Shutdown

Anatomy of an oil glut

Oil has shredded 5 bucks during the week just when analysts were shuning the oil glut narrative, despite all the signs were there. Now that translated into prices is becoming hard to ignore, but will it stop here?

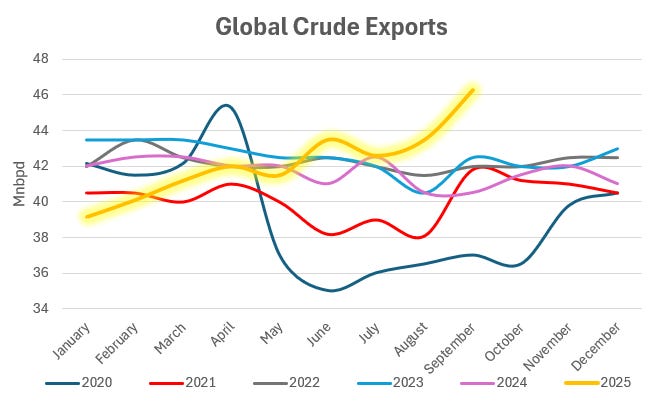

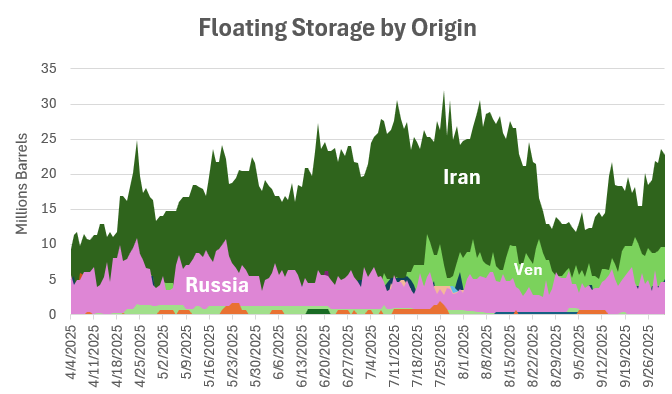

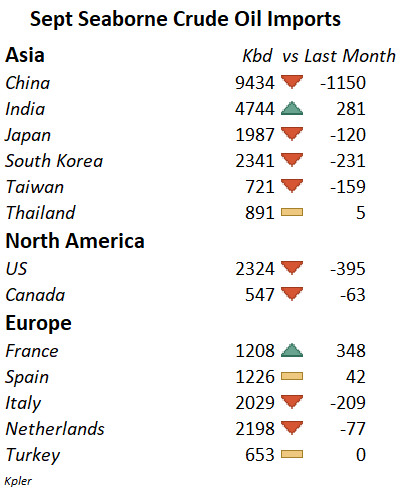

With September numbers in, the monthly crude seaborne exports showed a concerning pattern… and that’s September, all those VLCC fixtures we have seen last 3 weeks haven’t even loaded yet. We are in the upper range of the last 5 years, but we can’t blame OPEC for all of it, well… technically yes, it’s mostly all on OPEC, but not from the usual suspects, you have Venezuela at 1Mbpd exports (highest since 2020), Iran at ~2Mnbpd, and Russia trying to push more barrels as their refinery system is being bombarded day in and day out. And these barrels are going nowhere, they are being stationed in front of China’s shores until they decide to take them in.

