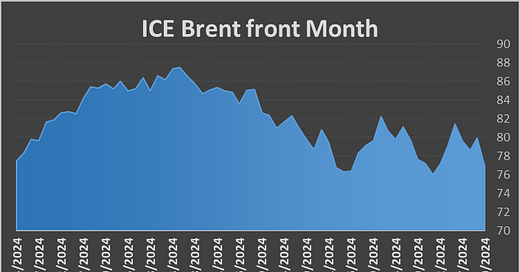

The meat grinder is at full tilt, we started the week with Libya, this time for real, are shutting down oil production in the main fields over a dispute of some spare change… Production seems to be finally halted, but since there was some oil in the pipes exports that were scheduled for the week continued, until the pipes went dry. I’ve seen some Aframaxes leaving the queue as force majeure was called. Eventually the Monday craze was paused when everyone turned around and checked refining margins (more on that later).

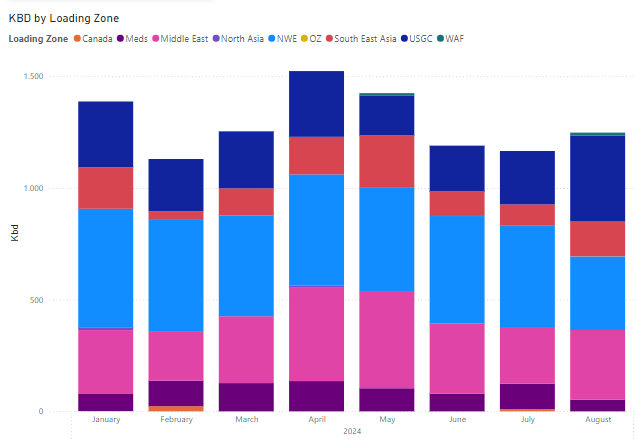

Libyan exports are concentrated in Meds refiners, as a natural replacement for light sweet Brent as shown below and total loss of this supply won’t make thing easy in a tightness of light barrels as we have been experiencing these las weeks, but fear not, replacement barrels were quick to emerge from East Med in Ceyhan and re-routing of Guyana’s flagship Liza crude. Market is trying to asses whereas it might be a good opportunity to use this as a catalyst to cut runs ahead of maintenance season.

I believe we will have this back and forth for a few more days between Haftar and the others, but eventually production has to start back. $70 millions in loss revenue for a country like Libya is a lot to pass on. Also, as we have seen in the last 10 years, every time they shut in, they lose 50-100kbd of production in subsequent months.

Then it came Friday, when Reuters reported that several delegates within the OPEC+ coalition said they expect to add 543kbd of crude output in October as it gradually restores the crude output halted since late 2022. This tanked the market and set the tone of the conversation back to the supply side. We’ll see…

Now housekeeping is done, let’s look at final imports for August, where China came back after a slippery July. Korea+Japan were taking advantage of cheap tanker rates and hold their rate.

On the physical side of things, not major shifts other than repricing of Atlantic barrels that were affected but the Libyan shutdown.

Cheap freight is China is encouraging Chinese oil firms to optimize aggressively around landed costs, selling WAF grades and buying Brazilian and also switching to even cheaper Russian ESPO Blend. Sweet crude premiums to sour grades lost ground as trade in November-arriving cargoes got under way, increasing the charm of buying long-haul cargoes. Chinese oil firms snapped up 15mn bl of Brazilian crude but re-sold to Europe 3mn bl of Angolan crude that would have arrived in China in October taking advantage of higher differentials. Sinopec got 12mn bl of Russian ESPO last week. ESPO Blend premiums have risen ahead of the opening this month of Shandong's new Yulong mega-refinery, which is expected to be a key buyer of the grade.

