Uphill battle

Weakness is starting to filter into flat prices as record activity in the physical window takes place

The week started auspiciously, trying to capture the sentiment of the previous week where there was greater activity in the physical oil market, which would undoubtedly have to filter into the flat price that has been trading within a range of 2 dollars. Any excuse would do, and the OFAC (Office of Foreign Assets Control) came to the rescue by sanctioning 35 tankers in a sort of showing some initiative for a problem that is getting away from them. Is it enough to modify the trade flows? No, but this market was looking for something to hold on to and this worked to remove some of the short positions, which were not that many.

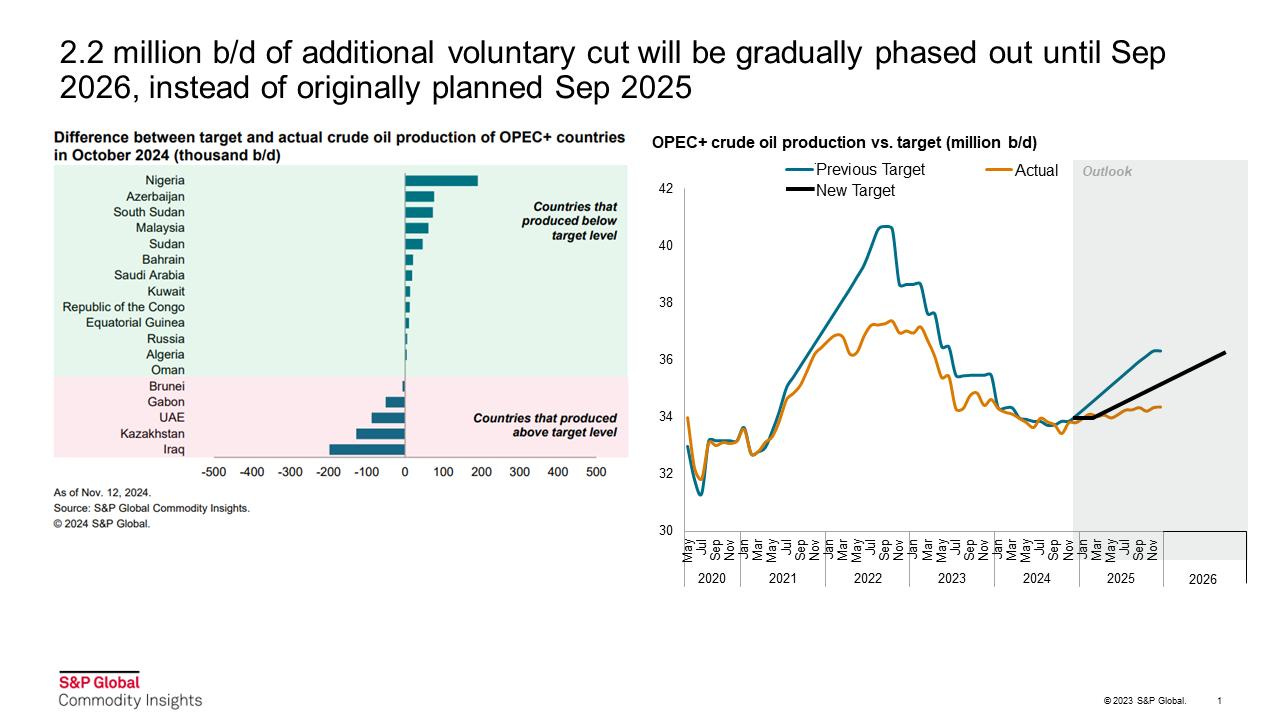

From there, all the focus of attention was concentrated on the much-announced OPEC meeting, where the outcome was the expected, but we wanted to see how the relationship between members was after everything that was said. In the last edition we commented on the inconsistencies between members and it was also a topic of debate in the specialized media, sort of a public hanging.

To make a long story short, it was decided to postpone the cuts until the end of Q1 of 2025, but the most interesting thing is the period they are going to consider to dismantle the entire scheme that would now go until 2026. The market reaction was accordingly, some volatility around the announcement and then nothing. Enough has been said about OPEC ability to influence the market, less so when everybody can see what’s going on. What is still weird is the usual “independent” research shops trying to spin a positive story after this clusterfuck. I guess I’ll never be invited to Vienna… anyway

The story of the week remains the relentless activity in the physical market, at the Platts window in the North Sea and also in Dubai. Monday set the record for most cargoes traded ever in the window, 8. The strange thing this time is that this activity is not translating into activity in the futures market, which is still very heavy and slow to react. To tell the truth, this buoyant activity is not spilling over into better premiums either, which are eroding by 0.05 cents a day in the two benchmarks but are serving to prop up the other crudes in the surrounding regions such as the Mediterranean and West Africa, which have reversed some of their prevailing weakness.

As mentioned before, the Brent complex is a closed market that is trading with different dynamics and there are 4 crazy cats passing barrels to each other at somewhat inflated prices but some traders started to take notice, therefore, WTI started to sail towards the European coasts in quantities that have not been seen for months.