We can confidently say that the Trump era has started. Following a moderate speech on Inauguration Day on Monday, the market sensed a shift in rhetoric. Most notably, there was a more conciliatory approach toward neighboring Canada and Mexico, softening the likelihood of a 25% tariff on crude imports, at least for now. The initial tone also included a more lenient 10% additional tariff on China, much to the relief of Xi Jinping, and an ambiguous stance on Russia—praising and threatening in the same sentence. However, nothing in these developments significantly influenced oil markets, and prices continued their existing trajectory.

By the end of last week, the exhaustion in the physical market was palpable, with little activity as traders anticipated some major Trump-related surprise, which ultimately did not materialize. Since then, we have seen a gradual retreat in flat prices. Given the level of paper positioning and excitement around sanctions, one would have expected a sharp sell-off in a classic “sell the news” scenario. Surprisingly, prices didn’t plummet. Instead, the fall in flat prices has been gradual, as have movements in differentials and time spreads. These are signs of a well-integrated market where most positions were already hedged. Despite a $4 drop from the highs of $82, this correction appears healthier in terms of market breadth.

So, what changed since last week? With more time to analyze the sanctions conundrum, analysts and the trading community began to realize that the impact wouldn’t be as immediate as the Indian and Chinese self-induced frenzy initially suggested. The two-month “grace period” (OFAC has clarified to India that tankers loaded with Russian oil have to discharge by Feb. 27) provides Russia and its customers with some breathing room to adjust logistics. Meanwhile, stranded vessels have begun discharging their cargo. The “Shandong Port Group,” an otherwise unremarkable port operator that gained fame two weeks ago for declaring they wouldn’t touch an OFAC-sanctioned vessel with a 10-foot pole on Monday, they discharged two such vessels—we have been here before. Similarly, India allowed some Urals shipments to be unloaded, extending insurance coverage to less reputable P&I insurers like Ingosstrakh and Alfastrakhovanie. Fun fact: many of the newly sanctioned vessels are under the Indian Ship Registry. India, alongside the UAE, has played a pivotal role in the exponential growth of the “dark fleet” so let me at least have my doubts about Indian compliance.

These sanctions have disproportionately affected the ESPO (Eastern Siberia-Pacific Ocean) trade from Russia’s Far East to China compared to the Baltic-India trade. A repositioning of Russian vessels has begun, with some moving across the North Pacific. Strangely, many of these blacklisted vessels remain idle near Kozmino port. This challenges my earlier theory that they would move to the Baltic to serve ship-to-ship transfers. However, I might still be correct in suggesting that Russia could use the price cap ($60) as a relief valve. Early indications show one or two cargoes from the Baltic loading under the cap this week. Meanwhile, a couple of 15-year-old Aframax tankers have been sold to “undisclosed buyers.” Ultimately, the market will adjust, as there is a $10 per barrel incentive for Russia to double down on its rogue fleet.

Back to crude, the spotlight is on India. Unlike China, which seems better prepared like someone alerted them beforehand, India was caught with their pants around the ankle and has yet to fill the void left by reduced Urals arrivals for March and April. To keep its refineries running, India has been paying exorbitant premiums for Medium sour grades since it’s economically more viable to secure feedstocks and maintain secondary distillation units running than to shut down altogether. Consequently, Indian refiners have issued three new crude purchase tenders, ranging from a couple of cargoes to full-year allocations. India is still out there aggressively bidding in the Middle East, West Africa, and Latin America but unlike China, which can absorb the ESPO shortfall thanks to an abundance of light sweet crude, India’s reliance on Urals is more complicated. Trading houses are hoarding the few available barrels, not to refine them since margins for the type of refineries assets they have is one of the worst, but to squeeze Indian buyers for higher premiums. By my estimate, India still short 5 to 10 million barrels to stabilize its position.

Refining margins are under increasing pressure, with gasoline as the primary culprit. In Asia, crack spreads for the whole barrel are flirting with negative territory, threatening run cuts specially in North Asia (Korea+Japan). Meanwhile, the reassurance of safe passage through the Red Sea has opened East-to-West arbitrage opportunities, sending excess gasoil to the Atlantic. This will likely pressure margins in Rotterdam and New York, the only few spots where middle distillates remain profitable. However, Asia’s refining sector appears on the verge of cracking under these conditions (pun intended).

