We have seen flat prices crashing down and rising again, volatility is at extreme levels due to low positioning in derivatives, (for those new to this game, swings of $1/2 in a day are not normal) but what we haven’t seen is the physical premium move in tandem, if any it got much steeper.

It goes like this: Cushing is drawing crude week by week at a much rapid pace, which is removing export barrels especially to NWE on the prompt, couple that with ongoing disruptions in Libya and China sweeping some cargos in WAF and Brazil. Barrels for mid September delivery in the North Sea are changing hands at Dated +2.5/3, which is well above the average for the year. Brent M1/M2 spread suggest the same holding above $1. This in term is lifting global light grades; even CPC that was subdued is starting to show signs of life.

So where this sudden rush to get light barrels comes from?

There are some speculative positioning long with the view that China will come back roaring for late October/Nov deliveries and should start buying now from West of Suez, there is always the holy grail of “more export quotas”. Market participants are starting to turn on OPEC policy shift, there is no way Saudi Arabia will dump barrels in this market they say…

I got two problems with that:

As seen in the chart above is all fun and games in the light complex, but for medium sour barrels, the prompt structure is near contango levels for Dubai, meaning there are more than enough medium/heavy barrels, and China is not there yet.

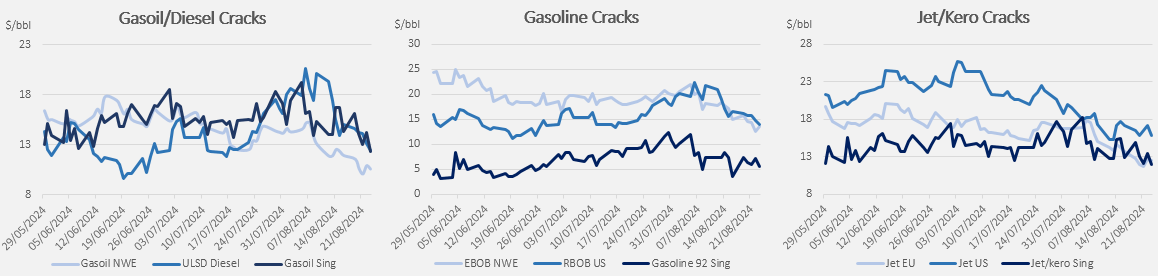

Refining margins are being smacked down in Asia above all regions, with the West not doing much better, so is hard to see were more products will find a home. Europe is becoming a dumping ground for diesel/gasoil, Latam is buying more from USGC and Dangote might be finally pushing out gasoline soon

Some adventurous are suggesting that maintenance season in Europe can take out up to 700kbd of capacity in September, which should show itself in this pricing cycle. I don’t see that yet.

On the global front, China is being picky. Unipec sold a WTI and some WAF crudes to buy Brazilian grades that were left aside in recent months. Is certainly picking up more Saudi this month and looks like total monthly imports will be back above 10Mbpd after a tragic July.

TMX is causing havoc in Latam grades that bode well in the USWC, China wasn’t particularly active in August so more Canadian oil will stay in the region. Russia is curtailing some exports (self-inflicted?) and there are rumors that a suez of Urals was sold to China and will take the Artic route.. try to hit that you goddam Houthi.

Meanwhile in the Red Sea, Delta tankers wants to prove to the world how safe navigation is, with their third tanker attacked this week. Note to insurers: is time to revise their insurance policy.

For tankers it looks like the start of Q4 is gearing up, the slowest to react was always the suezmax segment, which it started to creep up. Vs got a little ahead of themselves but pricing structure for Middle East crude definitely help, but we need those Atlantic barrels to cross to Asia to see a real recovery, so far, pricing is prohibitive.

Where I’m not feeling positive is in the clean tanker market.. with jet trades fading out, there is only the naphtha trade to keep rates above water..

So?

On Friday I saw the diffs settling down, Gunvor which was a net buyer till last weeks became a seller, so did Vitol and Trafi, also in physical premiums the frost is starting to thaw and product markets didn’t react that well on the recent rally. Not even Powell can wake up gasoil. We might see a retest of recent lows to cement this new trading range 75-80.