In my last report, I highlighted my constructive view on the short-term outlook for oil. However, with a decisive event approaching in the world’s largest oil-producing country, I wanted to briefly share my current perspective.

To sum it up:

If Trump wins: oil goes down.

But if Harris wins… oil goes down too.

Allow me to elaborate:

On Tuesday, we saw a sharp reversal in futures prices, turning negative after starting the morning more than $1 up, marking the third consecutive session with this pattern. But beyond futures, something also shifted in the physical market. In the North Sea, we encountered resistance with multiple offers and only one taker—our old friends at Petroineos—resulting in a slight decline in differentials, driven by the prospect of more WTI pricing into North West Europe and the Mediterranean

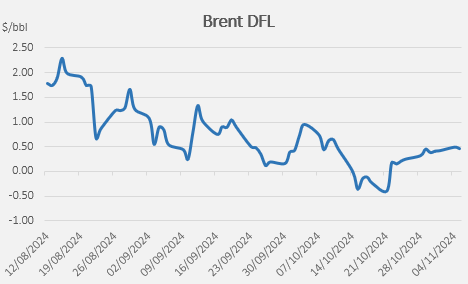

The relative strength of Brent against its peers was eroded today with DFL (Dated to Frontline) and CFDs pointing down, even when flat prices were still trading handsomely. The market is starting to soften at previous highs ($76 for Brent, 72 for WTI) suggesting that CTAs are exploiting this pre-elections volatility.

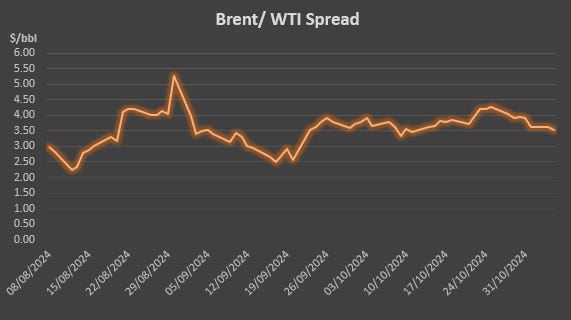

Brent-TI spread also giving up, not because of lack of WTI strength, they are still fighting for allocations in the pipelines that go from the Permian to Houston.

Futures structure also suffered a bit failing to catch the intraday upswing, possibly commercial hedgers moving down the curve to offset potencial volatility on the front.

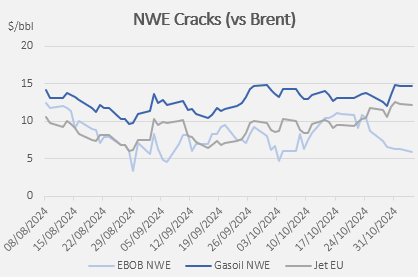

What was keeping this whole thing going in the last two weeks were refining margins, which already started to flatten or reverse the trend.

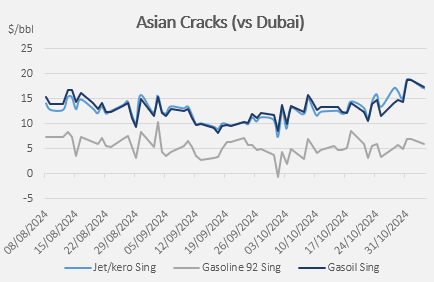

Asian cracks are seeing an inflow of Russian products once again, with freight selling off in the Middle East allowing a workable arb.

Today, oil and products looked like the rally overextended a bit in anticipation of the uncertainty around the elections, also evident if you compare it to other asset classes.

Underneath, it seems like an “oil as an inflation-hedge” was taking shape in the last sessions, that no matter the results it would be a sell the news and unwind. The dollar, treasuries can drag everything down.

How would the market interpret a Trump victory?

Initially, it would be negative, as it would imply a swift resolution of the Ukraine conflict, the reversal of sanctions, and peace reigning in Europe… but I don’t think it’s that simple. The Israel-Iran issue is somewhat more complex and offers less "leverage" than is assumed to redirect the situation.

Paradoxically, though, I think it would be bullish for prices, as lifting sanctions would also eliminate the $13 discount on “Dated,” ending the era of cheap Russian oil.

Kamala? I have no idea what that woman thinks, but unless she plans to load two VLCCs next week, I don’t think she’ll be able to sustain prices.

The big absentee here is China, which will wait to play its cards… in the meantime, it’s not buying anything.

Oh.. you asked about tankers?

Rates keep plunging, as usual.

Us-China relationship is also an important aspect of the elections.

China GDP is fuelled by exports, if Trump get in alongside implementing tariffs, it could exacerbate China economic slowdown

*The reader might or might have not been drinking at the time of reading