This week marks the 8th consecutive week of flat price decline, yet we’re still holding steady in the 70s—though that might not last much longer. The broader market mood is beginning to seep into oil and energy, and it's not just about flat price and financial barrels anymore. The physical market is showing signs of stalling. Uncertainty around tariffs and trade policies is keeping everyone cautious. Remember, physical oil cargoes are bought and sold months in advance, and no one wants to risk getting hit with tariffs while their barrels are in transit. The same applies to hedging; nearly everyone is using near-term futures/swaps to hedge, with no one willing to call Gasoil Singapore March '26 or WTI Houston October '27. The market is essentially in lockdown.

This week, attention shifted to CERAWeek, another oil event, but this one focused more on upstream (exploration/production—the less exciting stuff). CEOs from all corners were praising and flattering the new US Energy administration, but the message that came across was clear: "We stop drilling at $60." Despite the usual narrative in OPEC’s latest monthly outlook report and the IEA downplaying OPEC's view, something is changing in sentiment.

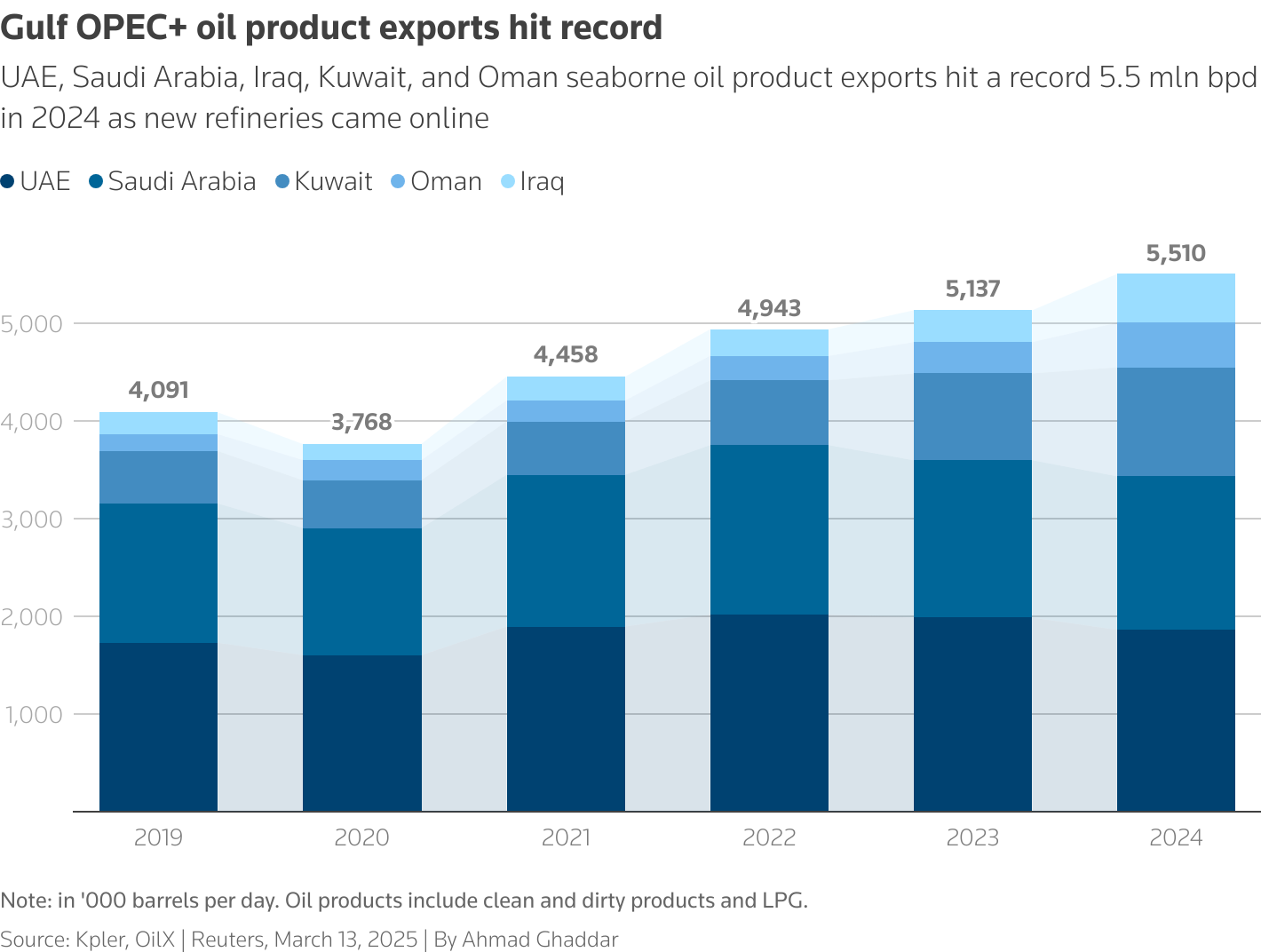

As we started to scrutinize barrels, we (collectively) began to think there may be more barrels out there than initially believed, and looking deeper into products, the picture is more defiant.

The datapoint I was expecting this week was Saudi Aramco's April allocations to Chinese refiners as an indicator of overall demand—and it came in below expectations. For March, Chinese refiners were allocated 41 million barrels, but for April, that drops to 36 million barrels. When Aramco announced its April OSPs at $3.50 over Dubai, it felt expensive given where the benchmark is currently trading. My guess is that China will seek spot barrels elsewhere.

This lack of appetite from the world's largest oil importer is spreading westward too, with North Sea markets dormant and no trades to report in the window. What’s concerning some market participants is that we were relying on the "Chinese Put" (when China steps in to buy at $70), but so far, they’re not interested. While flat prices may appear cheap, grade differentials and freight are not, deterring some price-sensitive buyers.

Another factor weighing on the market is the resumption of Russian and Iranian trade. These barrels are flowing again, back to a pre-January sanctions scenario, with the added advantage that 60% of Russian oil is trading under the price cap, making it easier to move.

On the demand side, the market isn't yet focused on what demand might look like in a contracting GDP scenario. It's too early to predict that, but it’s anchoring its view on recent data from US and Asia road fuel consumption, which isn’t promising. Only India showed a marginal improvement for gasoline, but jet demand in both the US and China is underwhelming. It feels like, if you strip out seasonal effects (cold snaps, freezing pipelines), the underlying demand is stuck in the same holding pattern as last year. A weaker dollar could help, as emerging markets haven’t been hit as hard. A ceasefire in Ukraine might boost Europe’s spirits and unlock fiscal stimulus (though it didn’t translate to higher gasoline demand in China, let’s see), and hopefully, there will be less volatility.

The big cloud looming on the horizon today is Europe’s trade relationship with the US. While no mention has been made regarding oil and oil products, the situation is currently limited to other liquids. However, any escalation or retaliation in the energy sector could have significant implications on both sides, given their interdependence.

In any case, some developments this week might offer us clues on where we go next.