We knew we had an exciting week ahead of us, but this escalated quickly. Liberation Day was a celebration of neo-mercantilism and will surely have an impact on the global economy—if it is not reversed in the next few minutes. Luckily for oil and energy, these items were exempt from any form of tariffs, as were Canada and Mexico. Nevertheless, the initial sell-off came on sustained fears of a global slowdown—and rightfully so, since oil demand is perfectly correlated with GDP growth.

According to the IMF and the World Bank, prior to this tariff showdown, global GDP growth was projected between 2.7% to 3%, and oil demand growth between 0.8-1.5 Mnbpd between the IEA and OPEC. History shows that a contraction of 1% in global GDP equates to roughly 1.1 Mnbpd in refined products. We need to dig deeper here, since this new scenario does not impact all parties equally. As disproportionate tariffs might seem, the worst affected will be the US consumer, as financial markets have shown us. As the EIA puts it, total liquids demand in the US is expected to grow only moderately to 20.5 Mnbpd—a lackluster growth, but growth nonetheless; well, that is most likely gone as traders grasped a WTI weakness over Brent in the initial reactions.

It is quite a complex scenario to analyze, but here is my chain of thoughts:

Less trade, fewer container ship voyages (blank sailings), lower bunker demand, and reduced Fuel Oil demand.

Flight activity is also positively correlated with the economic cycle, and with a weaker dollar and uncertainty, I think holidays on the French Riviera are off. Jet demand was already showing stress signs.A 25% tariff on foreign cars would translate into fewer new car sales, with people holding onto their old cars longer—a trend we have seen since the pandemic and one that can only accelerate. The average fleet age in the US is 14 years old, the highest it has ever been, meaning more inefficient gas guzzlers on the road.

Petchem in China—our holy grail—is effectively postponed… unless a new Chinese stimulus is around the corner, which could easily be the case, hence the positive reaction.

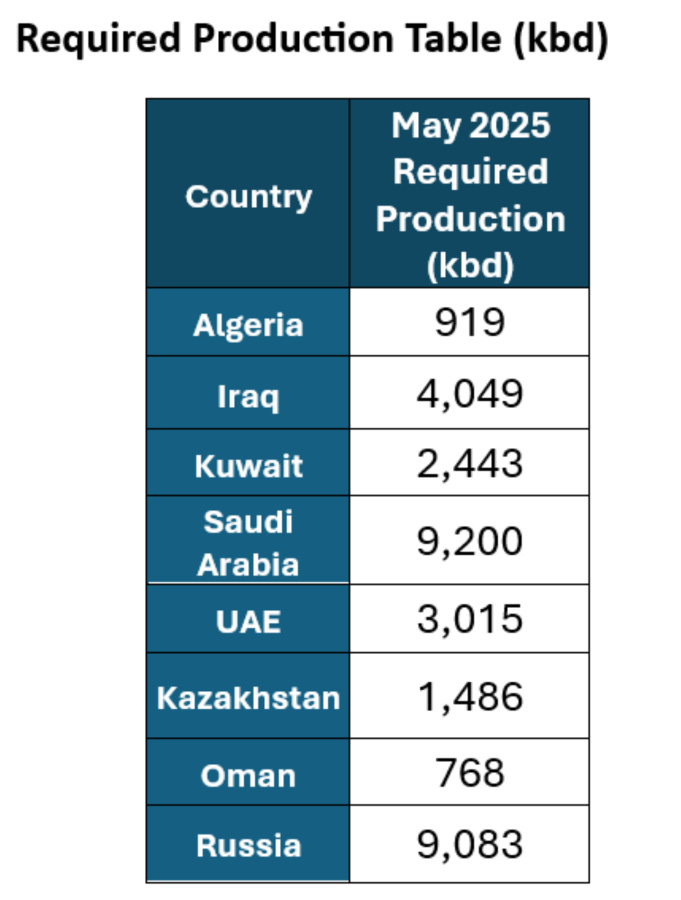

We still have a lot to analyze and await the next steps—well, that’s what we thought until we woke up to the news that OPEC got together and decided to bring forward the unwind of the voluntary cuts, injecting three times the planned volumes for May. April is bringing an additional 138kbd, and May, according to plan, is 400kbd minus the compensation cuts from Kazakhstan, Iraq, and Nigeria, which equals some 300kbd. So in net, we are talking about an additional 100kbd from a planned aggregated 250kbd using March as a baseline.

This definitely caught the market by surprise and sent oil to the lower band of the range once again, this time chopping $5 in one trading session. So, what’s the endgame here?

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.