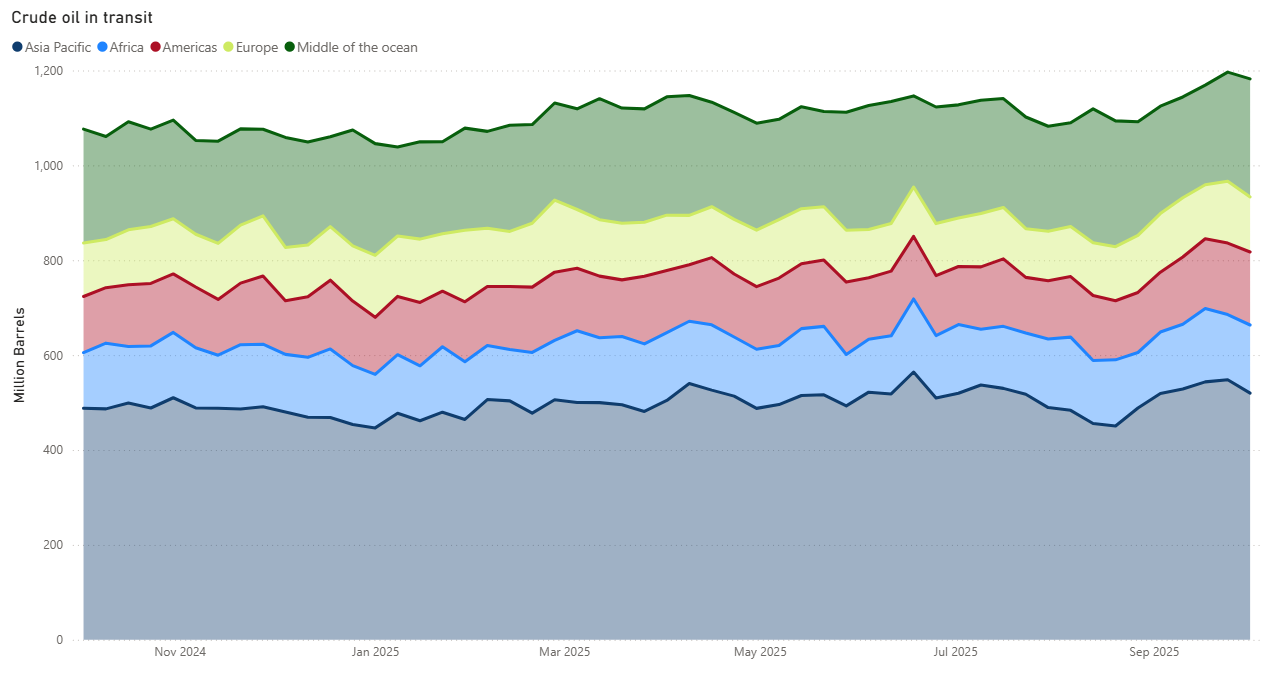

And while we have barrels piling up, the barrel count in transit is also moving up to multi-year highs, which explains why the freight market rally is not fading, even if charterers try harder to bring it down.

These were known facts, but what precipitated the slump this week (other than the OPEC drama) was China’s one-week holiday. And they take vacationing seriously there, since Wednesday, there were no bids, no fixtures no nothing, complete silence East of Suez. Add to that the end of month, end of quarter, when you have to make up and square PnLs, and you have a recipe for disaster.

