On the previous episode, we highlighted the move by two oil traders that prompted a short squeeze in Brent derivatives and subsequently moved across the Atlantic to bid up some WTI cargoes. That was a bold move against fundamentals but since oil has been trading on thin volumes near expiration, it didn’t take much to flip the narrative upside down, but then fundamentals prevailed, and an influx of (real shitty) data was hitting the markets all at once.

The trigger for me was a third in a row OSP cut from the Saudis to Asia. Remember like 6 month ago when the market was supported by the OPEC production cut in Medium Sours, that held the entire oil complex. Today, Medium Sours barrels is what is dragging this market down. There is so much Murban and Oman in the Middle East that even Chinese and other Asian refiners are being forced to take them in, even though when refining margins are quite low for light ends (Gasoline and naphtha).

Lighter benchmark grades like WTI, Brent, Bonny, CPC despite the sell-off are holding a premium possibly due to inventories composition, gossip around the tanks is that they are almost 70% full of medium heavies, which makes sense, you put on storage what is cheaper (Medium/Heavies).

So why is this thing falling like a rock? Well.. One could say that previous run up from $77 to $87 was unsustain that worked until those cargoes that were bid up aggressively need to take delivery, and then we started to see offers at Dated +2.5.. no takers and furthermore Exxon, UNIPEC, Shell on the offer side.. Dated+2.2… +2.. +1.8.. + 1.5 shit, take these boats out of my hands, and so Gunvor gave in and flip those vessels to the Meds, another one below WTI CIF Rotterdam.. Market was starting to fall apart and they were lucky to exit unharmed. Bold move, but you can only corner one benchmark, a piece of the market, Dubai linked barrels didn’t follow through, and more important refined products lagged well behind.

It’s a buyers’ market now, let the buyer set the price.

Oil Physical

Middle East: This is where the party is at, that price cut boded well with Asian buyers and they are taking advantage. Full allocations for August, September liftings looking at +1.5Mnbbl over current flows to Asia..sweet, light, heavy.. I’ll take it. Everything flowing east. Sours on the cheap, direct crude burn for summer demand removing some of the heaviest barrels from the market providing some support. There’s a drop in Russian loadings for July, India and China turning in.

WAF: I was constructive last week, these grades were trading firm to Brent, but man.. that got old very fast. Now they look expensive again to EU and the Meds. Good thing they managed to clear out the backlog when markets were strong, a handful of Nigerian left for August and 8 Angolan cargos left. NNPC, the Nigerian State Oil Co, owes $6bn to gasoline traders, no one is willing to trade again unless they foot the bill or.. provide a steep discount on flagship grades, Mr Dangote is also at odds with NNPC.

Atlantic: Premium has softened, and though the Brent/TI arb (we call it TI to WTI because traders) suggest that there isn’t much of a trade, there are cargos arriving early August from theGulf at healthy premiums yet. The fear in the market are the refiners in the Meds, those are the closest to start cutting runs if diesel doesn’t pick up.

Elsewhere, Brazil easing up, Guyana pumping up relentless, Russia self restrained for July (allegedly), Canada TMX still trying to find volume buyers for this strange crude.

Crude Flows

Some flows that highlight previous comments. The Saudi come back

US Exports as well ticking up, with Europe taking the lion share.

Meanwhile in Russia, july might end up 3.4/3.5, some 200kbd below last month, hence the pick up in volume from India and China in MEG (we call MEG to Middle East Gulf… because traders)

what about WAF? Stronger note for Angolan some left overs of Bonny light that Mr Dangote won’t buy locally.

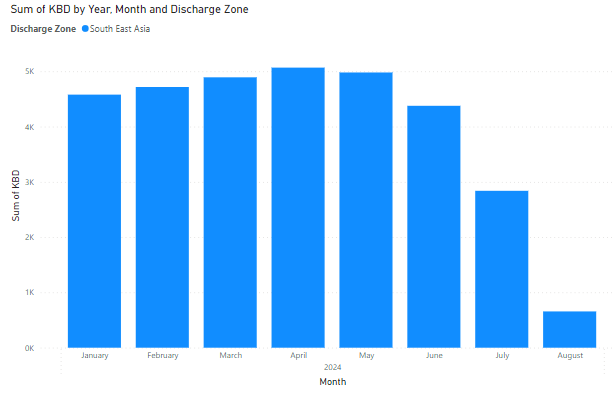

Regardless of the optimism, Indian crude imports are set to fall with the Monsoon season kicking in. July will probably end up below 4.8Mnbpd, which is low. We were expecting India to save the market, we should start to look somewhere else for the next two months.

