Well, maybe not dead but definitely in bad shape. This PR fiasco started a week ago with a bunch of members vaguely suggesting that the phase out of the cuts might indeed happen as previously agreed in the last meeting. Market was wary, or at least I was, that a return of these barrels would find its way within this year, and price action proved them what dumping 2 million barrels per day into this market would look like. They of course backpedaled and now OPEC and its allies have delayed plans to start gradually rolling back 2.2 million b/d of voluntary cuts by two months to December, something like paying down your credit card with another credit card. It certainly shows snags within the cartel and lack of self-confidence that they can turn this ship around. Cartel gone soft

This ambiguity among members signals they don’t have any dry powder to shock the market, and when looking at compensation plans for overproduction (Iraq, Kazakhstan) we get pledges and commitments of the already announced Tengiz field maintenance, Russia backing down production since they cannot sell crude as they used to, payment and collection are becoming trickier.

According to the table released by OPEC, eight members will add a collective 189kb/d in December and 207kb/d in January, "with the flexibility to pause or reverse the adjustments as necessary." yeah right...

Remember this 2.2Mb/d of voluntary cuts are part of 5.8Mb/d the cartel is currently holding offline, denting its market share to rival producers from the Americas and other emerging plays.

To conclude a chaotic week, Aramco OSPs came on Friday with another aggressive slashing for Asia and Europe bound cargoes, in a desperate move to retain market share, which begs the question, how far are they willing to go in the name of “Market Share”?

So, with OPEC in the backseat who the hell is driving?

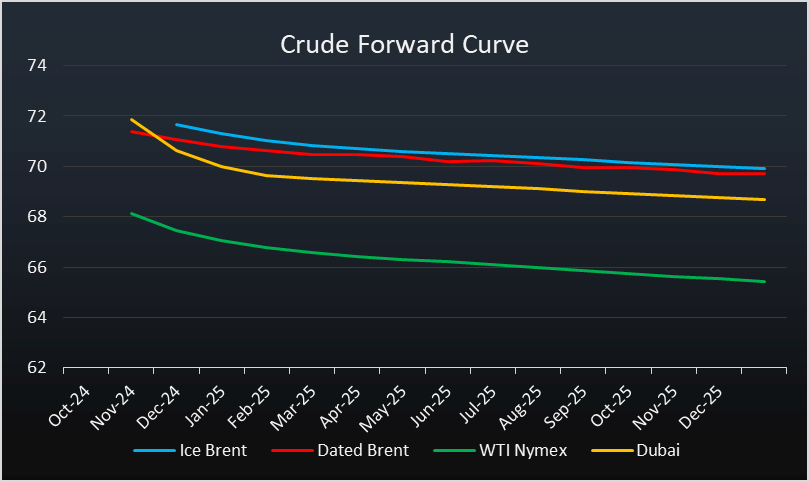

The whole curve collapsed in the last week, which now seems in sync with the weak physical market. An adjustment of prompt and structure indicators were long overdue, it wasn’t that long ago where we were seeing Dated at almost $3 over form month futures, a 2 bucks backwardation and cargoes changing hands at Dated +3… well, you can only push paper markets so much, (it helped that speculative positioning was quite low) but eventually commercial hedgers will have your lunch.

The compression of the time structure has to do with the brutal sell off but also looking ahead at Brent scheduled cargoes, October brings a couple of more cargoes delayed from September and that puts some pressure over M2 (Dec contract)

What changed this week also is the relationship between Dubai and Brent linked grades, with the EFS at more normal levels a dynamic for Atlantic barrels is starting to play out

