I’m just gonna dump charts and restrain of commenting because I don’t understand what the hell is going on.

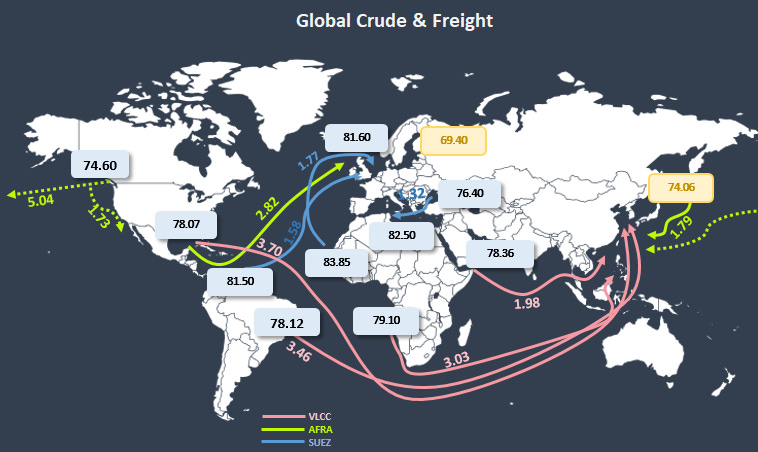

Everything is closed, there’s no place to run. Crude differentials across the board are in harmony, and with freight uptick, things are getting more intricate. I’ve seen this week more cargos from the USGC to Asia, when it doesn’t make economic sense from a hedging perspective. Atlantic has been busier as well with WAF clearing some cargos to India and Libya disruption helped Nigerian lights to hold their premium.

Now here is where I believe this sudden physical strength is coming from. There’s something going on in Cushing, TMX in Canada is depriving the Gulf Coast of heavier grades, and in turn refineries are running lighter grades, which makes sense since you should only chase Gasoline yields in this environment. Brent/Ti spread is supporting the whole Brent complex, with Forties once again setting the benchmark.

Despite wild moves in flat prices, this week, actually from more than 10 days, Vitol and some major have been pushing Dated above +2.5 for early Sept cargoes, physical premiums for near date loadings didn’t even budged forcing backwardation to “oh my god we are running out of oil” levels.

In consequence, DFL is blowing out

The Arabs are letting go a bit, but still defending their hard earned market share, medium sours aren’t clearing fast enough it seems.

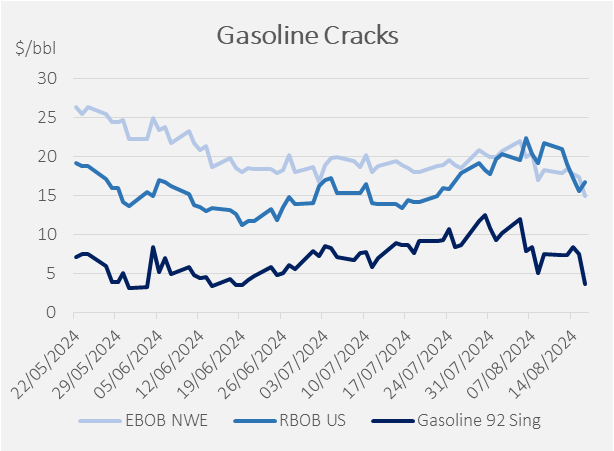

Products

Summer is over pal! Cracks are comming hard and is not just Diesel now. Refineries running lighter are pushing too many barrels onto the market and with arbs closed this will only price down. We were hoping for an Asian rebound and failed miserably

and what can we say about good ol’ diesel…

But at least we have Jet…. think again

And here’s the part I don’t get… why are they paying Dated +2? to lock in these margins?

We hear some voices calling for “Run Cuts” to which I don’t see it just yet. Refis in the US are running at 90%, in line with a $3.15/gallon at the pump and we have some maintenance coming in the Northern hemisphere, it should support some crude intake in those that already did a big turnaround this spring.

Tankers

You blink and you miss it. VLCCs finally reacted to a balanced number of inquiries in both Middle East and the USGC, with a pool of candidates that can only cover next 15 days loading window. Some WTI barrels that were destined to Europe had to change it course and reroute to Asia, tightening the list further more. Contagion should spread to Aframaxes eventually but we are still in the doldrums. Suezmaxes on the other hand might consider a move out of the Atlantic into the Pacific, Indonesia and India are moving some partial cargos that were meant for VLCCs

On the clean side, there’s nothing moving.. Inventories building everywhere prevents arbs for opening even with lowest freight rates in quite a while. Naphtha can save the day if production rump up from Dangote or Kuwait.