So it’s China then… no, that thing is dead flat. Apparent consumption is a little lower month on month, which suggest they are building stocks at 0.3/0.5Mnbpd. Not great

Latest data prompt me to adjust my S/D model and assuming Suadi gradually comes back to the market in Q4 I now see a small surplus, and not a big deficit for current Q

Paper Markets

Of course DFL and the futures structure fell sharply with markets tanking, but given the pace of the decline in flat prices these thing are still holding.. should you have a barrel in the North Sea is a good time to sell it.

The Brent-Dubai spread didn’t even budged, Saudis finally learned is all about market share.

Products

Recent drop in flat prices improved a little refinery margins across the board, but gasoil is still in contango, no signs to ease down for now as Middle Eastern arrivals start to hit European waters, remember those 4 VLCCs? well, there’s more coming to the Netherland shores.

Gasoline cracks should be doing better, but a slight recovery in Asia is keeping high hopes on forward demand, gasoline story is also a naphtha story.. that gave in a little and helped blenders to scrape some cents

Have you seen those lines at the airport? All eyes are set into Jet cracks, the last hope to save the summer for refiners. Jet cracks are flat in Asia and ticking up in the West.

We saw inventories for products built in the 3 key areas, though the US was skewed by the hurricane last week, after that large build we shold see a draw in gasoline and even diesel in the US. Europe is low (below 5 year average) but consistently buildings week after week. Japan is short Jet fuel, Singapore is full to the brim with gasoline.

Tankers

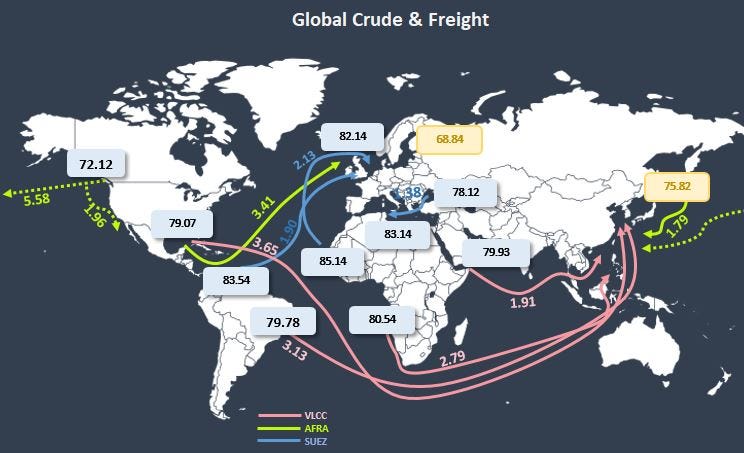

This week positive story comes from the much awaited rebound in freight rates, VLCCs were getting too cheap to pass and with a slump in crude prices there is renewed interest from Asian refiners, the caveat, is still driven by short hauls but at least is something.

Afras are being hurt by the USGC-NWE trade, lots of Afras in the caribs, not enough cargoes and some Suez coming in from Latam, looking for employment. Latest events in the Red Sea didn’t move the needle for Afras. Much of the ballasters are scattered in their respective regions, bunker is too expensive to gamble in a cross basin reposition.

Suez are steady with most of the action in the Atlantic

But, when dirty tankers react, clean usually takes the other side with weakening economics for arbs (inventories building). Soon we should see a revival in the MEG-Japan naphtha trade and clean some of the LR2s list. Vessels piling up.

The veredict

Let it bleed a little bit more, demand will be there when the price is right and seems we are getting close. Watch margins health, how prices react to news, muted reaction to geo/political means the degenerate gamblers have been washed out.

What are your thoughts currently ?