Much has been speculated over the last two days on the impact of the latest Russian sanctions by the OFAC, in this quick recap I’ll try to put some numbers behind this mess and asses the damage.

Needless to say the market reaction, specially on tanker rates, futures (FFAs) and equities was rampant with reminiscences of late 2022 when the price cap was imposed on Russian oil.

As we found out on Friday, this was the most important sanction package since the conflict started, not only by the shear amount of vessels hit but also insurers, traders, banks… they went all in.

Let’s focus on what’s keeping the oil markets on its toes: Does Russia have enough tankers to move it’s oil?

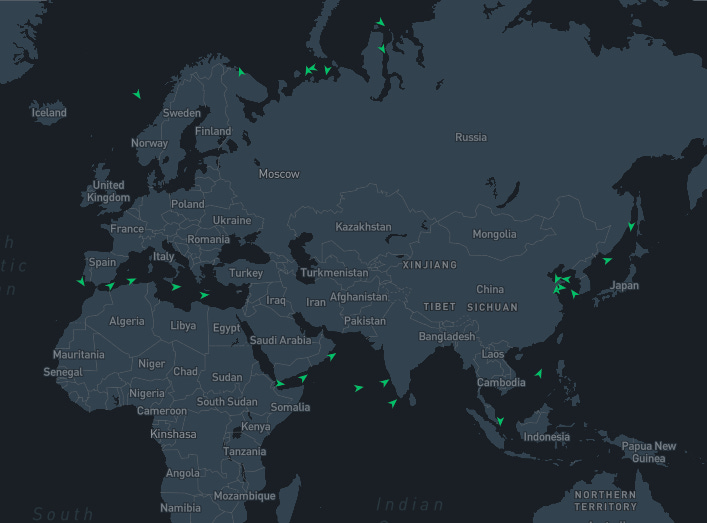

At the time of this writing, there are 20 Million barrels of crude oil loaded on the sanctioned vessels, with a wide range of trades. It’s important to clear this because the number of “180 vessels sanctioned” is thrown around without further specifying what was sanctioned. Total number on the OFAC records is 439, including previous rounds, Iranian, Venezuelan, Syrian.. etc..

From that list there are a lot of small tankers that only do regional trades between Russian and former Soviet countries like Azerbaijan.. some shuttle tankers in the Arctic that are irrelevant for the export market and totally unaffected by sanctions.

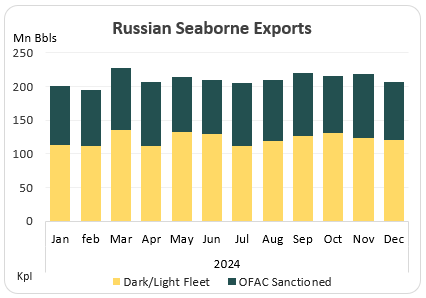

Taking last year as a parameter, we see that Russia used 339 Aframaxes, 165 Suezmaxes and some other Panamaxes to serve crude and dirty products international trade. I put them together because vessels for these different trades are interchangeable.

Also, I’m taking out vessels that loaded Kazakhstan crude and products from CPC, since though they load from the Russian port of Novorossiysk these aren’t subject to sanctions. So, of those 339 Aframax vessels employed, 85 were hit by sanctions (25.1%), 30 Suez and 2 Panamaxes.

Now, on top of those 85 Russia employed at the very least 110 Dark Fleet Aframaxes that aren’t sanctioned (yet) and the rest is a mixed bag of compliant, shady and probably more dark fleet. I just run a quick exercise to re evaluate the size of the Shadow fleet basing it on registry hopping, flag hopping and P&I insurance (or lack of). Last time I ran a Dark Fleet sizing it was in 2022 and numbers were similar to this but we know that it grew considerably during 2023 and first half of 2024. Let’s say at the very least there are 110 Afras, 38 suez Russia can tap on. Question is that enough?

This where we are right now in terms of flows, and the capacity needed to move these barrels efficiently. Theoretically, Russia could serve their exports markets using 117 Aframaxes and just 16 Suezmaxes. They used 340 Afras and 165 different vessels last year, talk about inefficiencies.. and that’s key to understand this trade. Sanctioned cargoes are highly inefficient, with waiting/idling times due to payment processing, weather for STS (ship to ship transfers), etc.. so take this exercise as the bare minimum they would need to fulfill their volume.

Time to make assumptions. I believe China won’t care much about OFAC since their trade happens in the far East, away from scrutiny, and actually some previously sanctioned vessels are doing the Kozmino - Shandong/Yantai run.

