One week after the OPEC shakedown, oil finishes on the green as if nothing ever happened, but things did happen, and not the way we would have thought.

Pre OPEC announcement, the thinking was 400kbd extra in the market, and more to come in July, but looking at numbers, the net output increase looks more like 200kbd or less, and all coming from Saudi Arabia. Forward guidance was also contested as the usual overproducers arrived at some commitment not to increase production, realizing we are beyond the “compensation cuts” conversation… not going over from current production levels is enough for this market.

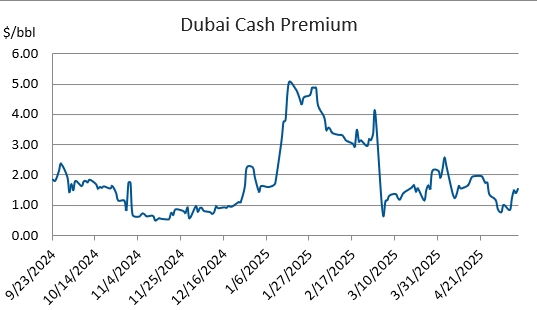

So after the initial shock, Dubai physical premiums bottomed, followed by a contemplative OSP hike from Aramco after the announcement. Allocations to Asian customers were in line with last month, nothing new on this front.

The weakness expected in Middle Eastern crude benchmarks was not, but usually when we have this kind of earth-shattering announcements, some get hurt, and counter-intuitively, the Brent complex did.

We were already having problems in the North Sea, but we could easily mask them with the alleged Middle East overflowing supply, pricing Brent grades stronger in relative terms to medium sours, but the issue of too much light sweets in the Atlantic basin is a real threat now that one of the main takers of Forties, PetroIneos Grangemouth 160kbd refinery in Scotland ceased operations last week, leaving available to the market 5/6 aframaxes cargoes per month looking for new customers.. and those customers are increasingly hard to find, as these Forties are shown again and again in the Platts window, passing from hand to hand and ultimately selling down to a discount to Dated Brent, and in term flipping the prompt structure in contango... yes, we have the first contango of the season and it’s not OPECs making.

Wait, you think this is bad? While everyone is trying to decipher Saudi intentions and Iran’s possible comeback to the international markets, there is a silent “light sweet” revolution going on in the Atlantic basin led by Equinor and Exxon.

Johan Catsberg, a FPSO up there in the Arctic, is already loading one Suezmax per week, pushing light sweets down to Rotterdam. The platform is projected to achieve full production (220kbd) by the end of summer.

Crossing the Atlantic, in Brazil, the Bacalhau FPSO, an Exxon & Equinor JV is anchored and with the final checks to begin production in H2, another 220kbd of light sweet.

The Guyana One FPSO, which arrived a couple of weeks ago at the Yellowtail field in Guyana, again, a JV between Exxon and Equinor, at any point in Q3 will start producing and is expected to reach 230kbd by year-end.

Further down south, Argentina is completing the pipe and terminal expansion that will accommodate Suezmaxes, adding an extra 150kbd of light sweets to the region.

Unlike shale drilling, these projects have already been paid for and will start pumping no matter what the price is. Equally impressive about these off-shore developments is their breakeven, which ranges from 27 to 45, rivaling OPECs low-cost producers.

Now the question is, where is all this oil going to go? For light sweets, we have limited outlets in the region. Dangote comes to mind as they could absorb 200/300 kbd when running at full tilt. USWC is a common destination, but I would bet there is any future in that trade as refineries are blowing up and closing down. Asia emerges as a possible candidate, but the logistics are tricky, since that arb only works on a VLCC, and VLCCs are quite difficult to load from FPSOs, only for a short time in summer, but it is mainly a Suezmax market, and it will have to stay local. Europe? BP is scaling back its Gelsenkirchen refinery in Germany by a 3rd going after base oil and chemicals, Shell has already turned off the crude distillation units at its Rheinland Wesseling to pursue biofuels, and Exxon plans to downsize operations at its Port-Jerome complex in France… roughly 500kbd of refining capacity in NWE gone.

At least we have WTI plateauing but is still a volume that will be hard to absorb, until Brent and its linked grades start pricing to Asia. The Brent complex was freeloading on OPECs drama, not interested in pushing barrels to Asia.

A return to the old paradigm where Dubai trades at a discount to the western benchmarks is expected if loosening the rope is indeed the forward policy, but who’s more lose?