This week was quiet in terms of twitting from the Man, so we could say it went rather uneventful. The physical market is towing its line, but flat price has a little boost in the shape of choking further more Iranian crude flows to China, with the usual sanction on vessels but with the added seasoning of going after and end buyer for the first time, Shouguang Luqing, an independent Chinese refinery often referred to as a "teapot" refinery. No surprise there as it has been signaled as the key buyer of Iranian oil for years. The change in tone is what put the market on edge, even knowing that these kinds of sanctions are not that hard to circumvent. It only introduces more friction and we might see a slight drop in Iranian loadings, that as today is business like usual.

In keeping with the theme, the US resumed the attacks on the Houthis as the cease fire is slipping through our fingers.

It doesn’t change much since the Red Sea remains practically shut for western destinations, but if anyone had any hope of these route reopening in the near future (I thought so), those dreams have been shattered. Durban bunker traders salute you Mr Trump.

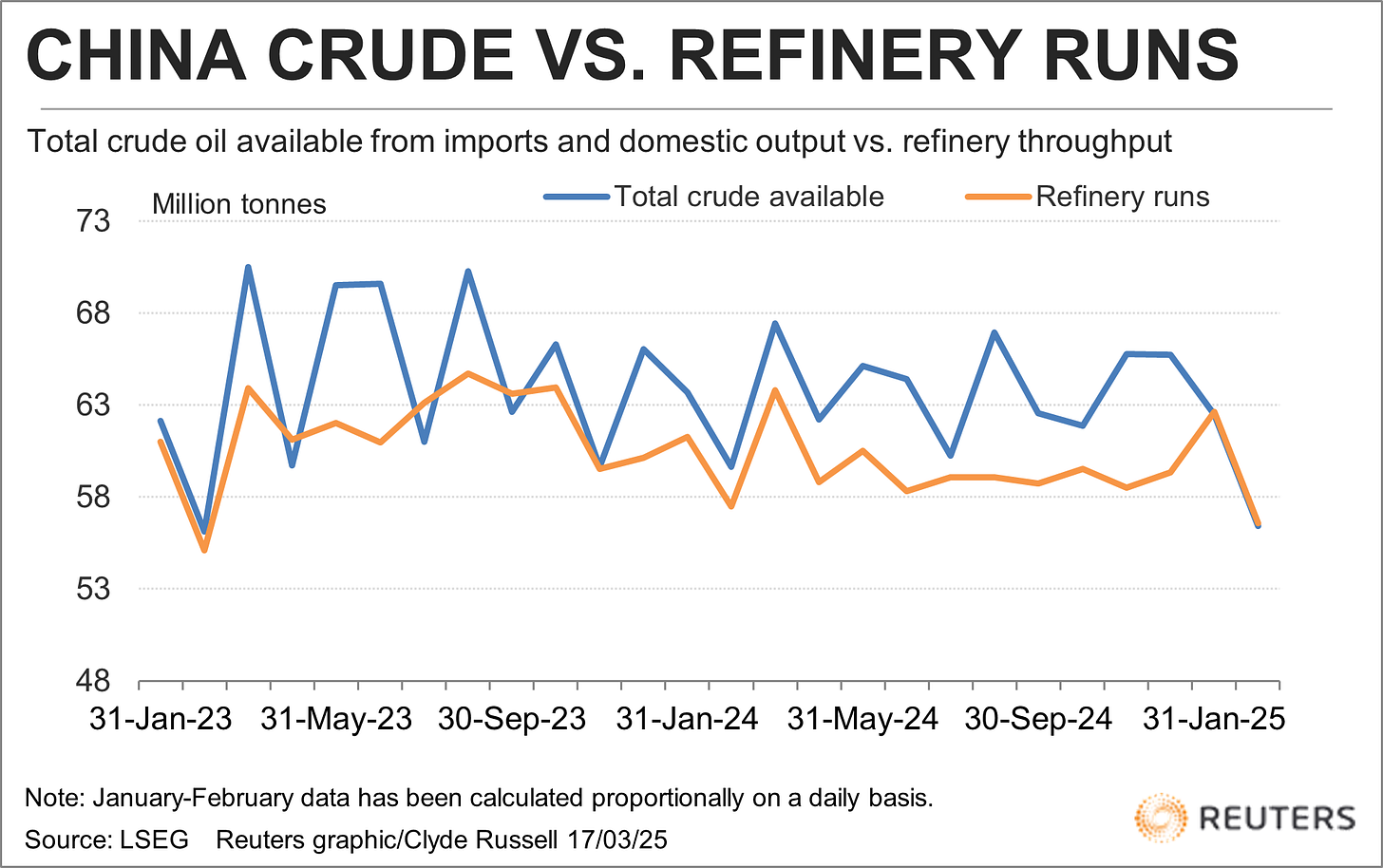

We are ending Q1 and we are still trying to figure out what the hell is going on in China, official data released this week showed what we already knew but the numbers are abysmal, refined products exports are 20% in the first two months compared with 2024, while crude throughput are 2% above last year, and crude imports in the first two months are 5% below 2024.

Is no secret by now that they have been dipping into their inventory, understandable when oil prices are above your average inventory price, but I doubt Chinese tanks are priced below $70. By the looks of it, there is an interplay between stocks on shore and those Iranian/Venezuelan barrels floating on the coast. Floating storage is also considered inventory when you are the sole buyer of that crude. But again, their strategy is disconcerting many in the market, Chinese traders have been on the sell side for the most part of the month, even with profitable arbs opening, there is not much going on. March imports look a little bit better; April should be stronger as they have been loading a lot from Brazil and WAF.

A pause in the tariff rhetoric brought some needed calmness to the Atlantic, where things were really quiet. Seems like the turnarounds both in Europe and the US have been pushed back a little to capture the refining margins we saw from Feb to March. We should see higher runs already in the US, and Europe should start buying more consistently. Weakness in differentials is evident now, with the Brent/Ti spread back to $4 and Dated premium close to parity (Forties sold at Dtd+0.25), I got that one right.

What I got wrong is the resilience in the Middle East, no matter that China is selling every day, Vitol is single-handedly keeping the party going, not without a cast of doubts around price discovery and benchmarking… Upper Zakum, Murban, Oman grades… whatever, Petrochina is selling them all no matter the quality… and the premium is fixed at $1.4/1.5. Vitol is having its “Total” moment playing the benchmark, the rumors being that one Indian refiner is behind this move. We will see where all these cargoes (16 so far) end up. Economics now dictates that Atlantic barrels are in much better shape to land in India/China, yet, we are not seeing a rush to pick up those barrels.

Meanwhile, the witch hunt at OPEC continues, claiming the first casualty, the Kazakhstan Oil Minister has been sacked failing to contain Chevron and friends for exceeding the quota. A new plan has been drawn for “cheater” to compensate for the undercompliance that goes till 2026. The market took it with the seriousness it deserves.

Appart from that, something I have been noticing for a few weeks now, I’ve seen arbs open for weeks without anyone taking any action, tanker rates that should have spiked weeks ago are firming just now, prices barely reacting to high frequency data (inventories, OPEC, Iran, etc..), it certainly feels that no one is at looking at the screen, or more probably, no one has any clue where this could go. Also, with all this mess around fiscal and monetary policy all around the globe, credit, which is the lifeblood of commodities trading is getting more expensive, paralyzing the less capitalized traders.