Since the oil markets look rather underwhelming we might start looking for other sources of revenue and since this trading thing is all about creating risk, what better thing than trading tankers.

The market structure for tankers is well defined, you are either structurally long tankers (a shipowner) or short tankers, an oil producer, refiner, trader that needs to constantly move barrels.

It gets more interesting when you are on both sides of the trade, so let’s explore the basic techniques for generating some extra PnL with these boats.

First, for non-shipping people, let’s address some definitions:

Time Charter is an agreement to hire a vessel for a specific period during which the charterer is responsible for the commercial operation of the ship. The charterer arranges for payment of bunkers, port and canal dues, and fixes the cargo while giving voyage orders to the vessel. Apart from any rights to stop or reduce the hire, the charterer assumes the risk of any time lost in port or at sea.

TCE (Time Charter Equivalent): is a measure of a vessel’s daily earnings, calculated by deducting voyage-related expenses (such as fuel and port charges) from gross revenues and dividing the result by the total voyage duration in days

Spot trading refers to the practice of chartering vessels for single voyages rather than long-term commitments. It involves negotiating freight rates on a per-voyage basis, usually in response to market conditions and cargo availability

Worldscale (WS) is a freight rate system used in the tanker industry to provide a standard reference for calculating voyage freight rates. It allows shipowners and charterers to compare different voyage options by expressing freight rates as a percentage of a nominal base rate (Worldscale 100). The system accounts for port costs, voyage distances, and fuel consumption, ensuring that returns remain consistent across different ports within a designated range

FFAs (Forward Freight Agreements) are financial instruments used for hedging exposure to freight market risk. FFAs are cash-settled contracts, meaning no physical delivery of a vessel or cargo occurs upon settlement

Bunker refers to the fuel used by ships for propulsion and operations. It includes different grades such as High Sulfur Fuel Oil (HSFO 3.5%), Very Low Sulfur Fuel Oil (VLSFO 0.5%) and Marine Gasoil (MGO 0.1%)

Demurrage is defined as liquidated damages for delays beyond the agreed laytime allowed for loading and discharging. If laytime is exceeded, the charterer is required to pay a penalty for the extra time used.

Long Freight

This is pretty much the most common play you will find out there, you take a vessel on Time Charter for a fixed period, 1 year, 3 years, 5 years. Each period has different pricing depending on the market.

You take a vessel on time charter and expect the spot market to be on average higher than you pay. Pretty simple right? Well, no. There are some important points you need to plan ahead, like where and when you take delivery of the vessel, is not the same to take delivery in Singapore, where there is no cargo available and you need to ballast (sail empty) to Middle East, position a vessel can cost you upwards of $250k in bunkers. Also you need to have an idea of what you want to do with the ship. What are areas you want to trade? that goes more in line with how many voyages you intend to do, because if you want to trade let’s say Middle East-China, you trade every 40/45 days, meaning you have price exposure 8 times a year. It depends how much volatility you are allowed to stomach. Also you need to calculate where you re-deliver the ship at the end of the charter, the last voyage is key.

Quick Buck

It might happen that you don’t have a defined POV over the long term, but you want to take an opportunistic trade for the long haul, you take a vessel for a long time charter, 2/3 years and charter out (you relet the same vessel) for a shorter period. The shorter the period, the more expensive it is to charter a vessel (usually).

When to you this? when you had a rough year and need to generate some PnL and FCF for a year. Works for embellishing balance sheets. For the second year on, that you are exposed, you can try the same if the market held, or do some combination with spot and FFAs… if fails, next year you do it again with another vessel and hide the losses of the first one… that’s how you survive in this industry son, is all about cash flows.

Spread Betting

If you think about it, freight is just a spread between two locations (and time) so you could trade spread vs spread and try to profit for inefficiencies in both markets.

Ideally these should go hand in hand, for example, TD25 is the freight route between USGC and North West Europe. You have WTI in the US Gulf Coast, well, actually is WTI Houston which is the differential of WTI futures contract + delivery costs in the Terminal, and you have Brent futures. When the market are misaligned, you can buy the spread (Buy Brent/sell WTI) and sell freight trough FFAs.. eventually these markets meet. The caveat though is that you need to understand the dynamics of both markets, the tanker market and the oil markets. Maybe there are a lot of ships available and freight rates are depressed no matter what the oil spread is doing… or the spread is much higher than the freight rate. This is common practice for clean product traders, they do this a lot in gasoline trades from Europe to US atlantic coast, and naphtha traders with TC1/5 and middle east and Japan naphtha swaps.

Hitchhiking

Since we are talking US Gulf, there is a common practice, specially since the inclusion of WTI into the Brent basket for shippers to co-load cargoes and charter a bigger vessel with better economies of scale. Let’s say you have 1 million barrels to move to Europe and a Suezmax is $4.5/bbl to Europe. A VLCC is $3.5/bbl, but you won’t send a ship half laden (you always pay as if the ship is full), so, you call around other colleagues who might have the same need and you both fill the vessel. It works when you need to load the bigger vessel through ship to ship (STS), everyone sends their feeder and off you go. Some people say this might be collusion… well.. let’s move on

Short Tankers?

