This week brings an added layer of complexity, how do you analyze a market when nothing is happening? And by nothing, I mean no volatility, barely any news, and almost no physical activity. We had a few sessions in the Platts window where literally there were no bids or offers, except for a few spot trades where we saw the differentials drop a bit, following the trend of recent weeks. Some traders were a bit shy, pulling back barrels that we all know are lurking for mid-November arrival in Europe.

The market consensus has been around $75 for a while now, and this week prices were certainly floating around that mark. Here's the problem: what happens when everyone thinks the barrel is worth $75, and it actually hits $75? Nothing, absolutely nothing. No one buys or sells, and as a result, some things need to start moving to get the flow going again and the low hanging fruit is always tankers, but that’s not enough. Slowly, we’re starting to see Mediterranean grades (like CPC) correct violently, to the point where they’re starting to price into Asia, even entering the Brent ecosystem. There is no way to hide it, there is an overhang of light grades in the Atlantic and will take time to clear, especially those Libyan barrels that should go to the Meds, but in a panic, refiners covered their Oct/Nov needs with other Med origins when the shut in began.

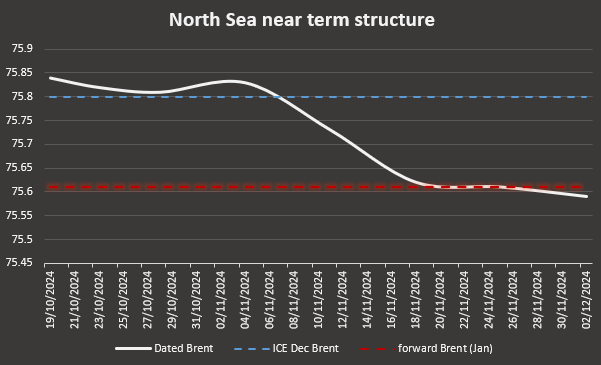

The disconnect between paper and physical markets became obvious again this week, with Brent prompt in contango, though slightly, and the futures clinging to the good old backwardation at around $0.50 per barrel. The trend in recent sessions has been strengthening both the short- and medium-term structure when the flat price rises, but the day it doesn’t, the structures collapse again without any support.

For now, the lack of offers remains the main factor keeping prices propped up and without much volatility. It's a double-edged sword—just one trader needs to think about bringing a VLCC to the North Sea and with 2 million extra barrels this could go haywire. According to the “fixtures,” there are a few VLCCs scheduled for late November that shouldn't have much impact since refineries are expected to be running at full capacity in northern Europe by then, but if some WAF or Guyana barrels which are struggling to survive in this premium-crushing environment make it to European shores, things could get tricky.

But there are reasons to stay optimistic. Here, we were advocating for refinery run cuts in Europe and Asia, and we got what we asked for—maybe even too much. That’s why this week I want to focus on products, as there are some interesting stories.

As expected, crude stocks continued to grow slightly, but product stocks are still decreasing, particularly in the U.S., with refinery runs increasing. This suggests that maintenance season is coming to an end in the Americas, and it probably won’t last much longer in Europe. Asia should start prepping for winter as well.

Even though this maintenance season was smaller than last year’s, if prices held up this well (with only two dips below $70 and quick recoveries), then we might have found a more solid floor than it seemed.

The other big unknown is commercial crude stocks. For now, the pricing centers prefer to send barrels to storage rather than shipping them across the world—like WTI and Brent—but generally, at year-end, refineries like to reduce stock for accounting reasons, so the only place for these barrels to go is Asia. We’ve seen a bit of this already with some sour grades heading to China and Korea from the North Sea.

Geopolitics? We are pushing our worries further after Nov 5th… market seems to buy this narrative that nothing will happen till then. Any surprise will certainly catch us with our pants down, make sure to wear clean underwear just in case…

Should circumstances remain unchanged, and to understand my bias (every analyst has one) this is where my head is at:

Short crack (distillates above all)

Short Brent/Dubai spread

Long tankers if the above performs

Now you know… let’s dive in

Oil Physical

In recent months, the drop in crude arrivals at European ports has exceeded what would be expected from regular refinery maintenance, indicating that some refineries