Last week it was the paper traders who reacted, this week, the physical market did the heavy lifting, so setting aside the “Geopolitical Risk Premium”, we have some solid grounds for oil to sustain this new price regime in the 70s.

Despite the missiles flying around, nothing materially changed in terms of cargo availability, and if anything, while everyone is not looking, the likes of Saudi Arabia and the UAE are loading at an above-normal pace, and so is Iran that performed a risk management assessment loading one tanker at a time in the vulnerable Kharg Island. Wars cost money, so a cash-strapped Iran is frontloading just in case, while at the same time is moving its floating storage near Chinese customers to assure product availability. Surprisingly, Iran has become one of the most trusted suppliers in the Middle East, unlike some NOC across the Gulf (more on that later).

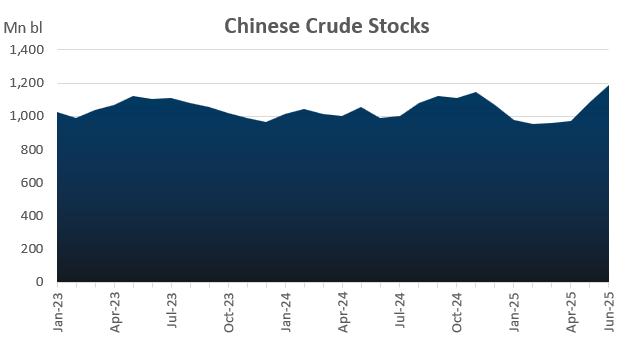

As Iranian barrels pile up, the discount widens, now offering these barrels at Brent Sept -$3, when they usually go at -$2. Better economics for the Chinese teapots, but is it enough? And here is the key to understanding what could be next, with prices approaching $80, what the buying cycle will look like in the next month.

Doing some Chinese accounting, they built almost 100 million barrels during April & May, at an average delivered price of $68. June looks on par with May at 11.5 Mnbpd of imports, plus 4.2 domestic production and running at 14.6 Mnbpd, which still leaves us something like 1 Mnbpd in builds, so definitely they have some wiggle room to play. If this high flat price environment persists, they will be better off “buying from the tank”.

The situation is different for Korea and Japan though, as they are starting to panic and making inquiries in the Atlantic, although the arb does not work.

Tankers, which are the weakest link in this whole mess, for their part, are flowing normally in and out of the Gulf, with freight rates holding up nicely. Before the flare-up, tankers in the Middle East were dirt cheap, and more than a few traders took them without a cargo in line, just as a free call option, and it paid off. To test the strength of the freight markets, we need to see this behavior spreading to other regions, and so far, we are not seeing that.

Speaking of call options, the enhanced volatility we saw on flat prices is mainly due to options on WTI, where out-of-the-money (OTM) options, aka Lottery Tickets, are making everyone wonder if this rally is overdone. But as things stand, a push above $80 would trigger a delta hedging that could make Trump nervous.

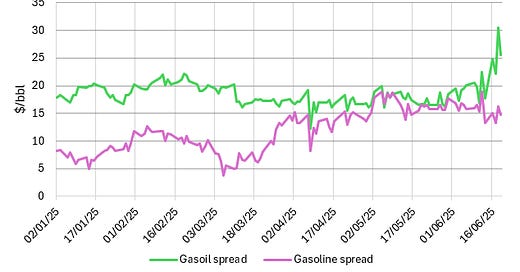

But that’s hypothetical, this is real. There is something screaming caution in the market, and that’s Gasoil, which saw a disproportionate increase relative to oil, and fears are somewhat sustained in Europe.

Since 2022, Europe has increased its dependence on distillates from two key players, Al Zour in Kuwait, right next to the hot zone, and Relliance from India, which already floated the idea of curtailing exports if the supply of crude oil is at risk. The timing of the European leaders couldn’t be better, moving forward with the 18th sanction package on Russia, trying to lower the price cap to $45, now abandoning the idea, but also dangerously suggesting trimming refined products distilled from Russian crude, aiming at India and Turkey’s Tupras.

The market is growing to the idea we might be entering Q3 running on lighter slates, but with these refinery margins, we have the certainty that there still will be appetite for crude oil. This whole conflict pushed the high refinery run season a few weeks forward.

Supply has been reactive to risk pricing accordingly, now it's time for the summer demand to show us if they validate the prices at the pump, which still haven’t been fully passed on to consumers. We already know Jet demand won’t be there this summer as flights will be kept domestic in the East of Suez.