There is the easy way with futures (FFAs) but these OTC derivatives are often not suitable for tax purposes, so you need to get creative with physical short.

You can do this as a discretionary trade, but the only time I did it was to hedge my length exposure in this particular vessel class, since my VaR was glowing red and I need to take some heat off.

When you talk Time Charter, there is no single pricing structure, it can be fixed, it can be index linked, fixed with a floor or a cap on gains (say you pay 20k a day + 50% of the earnings beyond 25k). You need an active time charter market, like the one we had in ‘22 and ‘23, so if you have a view that markets are going to be softer in the future, you take a Time Charter index linked, and automatically charter the vessel out trying to match the periods, so you get pay a fixed amount per day, and expect to pay less in your indexed time charter. You usually define a basket of representative trade routes and you pay the weighted average of those on the following month.

Another way would be to sign what is called a Contract of Affreightment (COA) where a charterer commits to ship a defined volume over a defined period at a fixed rate (+ a variable on bunkers). You could sign that without having a ship and get it in the spot market every time you need to lift. This is quite risky, the Iranian trade used to work like these.

Gaming WS

without getting into much detail of how Worldscale works (This deserves another post) we know the WS rate includes port cots and extreme variations in port costs can impact earnings, particularly for short voyages at high or low rate levels.

Since the tanker market is quoted on WS levels as multiples of 100, embedded in the WS rate is the actual port cost, when the market is strong, let’s say WS160, you multiply the flat rate of let’s say $12/tn x 160%. Let’s say you have a vessel open in the East Med, if the quote is WS160 for a Cayhan-Lavera run, you collect $19.5 per ton, but your port costs are fixed (Gross tonnage, required tugboats, etc..) so you make 60% over the fixed port costs, in this case this differential is greater in Ceyhan than in Sidi Kerir, so you will send your boat there, on the other hand, when the market is weak, your choice will be the port with lowest costs, as you might not end up recovering the full amount.

Waiting Game

When rates are weak, and you don’t see the end of it you are better off sending your ship to an area with a lot of congestion, like WAF, so you collect demurrage while the vessel waits to load/discharge. Demurrage rate often is higher than the TCE, so leaving you ship stranded, on charterers account, is making more money than if it was sailing. Downside of this is that demurrage takes 3 to 6 months to collect. At some point you could borrow working capital against these claims, but I don’t know if it is still the case.

CleanUp

When you have a new crude oil vessel coming out of the shipyard or dry dock, it is customary to make the first voyage with clean products, most of the time East to West, to capture much higher freight rates. Clean tankers, in a per ton basis are much more expensive than crude/dirty tankers. It works for repositioning, saving on ballast bunkers. Alternatively, you could do it if the market conditions allows. Back in 2022 I had an Aframax on time charter, I talked to the owner and we send it to dry dock as soon as I got a slot, I think it was like $5M for the cleaning and coating, we split the bill and I made it trade clean for the rest of the time charter. That one worked well.

Triangulations

Triangulation generally refers to optimizing vessel employment by arranging consecutive voyages that minimize ballast legs, allowing a ship to remain profitable without excessive repositioning and creating a fixed timetable so you can hedge with FFAs way in advance.

Virtual Scrubber

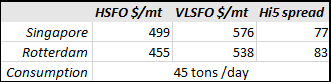

Since IMO 2020 regulations, ships were required to lower C02 emissions and to achieve that you either burn the lowest sulfur content bunker 0.5% (VLSFO) or you could install a scrubber, which is a “thing” installed in the smoke stack that washes the exhaust gasses and allows you to burn 3.5% high sulfur fuel oil, which is cheaper. The spread between these two fuel types is commonly known as the Hi-5 spread.

As any spread it widens and shrinks, but you also have different spreads in different locations. When you have a fleet of vessels and some of them are scrubber fitted, others just plain VLSFO burners, if you happen to have these vessels switched, for example you have a scrubber fitted vessel in Singapore that burns HSFO at $499 per ton, and you have a similar vessel in the Atlantic with the same consumption but no scrubber fitted, meaning it has to burn the more expensive fuel VLSFO at 538, ideally what you want to do is to swap the vessels and position them in the right place, but it takes 3 weeks and costs money to move a ship to the other side of the world and by the time it gets there the trade is gone. So, instead of moving vessels, you try to lift bunkers at the same time, or try to lock in these bunker prices for future delivery with your bunker trader, and you swap the invoices, so you transfer the cheapest bunker cost to the vessel in Singapore and viceversa… that way you can extract a few dollars.

There are some other trading practices in physical freight.. (I might need to talk with my lawyer before disclosing those) but the reality of freight trading is the same as any other trading activity, beat the benchmark. We are usually assessed by how much we overperform or underperform the benchmark whereas Baltic, the next guy.. so any advantage you can take, it counts.

Very insightful piece....for a guy who has a "fleet" of shipping stocks. Very good...but I need to study before you give me the test!!