Things are going back to normal—low volatility, the usual Friday dump in flat prices. On the surface, not much has changed, though the drivers that held and took Brent once again to $77 are starting to turn slightly.

This week, events pivoted around the Black Sea and West Meds—first with the CPC saga and later in the week with the return of Kurdish (Iraqi) barrels flowing back to Ceyhan after a two-year hiatus. Let’s analyze the spillover effects for the oil markets. Spoiler alert: none.

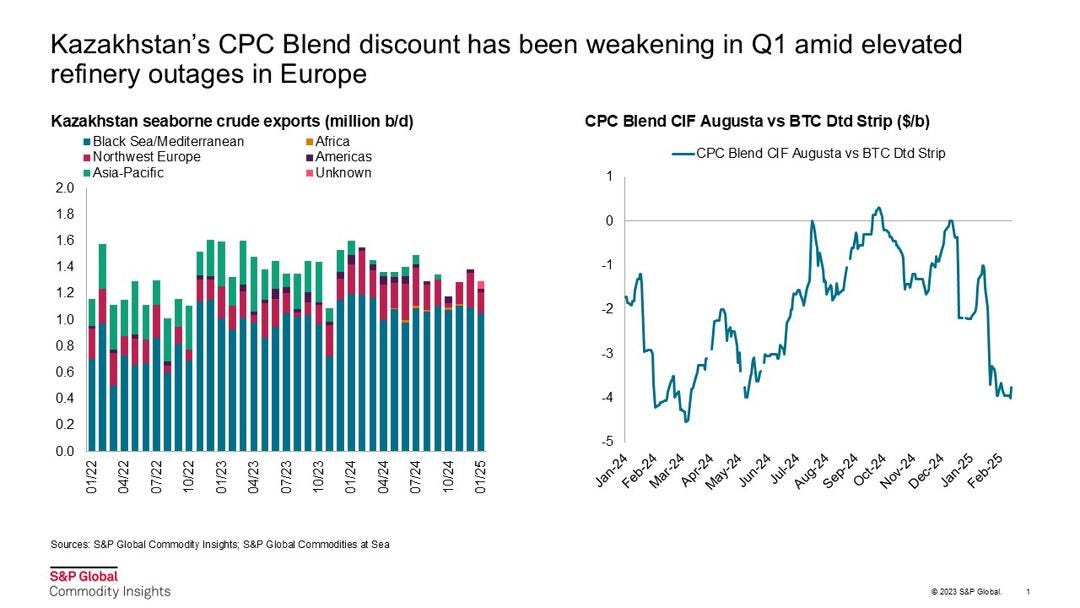

The CPC is a major crude oil pipeline system that transports oil from Kazakhstan’s Tengiz oil field to the Russian Black Sea port of Novorossiysk. It spans over 1,000 miles, and nearly 80% of Kazakhstan’s crude oil exports pass through the CPC pipeline, with a flow of 1.3M bpd. On Tuesday, Ukrainian forces attacked a pumping station (every 100km or so, you need these pumps to maintain pressure in the pipeline), and it is said that operations might be reduced by about 30% to 40%.

In another context, losing 400kbd would be catastrophic, but we’re talking about one of the lightest sweet grades, which already trades at a $3 to $4/bbl discount to Brent. It’s one of the least sought-after grades in the Western Hemisphere due to its high API (very light) and poor distillate yields.

The world won’t miss it—if it’s really the case that we lose 30%, as Russia states. As we speak, loadings remain normal. The CPC March program, recently disclosed, is still signaling 39 cargoes. There is enough storage capacity in Novorossiysk to buffer the immediate impact, and as a last resort, Kazakh oil can reroute some KEBKO (as this grade is known) up to the Baltic ports through the Transneft system. At most, we could see CPC pricing inching a little higher, but no more than that. If operations don’t resume back to normal in a month or so, then we should start to worry.

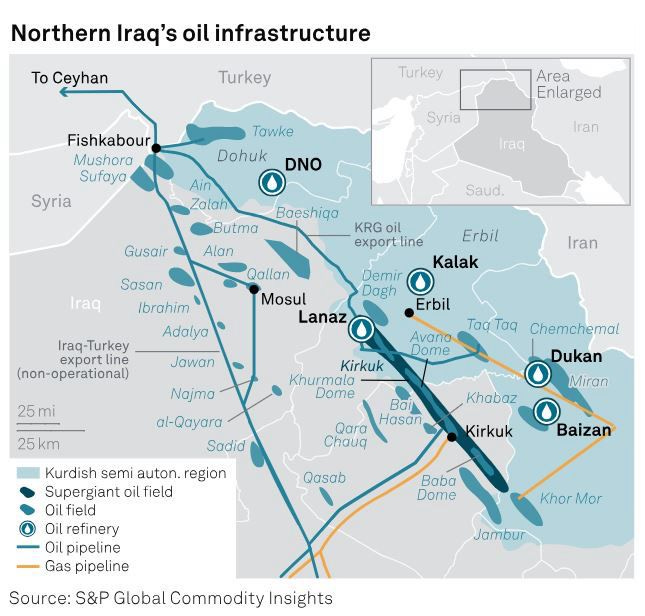

For the Iraq/Kurdish drama, it would mean redirecting flows that are already in the market—currently leaving from Basrah in the Persian Gulf—to Ceyhan in Turkey. Kirkuk blend is a more in-demand grade, as with any other Med-sour, and this rerouting might have some pricing implications for India and China. Adding 300kbd to the Meds and removing those from the Middle East could support Aframaxes, which were sagging since the pipeline ran dry. India might get away with a Suez here and there, but for China, it could mean a couple of VLCCs a month needing to source from elsewhere—not that there are many Med-sour outlets available.

Alleged U.S. pressure to restart Kurdish oil exports initially sounded bearish for Brent sentiment, but overall market fundamentals remain largely unchanged. The impact of increased Kurdish exports could be offset by reduced CPC pipeline rates, effectively balancing supply dynamics in the West Meds. A key implication is that this move may be intended to compensate for lower Iranian exports, raising broader geopolitical considerations. Additionally, the situation highlights an ongoing question of authority over Kurdish oil exports—whether the decision ultimately lies with Iraq, OPEC+, or the U.S.

And speaking of OPEC, as the deadline approaches to gradually unwind the production cuts, they came out testing the waters with contradicting headlines. Some outlets reported a further delay, while Russia’s Lavrov said they would increase production… (even if they were “allowed” to do so, they would struggle to move back above 9Mbpd).

As the market stands today, the Dubai premium still holds above $3, but we are now seeing China turning away from the Middle East to Brazil and WAF for March loaders. Reduced exports in March from Saudi Arabia could scare OPEC away and actually postpone the return of these barrels, but ultimately, economics dictate the way. If March Dubai averages close to $80, they might ease the pain and release some barrels; if we get stuck in the low 70s, the show could go on.

Events also evolved around the peace deal between Russia and the U.S. (note: I didn’t say Ukraine). As things are heading, I stand by my position that these barrels won’t return to Europe anytime soon. Something has changed, though—I heard the word “sanctions” for the first time in the discussion. The U.S. might be the linchpin in welcoming Russian barrels (VGO, HSFO), but it won’t be so easy with the Europeans.

And Russia is having its fair share of hiccups as well. I lost count of how many refineries were attacked this week, but the hit is substantial. Reports indicate that 15% of total refining capacity is out. That means less diesel for exports, more crude for exports (Baltic and Black Sea loading programs have already been revised up for March), and less fuel oil… The latter poses a problem in an already tight HSFO market.

Other than that, the week went on cruise control. Refining margins are in command.