Chinese refiners have been negotiating with the government for larger export quotas for clean products this year, partly to determine how much crude to import in October-November. They initially hoped for export allowances of up to 12.5 million tons (100 million barrels) in September, but these hopes are rapidly diminishing, with market expectations now leaning towards a 7M ton batch or even less. Restricting product exports would, in turn, reduce refinery run rates which are already low. Chinese fuel demand has historically peaked in September-October but dismal government investment this year is dampening oil demand from the construction sector, hitting hard on gasoil.

US exports continue to wind down, with Europe rejecting some cargos that could work well in the Meds.

September deliveries of WTI to Europe were expected to be higher than in August, even though refinery maintenance was expected to cap demand. Buying interest for WTI from Asia-Pacific refiners remained restrained in the current cycle. Asian buyers typically come seeking WTI nearly two weeks prior to European customers. Weak demand from Asia-Pacific normally leaves more WTI available. The differential between Dated Brent and WTI still makes the arb lucrative, but it seems there’s no appetite.

Middle East loadings in August make their way to the East as the Brent/Dubai diff is making it impossible to send them to Europe, situation on the red Sea doesn’t help either.

WAF performed well during August, and last reshuffling of cargos that were resold into Europe kept the momentum on strong diffs.

You know who is not doing so well? The comrades

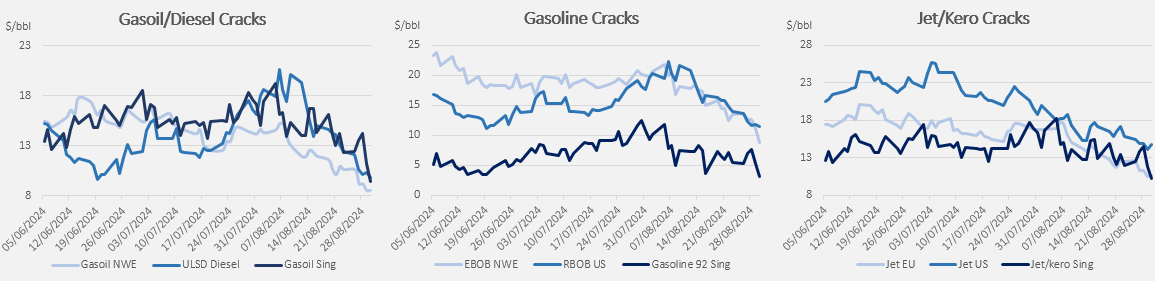

Now to more serious stuff, refining margins took a nosedive this week and is starting to worry, best days are definitively behind us.

Despite weak margins, diesel/gasoil arrivals in Europe saw an increase during August, with more flows from the USGC. At this point EU is becoming the dumping ground for global diesel.

Gasoline flows to the US saw some Asian inflows, replacing NWE cargos

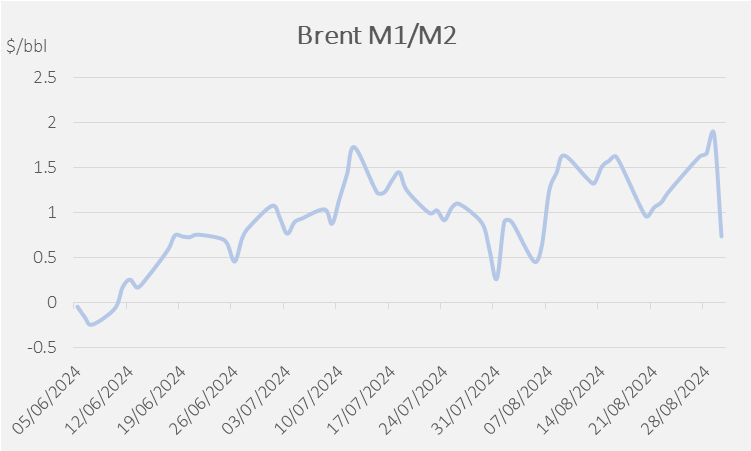

On the paper side Dated lost some of the premiums with all the choppiness during the week but some of the action was due to contract roll. Non-commercial, or speculative futures and options traders, lifted long positions by 9,928 contracts of 1,000 bl each in the week ended 27 August to 310,041, the US Commodity Futures Trading Commission's (CFTC) Commitment of Traders data showed on Friday.