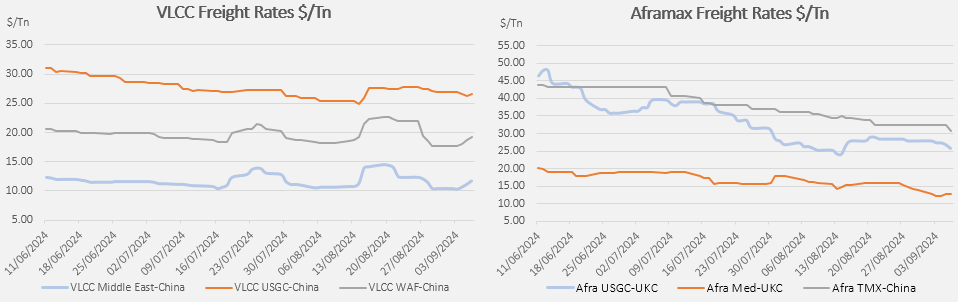

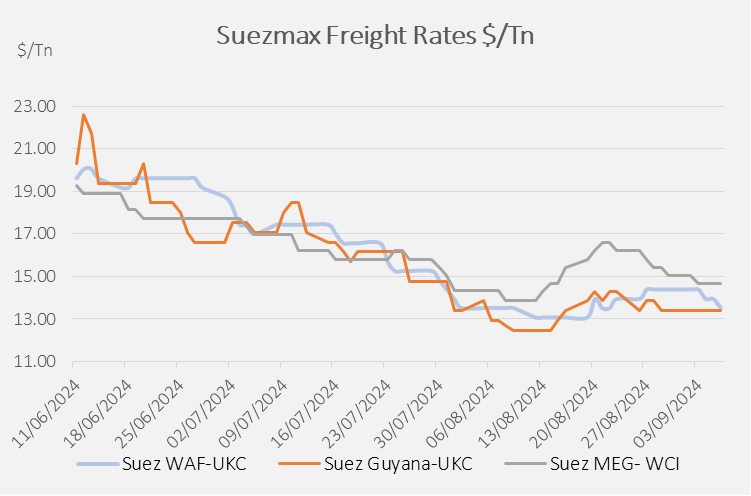

and lo and behold, from mid-week we had in influx of fixtures for VLCCs and Suez in the Atlantic, with 3 VLCCs fixed to Korean interest from the USGC, just on Friday.

China is reselling some of the Middle East allocations (Murban, Upper Zakum) and going Atlantic, switching for Brazilian and returning to WAF. The arb is open once again for the long-haul cargoes (flat curve) and tanker market reacted accordingly.

Looking a bit to flows, the US came back punching above 4Mnbpd for the week

The tide is also lifting Latam barrels, especially Brazil and Guyana, pricing down because NWE is a dead market. Some Guyanese are heading to the Meds to replace Libyan cargoes

Middle East is gathering steam as well for next week

WAF is also gearing up, with Dangote once again sputtering (half the intake for this month, gasoline dreams will have to wait)

On the Chinese front, we are on track to repeat last month, no surprises like July. We should be around 10.5 in September, a little bit more than August. Certainly, China likes cheap oil and something the market underestimated and got wrong is the impact of TMX.

I’m willing to say the culprit of these whole mess in the Middle East started with TMX, pricing aggressively at China’s doorstep. That created havoc not only in the Middle East but in Latam barrels that used to stay in the Pacific, that pipe changed the whole landscape and left everyone scratching their heads. This week one private Chinese refiner bought 7 cargoes from TMX, adding insult to injury to our OPEC friends.

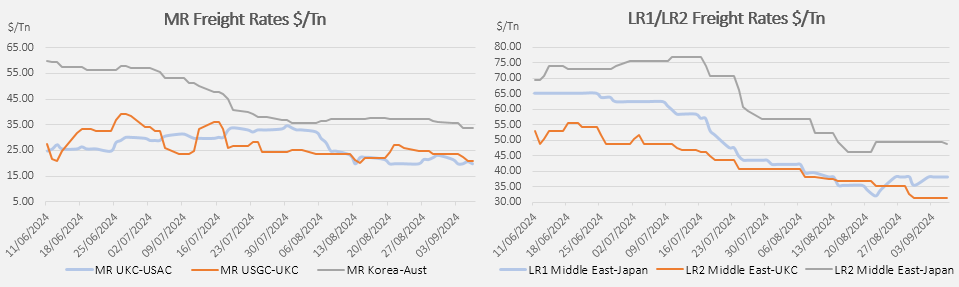

Refining margins are giving a fight on their way down, don’t see a turn around here, but the conversation shifted from “Refinery Maintenance” to “Run cuts” in the last days. Simple refiners in the Meds are considering cutting and we might be already there in APAC. Gasoline margins are bad and now not just compared to a bumper 2022/23… they are getting bad at historical levels. We should start seeing some product stock builds, and not only Gasoil. We had some of that in the EIA report for US gasoline on Wednesday.

Notwithstanding, some 300kbd are going offline in the next days in Europe and the US, question is for how long.

I like big boats and I cannot lie. We are entering the Magic Q4 for tankers and VLCCs are getting some attention, the cross-basin trade is starting and if market structure stays on these levels Asia will definitively switch focus to the Atlantic.

What I don’t like are clean tankers, in a world of refi run cuts and no incentive to build stocks product tankers will underperform.

The Verdict

I think we had enough of selling this week, flat price correction might be overdone and we the dumb money positioning short after a 10% fall, a snapback is due, just to keep everyone sharp. Product markets are giving away (so does crude to some extent) all the risk premium that collected during the last two years. Risks to the downside materialized already, and I’m not talking the supply risks, but the demand risks. Resolution of the ongoing conflicts won’t make a scratch to this market. Lastly, is not China what worries me more, it is what it is and that’s embedded in the 70s price. What I’m beginning to worry about is Europe, that looks like a bottomless pit.