Hurricanes, OPEC+ cheating, low volumes, futures expiration, shitty fundamentals and hot money, where are we?

A lot has happened in the last week, but at the same time, nothing is happening. There are two tales for this story, the physical market and the paper market, each signaling different directions.

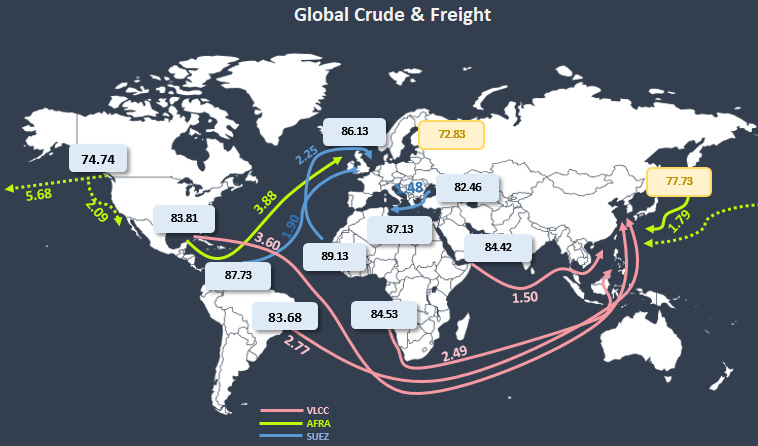

Oil Physical

Middle East is lagging in terms of pricing compared to Western benchmarks, as noted before, Middle Eastern grades are cheaper despite selling well, we have full allocation to Asian refiners but not enough appetite for medium sours and some refiners are switching to lighter grades. August loadings to China are set to increase by 1.5Mnbpd, approaching more normal levels, yet, Saudis are still behind average. On the other hand, we have Iraq exporting above “agreed” quota.. so did Russia. With prices on the high side nobody seems to complain.

WAF feels more constructive than prior weeks, though there are some cargoes lingering for August, China and India have been more active sweeping up medium sours now VLCC rates seem to have found a floor (they can always go lower). The recent export programs that surfaced are a little higher for August.

North Sea here is where the game has been in the last couple of weeks, we saw Gunvor in tandem with Trafigura propping up the Brent benchmark after the big sell off and though it worked (on paper) Gunvor had to move these barrels into the Meds since there were no bids for NWE. Brent is getting expensive but you know what is more expensive? WTI.. that thing due to domestic pricing dynamics got out of whack.. the arb to EU is still possible because of cheap freight, although the spread between WTI and Brent is collapsing quickly.

Meds, like WAF pulling strong, Canada TMX still trying to market their High TAN crudes, some partial cargoes went to USWC, some to China, one to India and some to VLCCs in Panama.

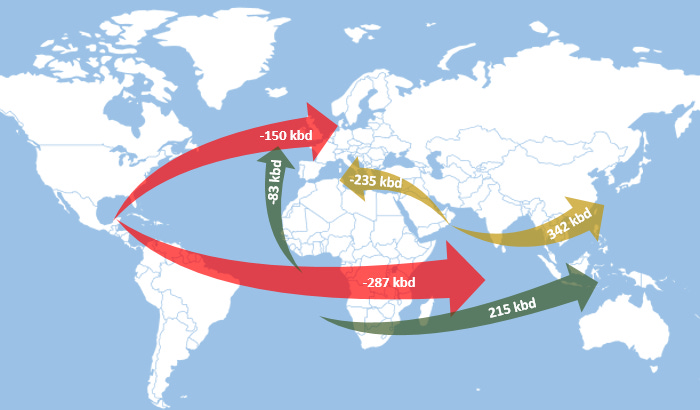

Weekly Crude changes in volumes for main arteries

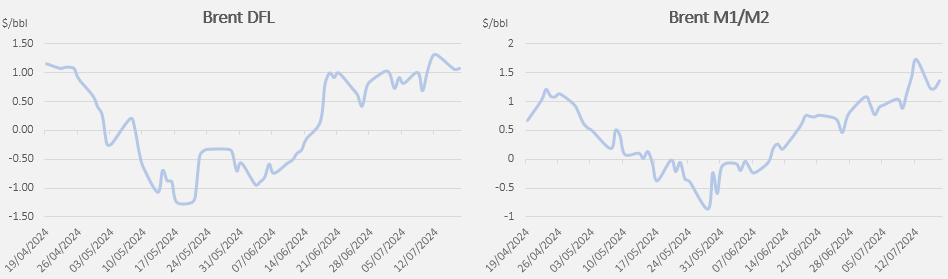

Paper Markets (Futures)

