Not much has been happening on the physical side, if any a continuation of previous days where everyone is measuring and trying to assimilate the punch of collapsing flat prices, as digesting this Chinese stimulus package. When the market is quiet you start to look everywhere to find an edge.

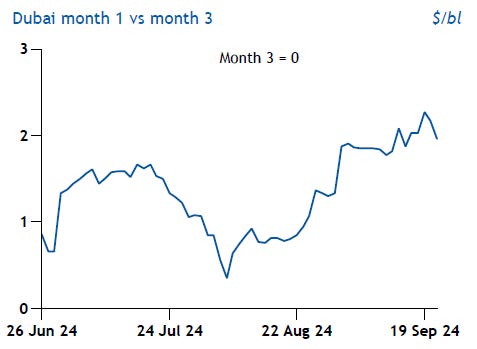

The power has shifted, invertedly, back to Middle East and I’m starting to concern if these people are following up events. In comparison, Dubai linked grades are looking pricey, in part Brent gave away all of their premium, but also there is some statement from the Gulf producers, sticking to their guns: “market is tight”, “robust growth from Asia” and all the things we heard before. Dubai intermonth spread M1/M3 is getting out of hand, and this is important because Gulf producers look at this when settling the OSPs for next trading cycle. Maybe Nov OSPs come with a slight bump.

For October allocations we know demand is there, but a pattern repeats: Western major with equity crude are selling into the window to Japanese (Mitsui again) and Thai refiners. You know who I don’t see there? Koreans, they are buying WTI.

Speaking of TI, another tropical storm, Helene, forecasted to intensify into a hurricane by today and make landfall in Florida on Thursday, it has already halted 16% of oil production in the U.S. Gulf of Mexico. As of Wednesday, the Bureau of Safety and Environmental Enforcement reported that around 284kbd of offshore oil production were offline. Additionally, 208 million cubic feet per day of natural gas production, representing 11% of the region's output, was also shut down. So far, operators have evacuated personnel from four offshore production platforms. That’s underpinning Fob WTI so far.

Back to China, where things are blowing up.