For all of us complaining about the lack of volatility in the oil markets, we got what we deserved, albeit not in the shape I envisioned, nevertheless it was an interesting week right from the get go.

On Monday OPEC “surprised” the market with their announcement on the go ahead on the reinstalment of the five times delayed production cut unwind. Was I expecting this resolution? No, it caught me off guard as I used logic; one might have expected that if conditions weren't deemed suitable when Dubai was trading at $75, they would be even less so at $70. Yet, somehow, $70 now appears healthier than $75.

Ironies aside, and I mentioned this last week, what is becoming harder for OPEC and their credibility is the non-compliance and a hands free attitude among its members. The rolling out of cuts just confirms that some members are not happy with their quotas, and when trying to bring forward a message of cohesion and unity this doesn’t play well.

On unity and cohesion, February production stats were particularly gross, with UAE overperforming by a lot (easily verifiable looking at crude exports + own refinery exports + changes in Fujairah stocks) but what amazed me more were Nigerian and Kazakhstan oil ministers outright bragging on how much they are producing, you don’t need further evidence than that..

And the market should start paying attention on the internal dynamics of the cartel, this growth in exports from these 3 countries came at the expense of Russia and Iran, two other members, so unless there is a hidden compensation mechanism we don´t know about, such backstabbing hardly reflects cohesion. Same thing with the narrative that is going around on which if Iranian barrels are removed from the market, OPEC can quickly fulfill that void. You think Iran will keep quiet watching how their “partners” profit from its misery? I would shut down the strait of Hormuz right away… and I think they already hinted that.

As for the real effects of bringing back 138kbd to the market is negligible, that could easily be absorbed by a small refinery in the Meds, even when we know these barrels (and way more than 140kbd) are already in the market. Oil just fell $1 on the news, and if it wasn’t for the man in the White House, it might just reversed, because deep in our hearts we were cherishing that OPEC did the right thing.

Tariffs, I won’t even dignify that, I will just let prices talk for themselves. Mars, which is the benchmark for med sours had limited reaction, pricing at a reasonably WTI+2, refining margins regained some of the lost terrain and WCS discount widened by a dollar. Is clear that the industry doesn’t want to front run the trade, they are accepting to eat some of the cost (both sides) and trade on that when things get clearer, but this back and forth brought some unintended consequences

Since the Zelensky fiasco Europe got an adrenaline shot, finally getting in front of the events and the market abided. European motorists woke up finding their road fuels are now 10% cheaper, and with all of the inelasticity of road fuel demands accounted for, a 10% change does move the needle, so for a market that wasn’t doing that bad in terms of domestic demand this will surely encourage more driving. Europe’s problem is the export markets, which are consistently weak (WAF, USAC) but as we go trough the turn around season these should equalize.

For much of this year, Brent complex was the one holding the market back, now is in the driving seat. Spot differentials are close to $1, the North Sea window came to life with more bids than offers, DFL can´t drill through 0.40, and the structure holds regardless of the slump in flat prices.

Tankers are doing their job of keeping those barrels out of the North Sea, and even with Dubai premiums collapsing we still have arbs closed into Europe thanks to our Houthis friends.

As flat price goes, “financial oil” is no stranger to overall market sentiment, but there is always the hope for “The Chinese Put” at 70 Brent, it worked before, why wouldn’t work now? Well, as Brent approached to the “strike” China came out with a messaging, and not the one we would like to hear. On Monday, the China National Petroleum Corporation (CNPC) released a report projecting that China's crude oil imports will grow just 1% in 2025, reaching 11.18Mbpd, and playing down gasoline and diesel demand for the year, also making a call for a shift into petchems, as the added steam crackers capacity for this year alone tops 25 million tons. With tariffs wars raging on, this is the bigger threat to Chinese demand, we all know the EVs and the LNG truck story. Naphtha and LPG is the focus now. All this to say, Chinese Put won’t come to the rescue just yet.

A true scale of Chinese demand will be the reaction to the new Aramco’s OSP, that came with a small discount for April to Asia, standing at $3.3 over Dubai/Oman averages, how many barrels they get allocated would determine their appetite, we went from 46M bbls in January to 38M in March, any figure above 40 will be welcomed as Atlantic barrels are priced out for now, but at 3.30 doesn’t look that competitive. Petrochina selling heavy in the Dubai window is not a good omen though.

Elsewhere, Ukrainian peace seems unattainable as the days go by, with persistent attacks on Russian oil assets that are proving to be an effective strategy. Russia is now pressing hard on removing sanctions, and even with Urals trading well below the price cap, specific sanctions on individuals, banking and loading facilities are hurting Russian volumes.

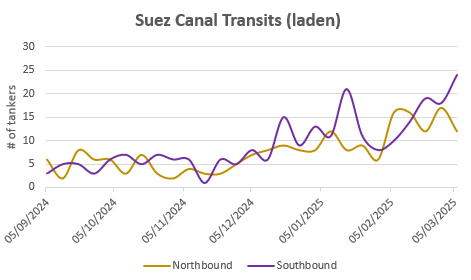

And it's not as if things are smooth in the Middle East. The U.S. is applying different kinds of pressure, the latest being the stopping and inspecting of tankers in the Malacca Strait—as if that would work. And traffic through the Red Sea didn’t pick up yet, only Russian linked cargoes sailing south, cargoes from the Arab Gulf going north remain very limited.

Empty threats, overacted nationalism, exhaustion—and oil is caught in the middle. Trading commodities is becoming a high-risk, low-return proposition; no wonder the "smart money" is retreating from all things bulk. That said, there are still opportunities. Let's see what we can find in the physical oil markets.