Where things are getting spicy is in the Brent/Dubai spread, reaching above $3, attributed in full to a premium for light barrels.

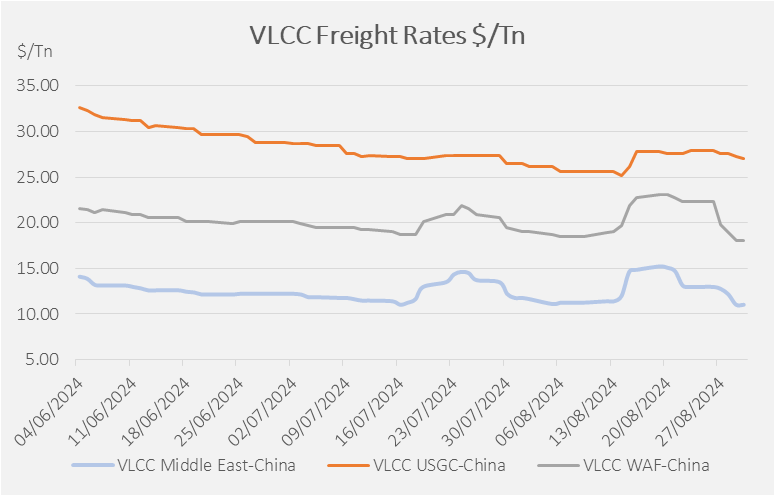

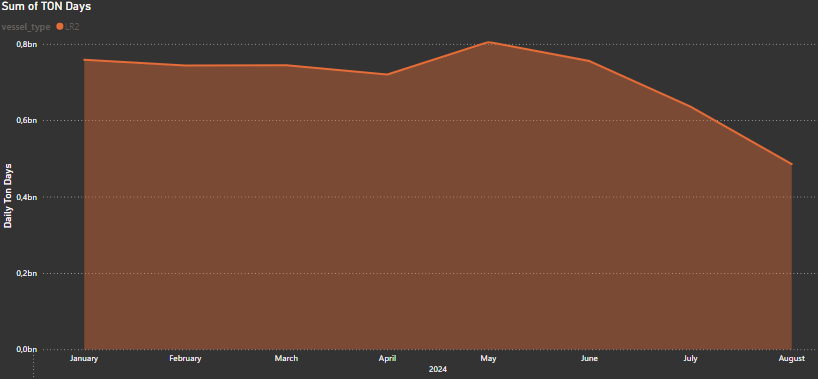

Tankers don’t lie, looking at ton days we have the double whammy, shorter hauls and lower export cargoes

All VLCC rates from the US Gulf coast declined by $50,000, sinking the bellwether rate to China to $7.5mn lumpsum, including $250,000 Corpus Christi load-port fees. The USGC-Europe VLCC rate fell to $3mn, including load-port fee.

Same is true for Aframaxes, a general summer slowdown in activity and substantial disruption to Libyan oil production affects disproportionally to the Afras

Suezmax tanker rates were flat, but the extended weekend in the US likely will allow tonnage to build up and help charterers negotiate lower rates next week.

Rates for MR shipments loading in the US Gulf coast rose slightly on tighter tonnage ahead of the long holiday weekend in the US, though chartering was quiet. Shipowners continued to hold out for higher bids from charterers after near 20pc drops on some voyage rates since 22 August. Charterers have meanwhile resisted reentering the spot market before vessel replenishment from the US east coast and east coast Mexico ports has a chance to boost US Gulf coast supply.

Tight LR1 supply in the Atlantic coupled with a surge in Brazilian demand for the larger vessel segment to secure refined oil product shipments after Russia's exportable supply dropped in August raised the rate on the route by WS15 to that level.