jerome

This week dull comes courtesy of the FED

This week in oil is pretty much a continuation of previous weeks, with a slow decay in activity in the physical markets as the year comes to a close. As expected, premiums are in soft landing mode, albeit showing some resilience to macro data and prevailing sentiment in the broader markets.

Story of the week is again not coming from the oil market itself, but from policy makers on both end of the geopolitical spectrum, that is China and the US.

China keeps delivering monetary bazookas, bigger every time, in a desperate attempt to wake up domestic consumption easing credit and providing fiscal incentives to key areas of their economy, which seems to be starting to work judging from initial retail sales and PMIs, somewhat translated into oil buying patterns which month to date are in par with buoyant November levels (10.3Mbpd).

But in this arms race, the biggest bomb was dropped by the man himself, Jerome Powel, providing an ambiguous path for future rate cuts, an oil which at the time of the FOMC was trying to shake off some bearishness coming from Middle East, immediately succumbed to the overwhelming pressure of the US dollar. From there oil resumed is previous trend down we kept going.

Is not so much the “commodities are dollar nominated” thing, rather than the shockwaves of a “higher for longer” would mean. Exhibit A) Brazil

Reminiscences of 2018 with emerging countries starting to blow up is definitively not a good omen for oil consumption, the difference is fund have been flying into safety for a quite some time now, so any impact would be limited, but this void in liquidity will persist.

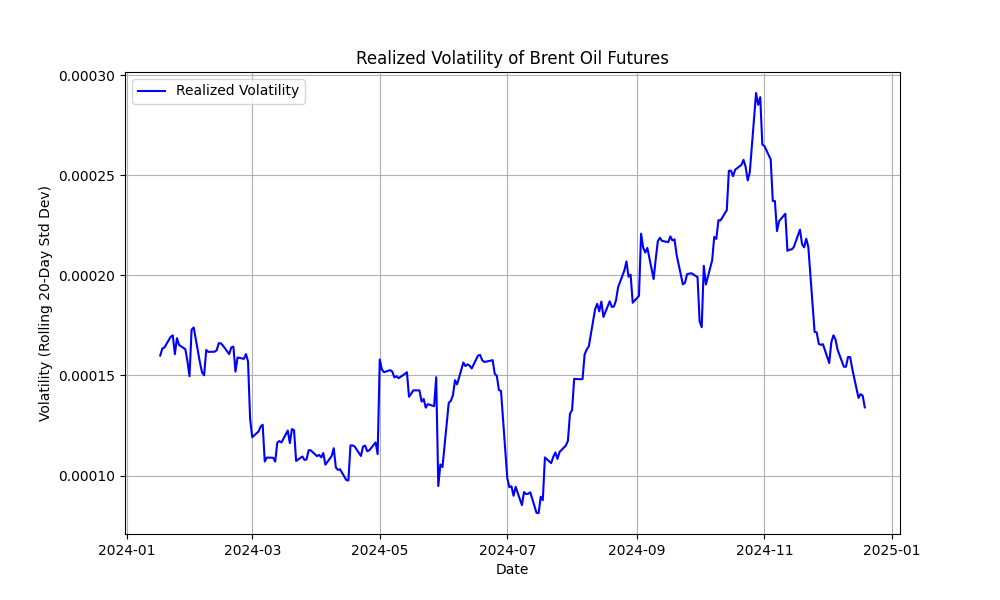

Brent realized volatility so far this year has been the lowest in 5 years, below 30%, with two ongoing conflicts, promises of trade wars and political upheaval in OECD countries.

As we enter the new year, an abundance of forecasts, predictions and best wishes populate headlines and though I don’t dwell that much in long term views I want to touch upon a few things that I have seen about a gloomy 2025.

Everyone seems to agree that there will be an oil glut in Q1, ranging from the more optimistic 400kbd to 2Mbpd, and that’s quite a range. I do agree that Q1 will be challenging and consensus stands around a 1Mnbpd of surplus, last time we had an imbalance above 1Mnbpd was in Q1-23, and Brent prices were on average $73, what is different this time around is that the futures structure is not taking notice of such violent swing is about to happen yet.

Ultimately, supply and demand balances are a function of price and price structure. We know China likes to buy cheap and store, but has already a war chest with over a 1000Mb and an allegedly storage utilization of 80% of shell capacity. They are already buying some extra 15 million barrels from Aramco alone in January, some Qatari and all the Angolan Jan program, so if barrels are intended to go on storage, should be the west which is running on tank bottoms, but in order to send those barrels to sleep, the incentive should be a hefty “contango” of above $1.50 to make economic sense.

Furthermore, as a refiner you can still lock in pretty decent refining margins into Q1, running crude and delivering products into the contract are a much appealing proposition. We might have seen some of that these past few weeks. I see more pressure on product builds, like we have been seeing, rather than a big crude pile up. This will end up biting crude on Q2 as margins deteriorate, but we’ll cross that bridge when we have to.

Another lack of evidence of a large build up in crude are tanker rates, a big surplus will answer all their prayers but yet, some are already locking in rates for Q1 at abnormally seasonal lows which doesn’t suggest a positive view. If you believe there will be such a surplus and the ensuing contango, then shipping seems like a safe bet, yet no one is taking that bet.

Looking further down the line, I’m also somewhat sceptic about Non OPEC supply growth since as we were stuck in the low 70s I saw evidence of projects starting to slowdown and production to flatten if not falling, the darlings of supply growth: Guyana, Brazil and Argentina are ending the last Q flat if not with some minor revisions to the downside with high borrowing costs putting drilling on hold.

On the other hand, I’m less optimistic than forecasters when it comes to demand. India won’t save the day, with Russian barrels out of the equation, the magic is gone. China is decidedly on its way out on road fuels and while coal remains cheap, that would be the fossil fuel of choice, you have to feed those EVs somehow. Emerging markets in general paint a bleak picture, as pretty much all of the countries pinned to be the engine of growth are themselves commodities exporters. I’ll be happy if we end 2025 with half a million barrels in total growth.

Ongoing conflicts underpinning oil market are taking another turn, and not in the way of a swift resolution as assumed with a Trump presidency. Russia is showing some signs of exhaustion, which is weakening Kremlin’s hand at the negotiation table. Refineries keep getting hit and is taking longer to bring them back, rubble is imploding, tankers in the black sea are breaking apart and a every week we had a fresh round of sanctions. Ukraine won’t settle that easy, regardless of what Trump advices… so this conflict will drag on.

And then there is Syria, which is a complete different animal to the proxy wars we have seen. The unfolding of a civil war with different rules of engagement and contagion to other Middle East countries is now a possibility. Remember the fall of the Assad regime caught the Arab nation off guard. This is something beyond anyone’s control. Iran “max pressure” is already being felt, although self-imposed by China, for now is more a function of price Iranian demand for their barrels that is keeping these barrels floating but when the price is right, those barrels will resume their flow to China eventually.

Now, enough about the future, lets see what happened this week.