While we wait for Liberation Day, during this week we had a fair dose of tariff debauchery that didn’t impact the oil market that continued its upward trend in what in a steady grind on improved fundamentals. Regarding oil not only we had tariffs, sanctions, but we had a new hybrid combining both.

After last week on what I considered a bold move with the OFAC sanctioning a teapot in China in relation to Iranian oil, this time it was Venezuela’s turn but with a twist.

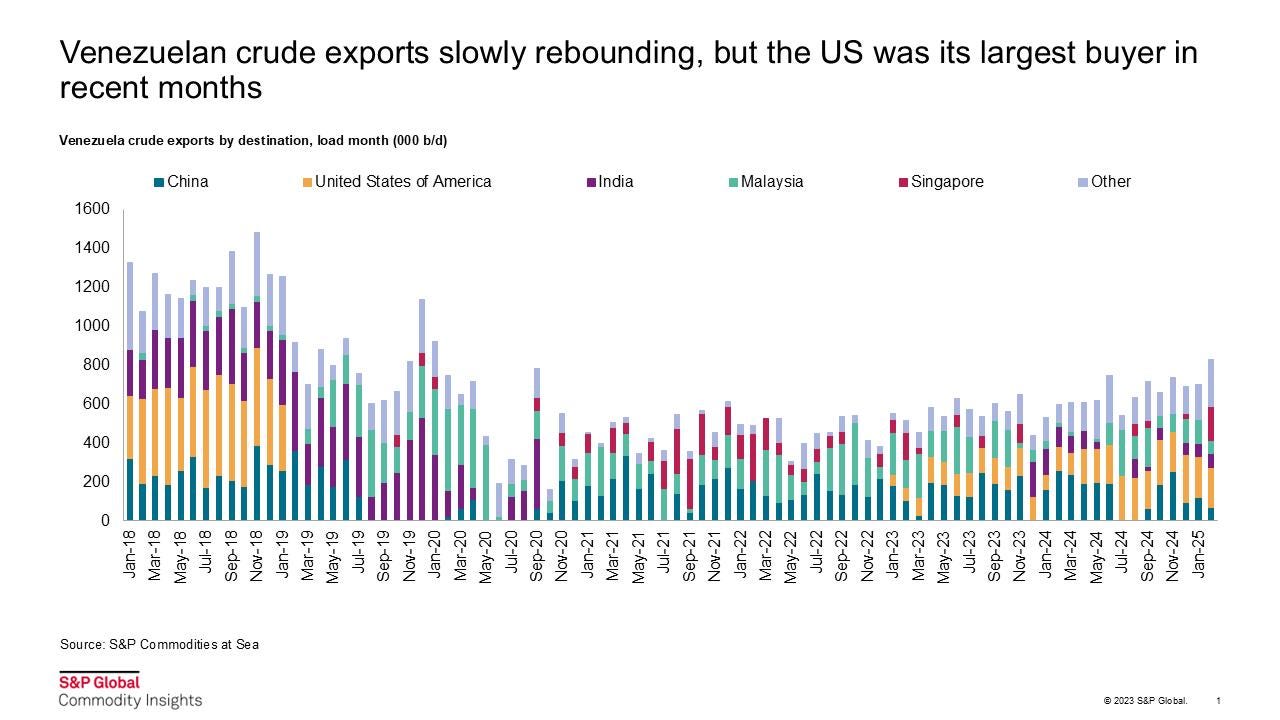

Trump decided that any buyer of Venezuelan oil will be subject to an additional 25% tariff for goods entering the US. This certainly is an innovative approach since the US it removes itself from arguably unilateral sanctions, and instead going after the buyer of these hard to enforce and police barrels. Venezuelan heavy Merey are a preferred crude for Chinese independent buyers in Shandong that were already having a hard time with Iranian and Russian barrels.

Relliance (India), Repsol (Spain) and Chevron are among the main buyers of Venezuelan oil but through licenses or waivers from the US. Relliance (it has one cargo in transit) and Repsol were quick to come out and announce they will be halting buying Venezuelan oil, Chevron for its part, just a few hours after this announcement got its license to import Venezuelan oil to the US.

And although China played it cool, saying this has no effect because refiners don’t care about tariffs, is not entirely up to them, proof of that is that enquires on Venezuelan oil dried up, waiting for the official stance. And is not only Venezuela they also did for Iran.

And here is the interesting part, because this latest move has Iran’s name written all over it. If this works for the 600-800kbd of Venezuelan oil, it might as well for Iranian, so don’t be surprised if we have the same scheme for Iranian oil in the next days. Judging from the immediate reaction of top Venezuelan oil buyers, this could be very effective.

As a result of this, the entire med/heavy sour complex tightened once again after some relief last week on Russia and Ukraine reaching a temporary truce on energy infrastructure attacks, a truce that is harder to accomplish as on Friday Russia accused Ukraine for attacking a gas metering station in Kursk region and power facilities in Belgorod, and tried to hit an oil refinery in the Saratov region, the situation here is still extremely fluid.

Regardless, or as a consequence of past attacks, Russian crude exports are going back to normal levels (3.4Mbpd) but China's state-owned oil importers including Sinopec have shied away from Russian oil purchases this month, a move that doesn’t correlate with the need to build stocks.

Strangely, China issued a 2nd batch of product export quotas, even when volumes for the first one hadn’t been exported... China is de-stocking

Over the last years the market’s Achilles’ heel has been the sour complex, which OPEC+ has been very effective to control, I have to handle that to them, controlling the sours market, you control the bottom of the barrel, regardless of how many light sweets are slashing around in the world, refining margins will be hot as you remove fuel oil from the spot market as well.

Elsewhere, light sweets are struggling with WTI begging to find an outlet until refining activity picks up. At least the situation around Canadian and Mexican oil has been restored for now, but the new big theme on the horizon is the USTR hearings where definitions on Chinese built/ordered ships and extra port surcharges will take shape. I don’t assign many probabilities of happening, but I didn’t assign any chance to oil tariffs either. We’ll cross that bridge when we have to.

The big names of the industry gathered in Geneva for the FT Energy summit, an event where you pay $600 to hear a bunch of old traders complain on how hard is to navigate the current environment, etc.. The message we got was pretty much:

• Market is well supplied (Vitol)

• Midstream optimization (Trafi)

• We won’t gamble anymore (Gunvor)

• Peak Oil trading from Jeff “Oil 300” Curry

Reality bites for the trading houses and though still profitable, margins we saw in 2022/3 are definitively a thing of the past. The strategy of integrating vertically in upstream and downstream is becoming less attractive as value creation goes.

But there are still some people making money out of this market, let’s see how:

Keep reading with a 7-day free trial

Subscribe to Oil not dead to keep reading this post and get 7 days of free access to the full post archives.