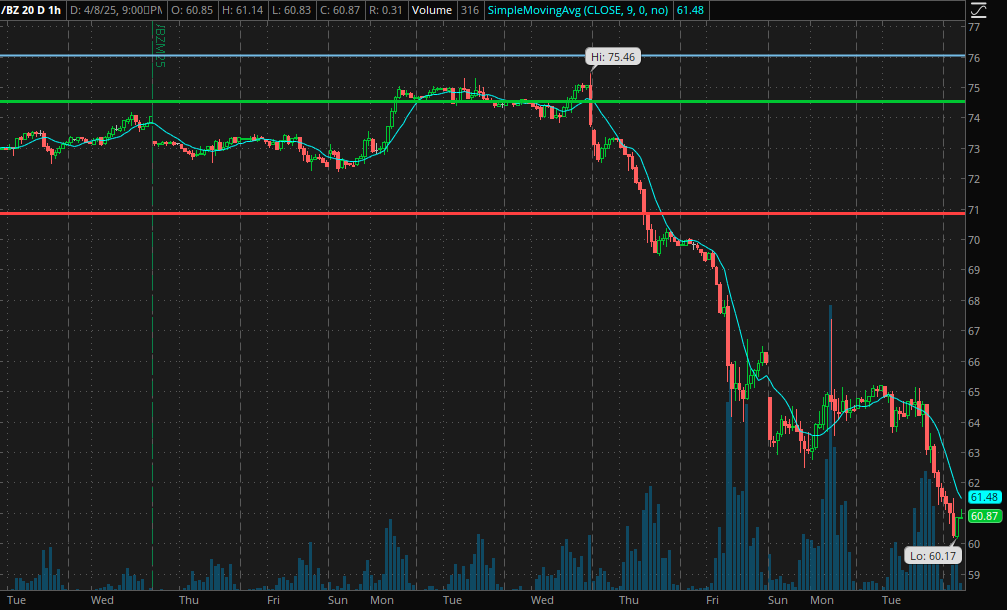

Latest developments in markets require bringing a quick update to see where we are in the physical oil. Flat prices (futures) can’t catch a bid and selling waves keep coming, crushing any attempt of a bounce. Looks like a fire sale, and is coming from the financial side.

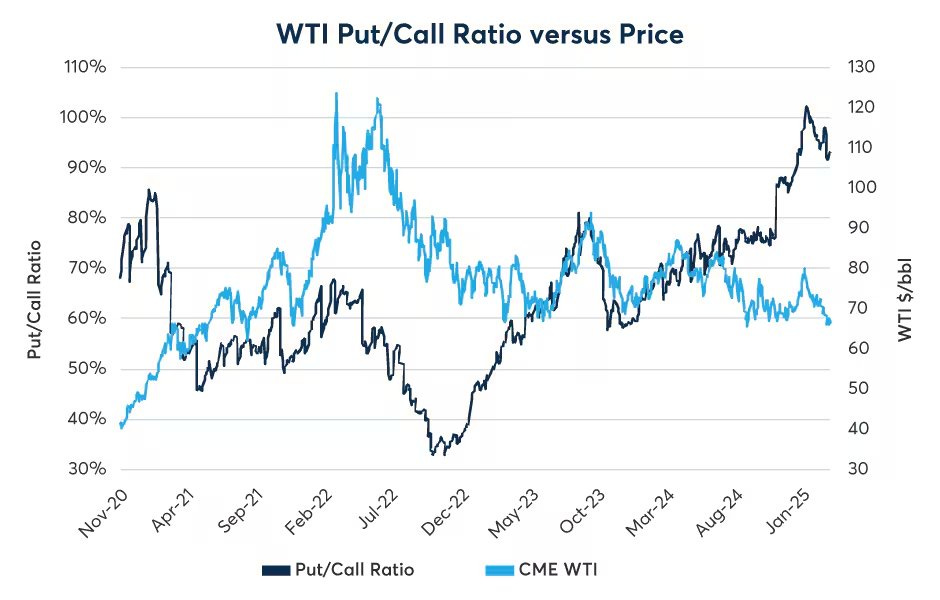

Selling started right away on Wednesday night on Liberation Day, quickly amplified by Saudi rushed decision to bring back more supply, and that was that triggered CTAs that were missing on the last leg up. Brent futures and options volume exploded on Friday and Monday, and with Put/Call ratio at the highest it has ever been since COVID, that pushed option dealers that were selling Puts to gamma hedge selling futures, adding more pressure to prices, and then the Global Macro boys came in, and if the global economy is to collapse, then the classic set up is to sell oil and copper, these two commodities that are perfectly correlated since the sell off started..

We can see the effects of liquidity and where these funds are trading, with action concentrated in the prompt and a classic trade by investment banks, selling the Dec25 vs Dec26 spread (which is in contango by now)

So are physical players following through? Not quite… if any, the imbalances I was remarking last week got even more out of sync from the financial cousins.

Oil is moving though, with a lot of fixing activity in the Atlantic, the Middle East and the Meds… who’s buying? Europe, India and Korea & Japan… Who’s selling? China