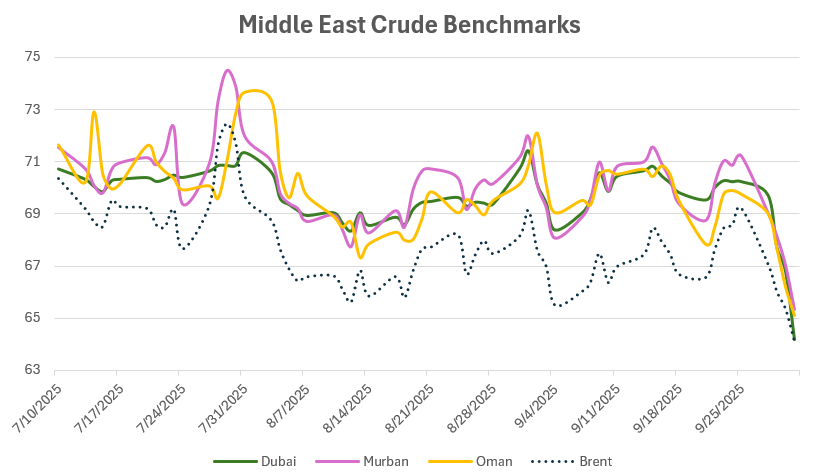

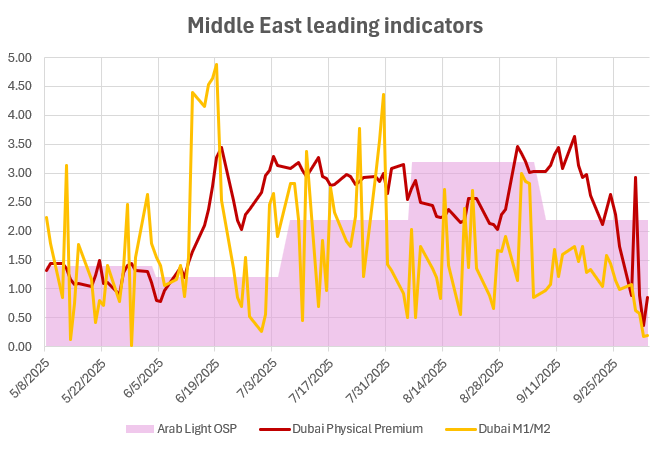

And disaster we had, where it was due. All 3 components of the Middle East complex took an unusual beating, propelling the benchmarks to lows not seen since 2022 (in comparison to Brent that is) closing the gap with Western grades. This is more a reflection of a normal functioning market, where Middle East sour crudes price at parity or at a discount to Western light sweets, but the sheer violence of the move in just a couple of days, unwinding months of heightened premiums, is something to consider. The Middle East was the last bastion of oil bulls, where all the geopolitical premiums were deposited, but as of late, this was sustained by fewer and fewer buyers, and by September there was only one firm buyer, which met with a decisive seller, Mercuria, that went to their limits to exercise a short position in Upper Zakum to the point of selling barrels they didn’t even own. Ballsy move, but paid handsomely in the end.

During September Dubai window, Mercuria sold 45 cargoes (22.5 million barrels), representing 92% of total volume. They were mostly Upper Zakum, we knew they had a large physical position there, but in the last day they nominated even 4 Murban cargoes, the first to surface after 3 months. The Dubai physical premium collapsed in just 3 days, though it made a weird come back at the end of the month but the fate is sealed. Nor the geopolitical context nor the refinery margins allow a +3 premium anymore. The only remaining shoe to drop are the Saudi OSPs that in theory should be a touch higher than the current $2.20, but if they are expecting to place all this extra crude they are bringing to the market, anything above that will be a hard sell to the Asian customers that by November will have a plethora of oil to choose from.

It is said that most of the cargoes that were arbitraged from the Atlantic (except 4 or 5 VLCCs from Chinese majors) don’t have a final buyer, so that will weight well until December.

And then there is OPEC+. Next Sunday meeting wasn’t particularly in anyone’s mind as traders settled with the planned 137kbd increase, but again, as the premier of any meeting, a market probe was sent and this time suggesting 500kbd increases and to wind down the 1.66Mnbppd cuts completely in 3 months. The reaction was equally dramatic, and so the subsequent official denial. In reality, no one is expecting an increase in this market environment, and if any, a more hawkish tone, as we started to hear voices from within the group bragging about bringing new capacity (Iraq 5.5Mnbpd by next year). More discipline will be needed.

September crude imports were lower for Asia, but this is explained by China keeping the Iranian and the rest of the “cheap” barrels floating. Shandong independent refineries, the main buyer of these barrels, are running out of import quotas, so they switched to fuel oil and other feedstocks as they are more available and priced at distress. The question in the market now evolves around the Chinese come back. Will they keep buying now flat price is even lower (the infamous Chinese Put) their inventory average? Refinery runs in mainland China are still climbing.