But India, and that’s my main concern, won’t dare to touch this vessels so the workaround that would be to create another layer of transactions in between the sanctioned vessel and the one arriving at Indian ports. India buys from Russia on a DAP basis, meaning they don’t get to choose the vessel, crude and freight are included in the same invoice, often obscuring crude FOB price.

The most probable scenario I see for this trade is to repurpose those OFAC sanctioned vessels to the Baltic and serve exclusively Primorsk/Ust-Luga ports to the Meds where they can STS to another dark fleet non OFAC sanctioned vessel

That will require 132 Afras, of which those 85 are included. It could be done with available vessels in the dark fleet, but to organize this it will require a logistical challenge. First they need to discharge all the Afras that are loaded and reposition them in the Baltic. That would take weeks. The problem here specially now is the Ice Class required vessels to enter the Baltic ports. Sovcomflot have around 25 of them, the rest being sourced from the dark fleet. That’s why they need to optimize this route

Is it allowed to do and STS from an OFAC vessel? technically it would mean a breach of sanctions, but the owners of the dark fleet non sanctioned vessels are the same one that the OFAC, it will only take to set up another shell company and off the races.

Also there is the belief that Trump won’t go much further with sanctions, so the risk reward is certainly there.

For the Black Sea trade is pretty much the same, requiring little less than 20 Suezmaxes, providing they still have safe passage from the Houthis in the Red Sea, though these trade is very reliant on bosphorus strait weather and waiting times. But volumes are manageable.

Other scenario, though improbable is something we saw at the earlier stages of the sanctioned trades, when India was still not buying Urals. There were a couple of STS near the shores of West Africa from Afras to VLCCs, a couple of rust buckets used by Venezuela and Iran that were routed to China.

This trade was highly inefficient, since it took like 3 month for the VLCCs to arrive.

This will require to divert all the Baltic volumes to China instead of India, but the amount of VLCCs needed is too large, especially at this time when Iran is running short on these vessels. Since Russia doesn’t have enough inland tankage capacity, they need to push barrels to the sea or shut in. Using VLCCs as floating storage and wait out until the Donald comes to Office, and start negotiations (if there is anything to negotiate at all)

To conclude, we will have a couple of weeks where the market (India will be short heavy sours) will be trying to the reshuffle barrels from every corner of the globe. It will take time to reassemble the fleet, and in the meantime freight rates will be volatile, with the classic spikes and sell offs, but eventually it will sort itself out, as it did in the last two years.

Another alternative is for Russia to start selling crude below the price cap (Urals FOB Primorsk currently trading at $71) at least until they get their act together.

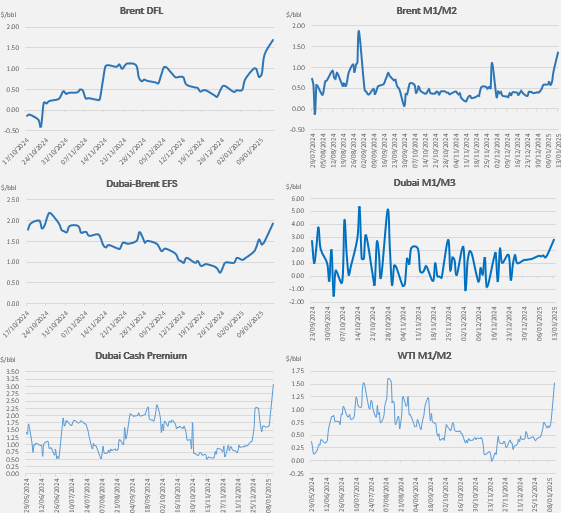

And since we are talking oil, let’s take a look at what transpired in a fatidic trading session at the beginning of the week.

Everything in the paper markets blew up, most notably Dubai Cash premium over $3, with an influx of Indians panicking and picking barrels on the spot market to replace lost Russian barrels. Prompt spreads in Brent and WTI also shot up on increased trading activity in futures and options, but the story of the day is undoubtedly the Brent/WTI spread, that collapsed on the news that Canadian oil might indeed would be under the tariff regime. WTI in Cushing was running already near tank bottoms, so any hint of tariff would create chaos.

By the looks of it, the rally entered a stage of complacency and self feeding mechanism, now that the market looks driven by the paper barrels rather than physical, maybe is time to get out. In 15 days China goes on Holidays, Putin will have his fleet repositioned and the anxiety around Trump would be over.

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.