In the Atlantic, trading activity has been sluggish, hindered by ice storms, Gulf Coast refinery outages, and freight rates that make long-haul shipments to Asia uneconomical. The trading community appears to be in a holding pattern, observing the tug-of-war between India and Middle Eastern producers. The market is also constrained by the upcoming Chinese Lunar New Year (January 29). China seems to have already packed its bags and be done with the buying. This surge in mobility, despite relentless jet fuel exports to Singapore that suggests they will be travelling by EV or train because domestic margin for gasoline and jet are abysmal, Nevertheless, this could offer valuable insights into the health of China’s economy, which has been showing tentative signs of recovery.

That said, it hasn’t been a dull week at all. The oil market has entered the most lively phase, as evidenced by Trump’s comments. It took just three days for the Man Himself to open his mouth on oil prices, calling on Saudi Crown Prince Mohammed bin Salman (MBS) to lower oil prices, causing a $1 drop in seconds. Balancing Saudi Arabia’s budget is already challenging, especially with ambitious projects like luring Vinícius Jr. to the Saudi football league for the hefty price of two Arab Medium VLCCs ($340M). Priorities, indeed.

https://www.nextbarrel.com/refineries_global.html

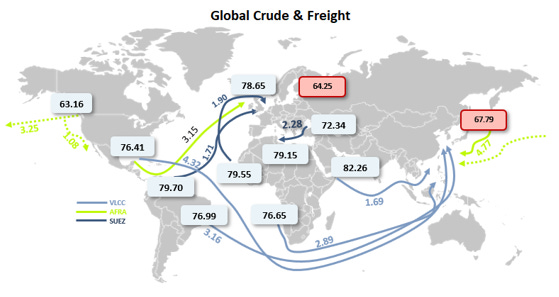

To summarize, this week has been marked by a sense of relief from China. Trump’s initial stance appears less aggressive than expected, and China’s frontloaded barrels may provide a cushion to ease market volatility. However, India remains in panic mode, offering some support to Dubai premiums, which remain absurdly high at over $4. Freight costs, although slightly down, continue to disrupt traditional supply routes from West Africa to Europe and the U.S. Gulf Coast to the Northeast. As the market digests these developments, all eyes already on the March trading programmes to see it we can carry momentum, offering some mixed signals, let’s see.

Oil Physical

Americas

A severe winter storm affected parts of the U.S. Gulf Coast, causing disruptions to port activity and some minor impacts on crude operations. Port Freeport and Port Houston experienced closures, though Texas oil and gas operations were minimally affected, with gas flows and power outages remaining limited. Meanwhile, North Dakota's oil production declined by an estimated 130,000 to 160,000 barrels per day due to extreme cold weather and operational challenges.

Inland U.S. crude grades exhibited mixed performance. WTI Midland firmed by 30 cents, while Mars Sour eased by 25 cents. Overall, medium and heavy crude prices softened following recent strength, driven by heightened U.S. sanctions on Russian oil. The Brent/WTI spread narrowed to $3.87.

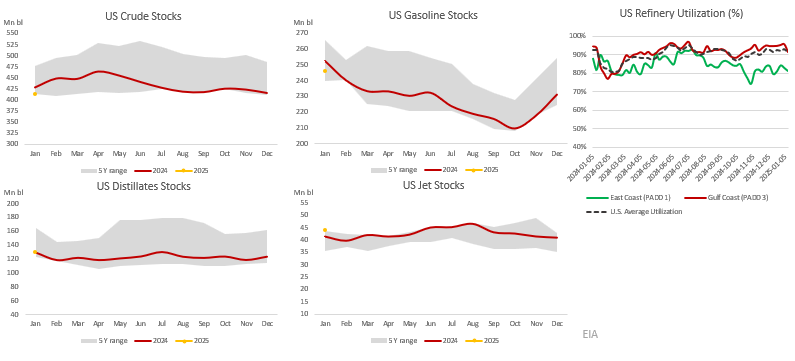

U.S. crude oil stocks fell by 1.02 million barrels to 411 million barrels in the week ending January 17, the lowest since March 2022. This marked the ninth consecutive weekly drawdown, the longest streak since 2018. However, refinery utilization rates fell sharply to 85.9% as refinery crude runs dropped by 1.1 million barrels per day and that is before the weather related shenanigans from this week, expect another 1 million barrels per day decline of crude throughput. Gasoline stockpiles rose by 2.3 million barrels to 245.9 million barrels, while distillate, the big surprise inventories decreased by 3.1 million barrels.

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.