Here is where the story takes a promising turn…

Dated to Frontline, which tracks the premium/discount for physical cargoes to financial futures is holding the $1 levels, signaling a strong demand pull, want more? Brent futures structure is in steep backwardation, prompt deliveries are pricing at a premium to September, is that a sign of high demand. Well I am more on the camp that producers are taking a view of a much softer demand at the back of the summer.

Dubai-Brent EFS (exchange for swaps) is pulling away no matter what, that means more Asian refiners buying in the Middle East, not the Atlantic, hence they can defer their purchases for 20 more days.. and that’s the weakness I’m seeing in the Atlantic (physical)

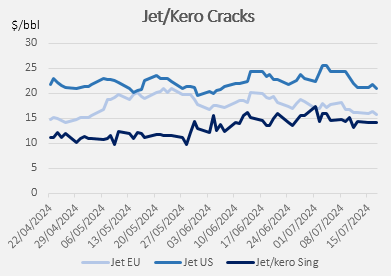

Products

When looking at product cracks, we should be doing much better at this time of the year, but we keep seeing product stock buildups elsewhere. Refining margins are taking a hit and the ghost of “run cuts” is looming in the horizon. Already happened in Asia and Meds refiners are not that far away, they might hold for the rest of the summer but market is starting to pay attention now. Products don’t flow, except Jet where there is a pocket of demand in Asia. The rest of the barrel is yielding close to negative once again.

Tankers

The real horror story. It has been a dire couple of months for tankers and I find the explanation not for the lack of available cargoes, which have been modest especially in the Middle East, but the lack of long haul cargoes, especially the Cross-Basin ones

I highlighted that while crude loadings remain somewhat the same around 40Mb, what’s floating is decreasing, only explanation is India and China sourcing closer to home, and it makes sense with what I discussed above.

VLCCs are the one taking the biggest hit, demand concentrated in the Middle East is pushing all ballasters to the region, though there is some optimism for Aug and Sept due to an increased volume programmed. It will take time to clean up the slack

Same story with Aframaxes, demand is for short hauls, and vessels have been positioned in their regions for months already, there is no particular market sucking all the ships, so they had better stay put.

Suez owners should be happy, they should be doing far worse cannibalizing Aframaxes cargoes, but they are holding. When there are not that many VLCC in the vicinity (Atlantic) the mid size boats thrive.

For clean tankers, the story is on the LR1/2 volatility, Houtis keep firing at ships, but there is so much one can pay to move Gasoil or Jet from the Middle East to EU, the arb is not supportive for more than 80/90 dollars per Ton. Those VLCC loading diesel to EU left their mark in this market.

The Veredict

We all were expecting a strong summer demand and is not there, but paper markets keep pushing ahead, and with low volumes and low volatility is not that hard to make a bull case around futures pricing. There is outside money pouring in long in par with equity markets, maybe is the “Trump Trade” setting in, but refining margins are saying otherwise. there’s no way for a refiner to lock in (hedge) at these prices, unless there is a discount in feedstocks. We also been sold the Q3 deficit story, well, when China is building stocks as it has been in the last 3 months… I don’t buy it. $83/85 Brent works for everyone… for now

Subscribe while I fine-tune this report, I’ll be incorporating more sections and build a proper thing. Ideas are welcome.

Super glad you started a longer form post, been looking forward to this for a while. Amazing insight into the oil market.

How does you determine a singular FOB price to represent different crude grades within a region? Does you aggregate multiple assessed prices from a source like PRA, or rely on last done?