From Wednesday on, the market went numb, everyone who had any interest in the oil market took off, and understandably so, that’s why we are going to make it to the point here. If you were in a coma for the last 12 days and woke up today, what would be different?

A couple of things actually, the market didn’t quite shrug off all the upheaval, we still have some trades for the “return to the mean”.

Crack spreads didn’t get the memo, and though they came down a bit, they are still up there, especially gasoil and jet, but gasoline, which should be outperforming distillates by now, is faring better thanks to the data we had in inventories. (The only kind of inventories that matter)

There has been some profit taking in middle distillates, but it looks rather tight in the western hemisphere, so these pricing trailing the peak of the escalation might have some justification after all. That is, until Asia, which is in a clear surplus, starts pushing barrels this way.

Some things did come off as they should, like High Sulfur Fuel Oil, as the squeeze finally appears to die down. This can give us an early indication of what to expect for the summer direct burn, most Middle Eastern countries already have compromised crude over fuel Oil, most of the African countries are buying Russian distillates to burn, and fuel oil was just left with one pocket of demand, albeit the most important one, the Teapots.

In the last month or so, China, possibly as part of a stimulus package, has started to incentivize its oil sector by maximizing runs at state-owned facilities and providing a tax break to import fuel oil and other dirty feedstocks for the infamous teapots. The same week, they doubled their refined products import quotas, indicating a clear shift in policy. Preliminary June oil imports look promising. We know this batch was mostly purchased two months ago when prices dipped into the low 60s, but the current buying cycle does not seem slow either.

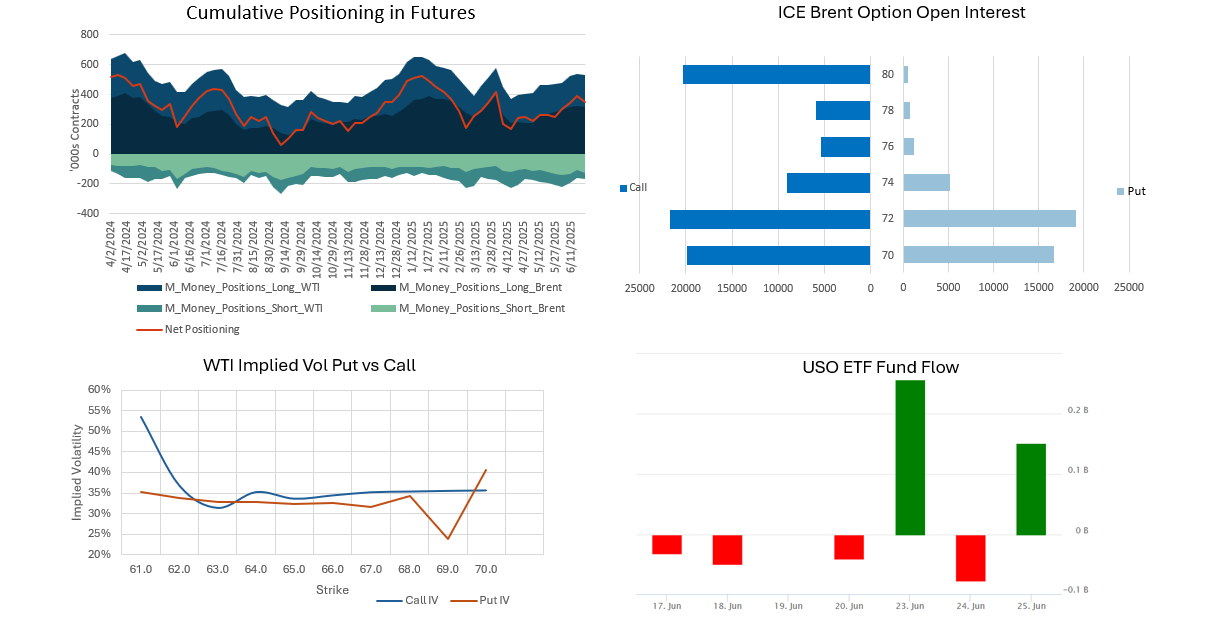

In the paper markets, it looks like nobody was seriously hurt, unlike previous bull runs, this was almost all retail-driven. Of course, funds bought into it, but still didn’t unwind fully, suggesting they were covered with options or deferred structures. Producers hedged all the way up, refiners sold cracks all the way down, so for the next weeks, we know at least that selling pressure won’t be there from the natural hedgers. This could play out to be favorable for flat price, everyone who wanted to lock in profits has already done so.